Oracle 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

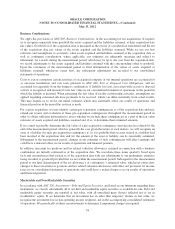

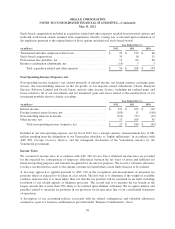

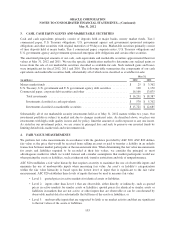

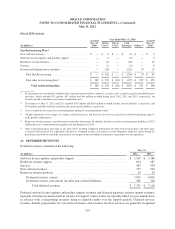

Assets and Liabilities Measured at Fair Value on a Recurring Basis

Our assets and liabilities measured at fair value on a recurring basis, excluding accrued interest components,

consisted of the following (Level 1, 2 and 3 inputs are defined above):

May 31, 2012 May 31, 2011

Fair Value Fair Value

Measurements Measurements

Using Input Types Using Input Types

(in millions) Level 1 Level 2 Level 3 Total Level 1 Level 2 Total

Assets:

Money market funds ................................................ $ 25 $ — $ — $ 25 $ 3,362 $ — $ 3,362

U.S. Treasury, U.S. government and U.S. government agency debt securities . . . 100 — — 100 1,150 — 1,150

Commercial paper debt securities ...................................... — 13,954 — 13,954 — 11,884 11,884

Corporate debt securities and other .................................... 229 1,983 — 2,212 106 1,885 1,991

Derivative financial instruments ....................................... — 69 — 69 — 69 69

Total assets ..................................................... $ 354 $16,006 $ — $ 16,360 $ 4,618 $ 13,838 $ 18,456

Liabilities:

Contingent consideration payable ...................................... $ — $ — $ 387 $ 387 $ — $ — $ —

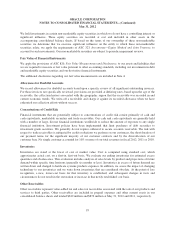

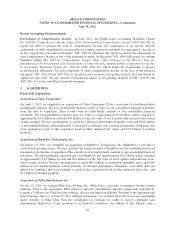

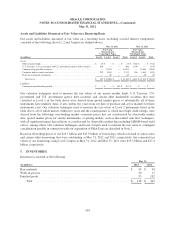

Our valuation techniques used to measure the fair values of our money market funds, U.S. Treasury, U.S.

government and U.S. government agency debt securities and certain other marketable securities that were

classified as Level 1 in the table above were derived from quoted market prices as substantially all of these

instruments have maturity dates, if any, within two years from our date of purchase and active markets for these

instruments exist. Our valuation techniques used to measure the fair values of Level 2 instruments listed in the

table above, all of which mature within two years and the counterparties to which have high credit ratings, were

derived from the following: non-binding market consensus prices that are corroborated by observable market

data, quoted market prices for similar instruments, or pricing models, such as discounted cash flow techniques,

with all significant inputs derived from or corroborated by observable market data including LIBOR-based yield

curves, among others. Our valuation techniques and Level 3 inputs used to estimate the fair value of contingent

consideration payable in connection with our acquisition of Pillar Data are described in Note 2.

Based on the trading prices of our $16.5 billion and $15.9 billion of borrowings, which consisted of senior notes

and certain other borrowings that were outstanding at May 31, 2012 and 2011, respectively, the estimated fair

values of our borrowings using Level 2 inputs at May 31, 2012 and May 31, 2011 were $19.3 billion and $17.4

billion, respectively.

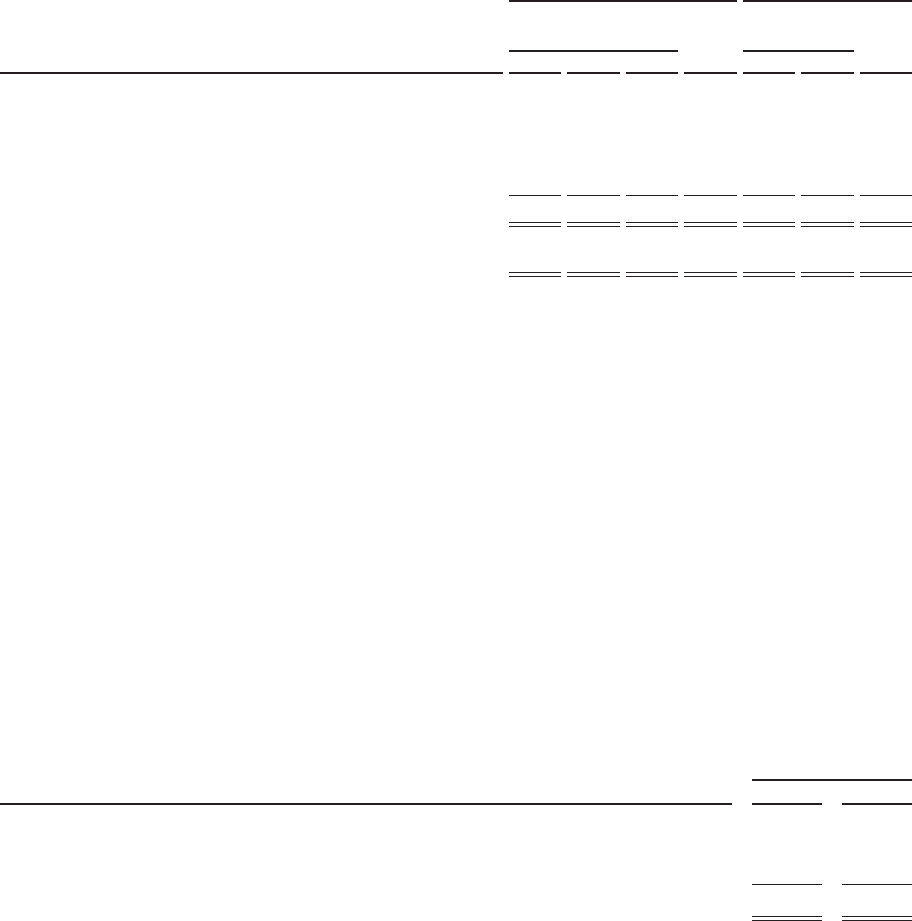

5. INVENTORIES

Inventories consisted of the following:

May 31,

(in millions) 2012 2011

Raw materials ............................................................. $ 45 $ 94

Work-in-process ........................................................... 20 17

Finished goods ............................................................. 93 192

Total ................................................................ $ 158 $ 303

104