Oracle 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

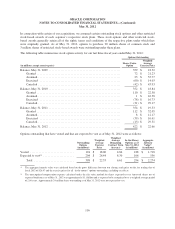

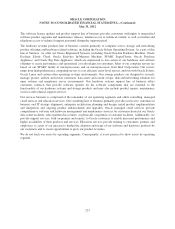

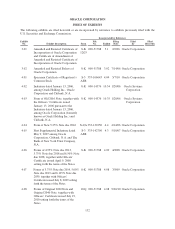

Geographic Information

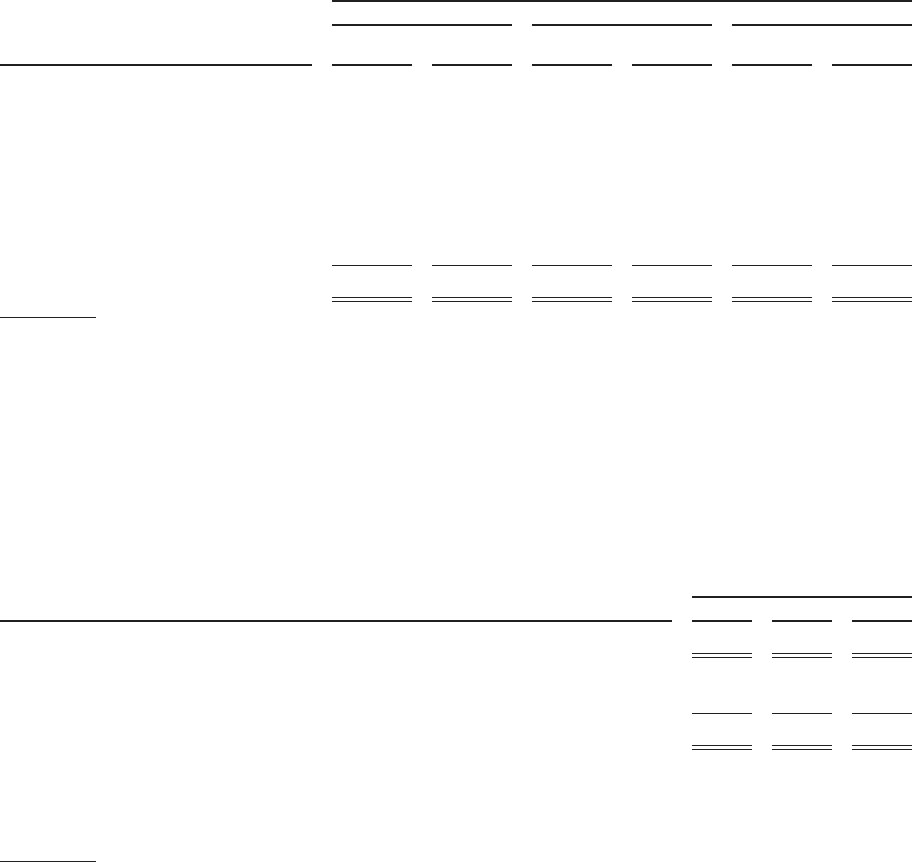

Disclosed in the table below is geographic information for each country that comprised greater than three percent

of our total revenues for fiscal 2012, 2011 or 2010.

As of and for the Year Ended May 31,

2012 2011 2010

Long Lived Long Lived Long Lived

(in millions) Revenues Assets(1) Revenues Assets(1) Revenues Assets(1)

United States .................... $ 15,767 $ 2,468 $ 15,274 $ 2,359 $ 11,472 $ 2,141

United Kingdom ................. 2,302 171 2,200 168 1,685 136

Japan .......................... 1,865 550 1,731 551 1,349 505

Germany ....................... 1,484 47 1,475 29 1,112 20

Canada ......................... 1,234 37 1,174 16 888 10

Australia ....................... 1,163 38 1,041 34 687 28

France ......................... 1,162 16 1,145 15 965 24

Other countries .................. 12,144 741 11,582 661 8,662 632

Total ...................... $ 37,121 $ 4,068 $ 35,622 $ 3,833 $ 26,820 $ 3,496

(1) Long-lived assets exclude goodwill, intangible assets, equity investments and deferred taxes, which are not allocated to specific

geographic locations as it is impracticable to do so.

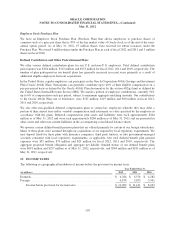

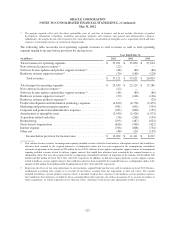

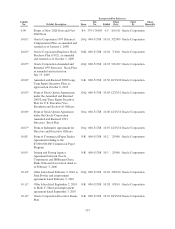

17. EARNINGS PER SHARE

Basic earnings per share is computed by dividing net income for the period by the weighted average number of

common shares outstanding during the period. Diluted earnings per share is computed by dividing net income for

the period by the weighted average number of common shares outstanding during the period, plus the dilutive

effect of outstanding stock options, restricted stock-based awards and shares issuable under the employee stock

purchase plan using the treasury stock method. The following table sets forth the computation of basic and

diluted earnings per share:

Year Ended May 31,

(in millions, except per share data) 2012 2011 2010

Net income ......................................................... $ 9,981 $ 8,547 $ 6,135

Weighted average common shares outstanding ............................. 5,015 5,048 5,014

Dilutive effect of employee stock plans ................................... 80 80 59

Dilutive weighted average common shares outstanding ....................... 5,095 5,128 5,073

Basic earnings per share ............................................... $ 1.99 $ 1.69 $ 1.22

Diluted earnings per share .............................................. $ 1.96 $ 1.67 $ 1.21

Shares subject to anti-dilutive stock options and restricted stock-based awards

excluded from calculation(1) .......................................... 110 57 141

(1) These weighted shares relate to anti-dilutive stock options and restricted stock-based awards as calculated using the treasury stock

method (described above) and could be dilutive in the future. See Note 14 for information regarding the exercise prices of our

outstanding, unexercised options.

126