Oracle 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

those preliminary estimates that are not yet finalized related to certain tangible assets and liabilities acquired,

identifiable intangible assets, certain legal matters and income and non-income based taxes.

Subsequent to May 31, 2012, we agreed to acquire certain other companies for amounts that are not material to

our business. We expect to close such acquisitions within the next twelve months.

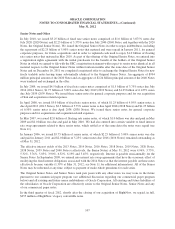

Fiscal 2011 Acquisitions

On January 5, 2011, we completed our acquisition of Art Technology Group, Inc. (ATG), a provider of eCommerce

software and related on demand commerce optimization applications. We have included the financial results of ATG in

our consolidated financial statements from the date of acquisition. The total purchase price for ATG was approximately

$1.0 billion, which consisted of approximately $990 million in cash and $16 million for the fair value of stock options

and restricted stock-based awards assumed. We have recorded $404 million of identifiable intangible assets and $111

million of net tangible assets, based on their estimated fair values, and $491 million of residual goodwill.

On August 11, 2010, we completed our acquisition of Phase Forward Incorporated (Phase Forward), a provider

of applications for life sciences companies and healthcare providers. We have included the financial results of

Phase Forward in our consolidated financial statements from the date of acquisition. The total purchase price for

Phase Forward was approximately $736 million, which consisted of approximately $735 million in cash and $1

million for the fair value of restricted stock-based awards assumed. We recorded $370 million of identifiable

intangible assets, $20 million of in-process research and development and $17 million of net tangible assets,

based on their estimated fair values, and $329 million of residual goodwill.

During fiscal 2011, we acquired certain other companies and purchased certain technology and development

assets to expand our products and services offerings. These acquisitions were not significant individually or in

the aggregate. We have included the financial results of these companies in our consolidated results from their

respective acquisition dates, which were not individually significant.

In aggregate, companies acquired during fiscal 2011 collectively contributed $231 million to our total software

revenues in fiscal 2011. Other collective revenue and earnings contributions were not significant or were not

separately identifiable due to the integration of these acquired entities into our existing operations.

Fiscal 2010 Acquisitions

Acquisition of Sun Microsystems, Inc.

On January 26, 2010 we completed our acquisition of Sun, a provider of hardware systems, software and

services, by means of a merger of one of our wholly owned subsidiaries with and into Sun such that Sun became

a wholly owned subsidiary of Oracle. We acquired Sun to, among other things, expand our product offerings by

adding Sun’s existing hardware systems business and broadening our software and services offerings. We have

included the financial results of Sun in our consolidated financial statements from the date of acquisition. For

fiscal 2010, we estimated that Sun’s contribution to our total revenues was $2.8 billion, which included

allocations of revenues from our software and services businesses that were not separately identifiable due to our

integration activities. For fiscal 2010, we estimated that Sun reduced our operating income by $620 million,

which included management’s allocations and estimates of revenues and expenses that were not separately

identifiable due to our integration activities, intangible asset amortization, restructuring expenses and stock-based

compensation expenses.

The total purchase price for Sun was $7.3 billion which consisted of $7.2 billion in cash paid to acquire the

outstanding common stock of Sun and $99 million for the fair value of stock options and restricted-stock based

awards assumed. In allocating the purchase price based on estimated fair values, we recorded approximately $1.4

billion of goodwill, $3.3 billion of identifiable intangible assets, $415 million of in-process research and

development and $2.2 billion of net tangible assets.

101