Oracle 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

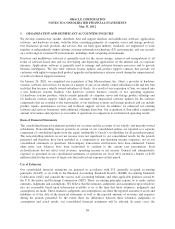

Stock-based compensation included in acquisition related and other expenses resulted from unvested options and

restricted stock-based awards assumed from acquisitions whereby vesting was accelerated upon termination of

the employees pursuant to the original terms of those options and restricted stock-based awards.

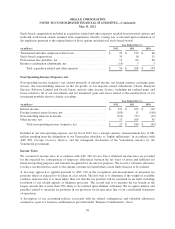

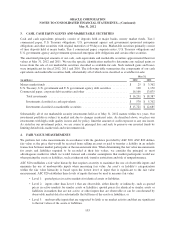

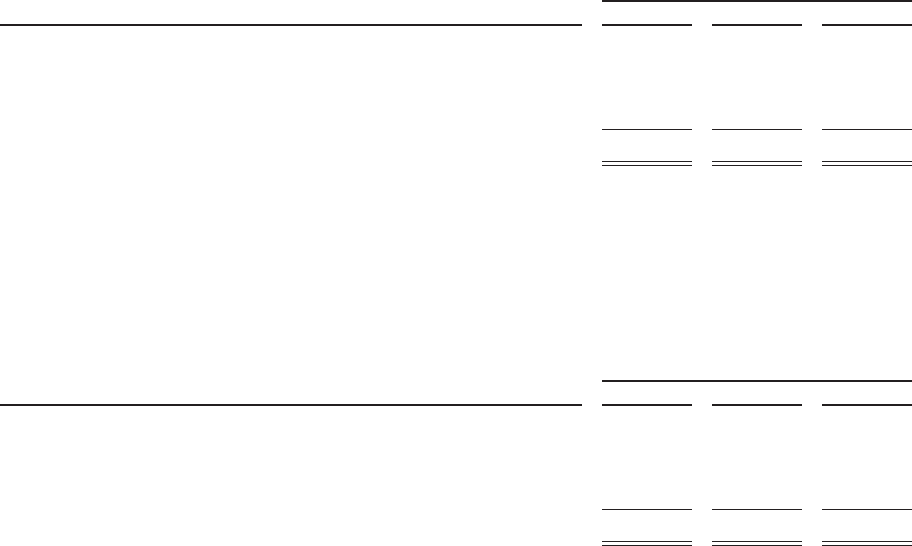

Year Ended May 31,

(in millions) 2012 2011 2010

Transitional and other employee related costs ..................... $ 25 $ 129 $ 66

Stock-based compensation .................................... 33 10 15

Professional fees and other, net ................................. 13 66 68

Business combination adjustments, net ........................... (15) 3 5

Total acquisition related and other expenses .................. $ 56 $ 208 $ 154

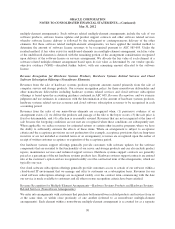

Non-Operating Income (Expense), net

Non-operating income (expense), net consists primarily of interest income, net foreign currency exchange gains

(losses), the noncontrolling interests in the net profits of our majority-owned subsidiaries (Oracle Financial

Services Software Limited and Oracle Japan) and net other income (losses), including net realized gains and

losses related to all of our investments and net unrealized gains and losses related to the small portion of our

investment portfolio that we classify as trading.

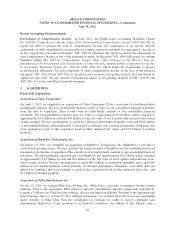

Year Ended May 31,

(in millions) 2012 2011 2010

Interest income ............................................. $ 231 $ 163 $ 122

Foreign currency gains (losses), net ............................. (105) 11 (148)

Noncontrolling interests in income .............................. (119) (97) (95)

Other income, net ........................................... 15 109 56

Total non-operating income (expense), net .................... $ 22 $ 186 $ (65)

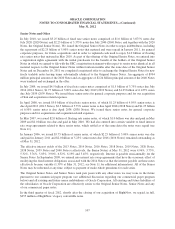

Included in our non-operating expense, net for fiscal 2010 was a foreign currency remeasurement loss of $81

million resulting from the designation of our Venezuelan subsidiary as “highly inflationary” in accordance with

ASC 830, Foreign Currency Matters, and the subsequent devaluation of the Venezuelan currency by the

Venezuelan government.

Income Taxes

We account for income taxes in accordance with ASC 740, Income Taxes. Deferred income taxes are recorded

for the expected tax consequences of temporary differences between the tax bases of assets and liabilities for

financial reporting purposes and amounts recognized for income tax purposes. We record a valuation allowance

to reduce our deferred tax assets to the amount of future tax benefit that is more likely than not to be realized.

A two-step approach is applied pursuant to ASC 740 in the recognition and measurement of uncertain tax

positions taken or expected to be taken in a tax return. The first step is to determine if the weight of available

evidence indicates that it is more likely than not that the tax position will be sustained in an audit, including

resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the

largest amount that is more than 50% likely to be realized upon ultimate settlement. We recognize interest and

penalties related to uncertain tax positions in our provision for income taxes line of our consolidated statements

of operations.

A description of our accounting policies associated with tax related contingencies and valuation allowances

assumed as a part of a business combination is provided under “Business Combinations” above.

98