Oracle 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

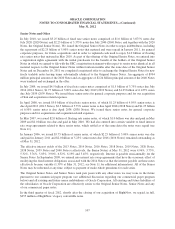

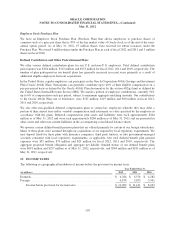

As described in Note 2 of Notes to Consolidated Financial Statements included elsewhere in this Annual Report,

we have contingent consideration payable as a result of our acquisition of Pillar Data that will settle in fiscal

2015.

As described in Note 2, we also have a commitment to acquire certain companies for cash consideration that we

expect to pay upon the closing of these acquisitions. As described in Note 8, we have notes payable and other

borrowings outstanding of $16.5 billion that mature at various future dates.

Guarantees

Our software and hardware systems product sales agreements generally include certain provisions for

indemnifying customers against liabilities if our products infringe a third party’s intellectual property rights. To

date, we have not incurred any material costs as a result of such indemnifications and have not accrued any

material liabilities related to such obligations in our consolidated financial statements. Certain of our product

sales agreements also include provisions indemnifying customers against liabilities in the event we breach

confidentiality or service level requirements. It is not possible to determine the maximum potential amount under

these indemnification agreements due to our limited and infrequent history of prior indemnification claims and

the unique facts and circumstances involved in each particular agreement.

Our software license and hardware systems products agreements also generally include a warranty that our

products will substantially operate as described in the applicable program documentation for a period of one year

after delivery. We also warrant that services we perform will be provided in a manner consistent with industry

standards for a period of 90 days from performance of the service.

We occasionally are required, for various reasons, to enter into financial guarantees with third parties in the

ordinary course of our business including, among others, guarantees related to foreign exchange trades, taxes,

import licenses and letters of credit on behalf of parties with whom we conduct business. Such agreements have

not had a material effect on our results of operations, financial position or cash flows.

13. STOCKHOLDERS’ EQUITY

Stock Repurchases

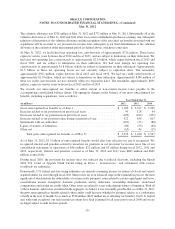

Our Board of Directors has approved a program for us to repurchase shares of our common stock. On

December 20, 2011, we announced that our Board of Directors approved an expansion of our stock repurchase

program by an additional $5.0 billion. On June 18, 2012, we announced that our Board of Directors approved a

further expansion by an additional $10.0 billion. As of May 31, 2012, approximately $3.1 billion remained

available for stock repurchases under the stock repurchase program prior to the June 2012 additional amount

authorized. We repurchased 207.3 million shares for $6.0 billion (including 5.2 million shares for $136 million

that were repurchased but not settled), 40.4 million shares for $1.2 billion and 43.3 million shares for $1.0 billion

in fiscal 2012, 2011 and 2010, respectively, under the stock repurchase program.

Our stock repurchase authorization does not have an expiration date and the pace of our repurchase activity will

depend on factors such as our working capital needs, our cash requirements for acquisitions and dividend

payments, our debt repayment obligations or repurchase of our debt, our stock price and economic and market

conditions. Our stock repurchases may be effected from time to time through open market purchases or pursuant

to a Rule 10b5-1 plan. Our stock repurchase program may be accelerated, suspended, delayed or discontinued at

any time.

Dividends on Common Stock

During fiscal 2012, 2011 and 2010, our Board of Directors declared cash dividends of $0.24, $0.21, and $0.20

per share of our outstanding common stock, respectively, which we paid during the same period.

114