Oracle 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

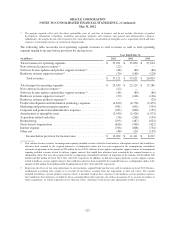

(2) The margins reported reflect only the direct controllable costs of each line of business and do not include allocations of product

development, information technology, marketing and partner programs and corporate and general and administrative expenses.

Additionally, the margins do not reflect inventory fair value adjustments, amortization of intangible assets, acquisition related and other

expenses, restructuring expenses or stock-based compensation.

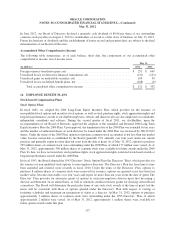

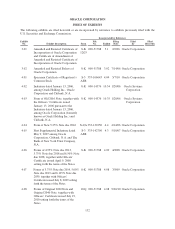

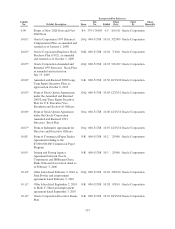

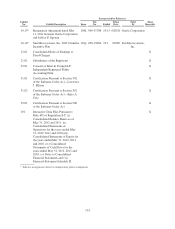

The following table reconciles total operating segment revenues to total revenues as well as total operating

segment margin to income before provision for income taxes:

Year Ended May 31,

(in millions) 2012 2011 2010

Total revenues for operating segments ......................... $ 37,221 $ 35,850 $ 27,034

New software licenses revenues(1) ............................. (22) — —

Software license updates and product support revenues(1) .......... (48) (80) (86)

Hardware systems support revenues(1) .......................... (30) (148) (128)

Total revenues ........................................ $ 37,121 $ 35,622 $ 26,820

Total margin for operating segments ........................... $ 23,439 $ 22,129 $ 17,286

New software licenses revenues(1) ............................. (22) — —

Software license updates and product support revenues(1) .......... (48) (80) (86)

Hardware systems support revenues(1) .......................... (30) (148) (128)

Hardware systems products expenses(2) ......................... — — (29)

Product development and information technology expenses ........ (4,630) (4,778) (3,479)

Marketing and partner program expenses ....................... (581) (601) (503)

Corporate and general and administrative expenses ............... (945) (800) (755)

Amortization of intangible assets ............................. (2,430) (2,428) (1,973)

Acquisition related and other ................................. (56) (208) (154)

Restructuring ............................................. (295) (487) (622)

Stock-based compensation .................................. (626) (500) (421)

Interest expense ........................................... (766) (808) (754)

Other, net ................................................ (48) 120 (139)

Income before provision for income taxes .................. $ 12,962 $ 11,411 $ 8,243

(1) New software licenses revenues for management reporting included revenues related to cloud software subscription contracts that would have

otherwise been recorded by the acquired businesses as independent entities but were not recognized in the accompanying consolidated

statements of operations in the amount of $22 million for fiscal 2012. Software license updates and product support revenues for management

reporting included revenues related to software support contracts that would have otherwise been recorded by the acquired businesses as

independent entities but were not recognized in the accompanying consolidated statements of operations in the amounts of $48 million, $80

million and $86 million for fiscal 2012, 2011 and 2010, respectively. In addition, we did not recognize hardware systems support revenues

related to hardware systems support contracts that would have otherwise been recorded by the acquired businesses as independent entities in the

amounts of $30 million, $148 million and $128 million for fiscal 2012, 2011 and 2010, respectively.

(2) Represents the effects of fair value adjustments to our inventories acquired from Sun that were sold to customers in fiscal 2010. Business

combination accounting rules require us to account for inventories assumed from our acquisitions at their fair values. The amount

included in hardware systems products expenses above is intended to adjust these expenses to the hardware systems products expenses

that would have been otherwise recorded by Sun as an independent entity upon the sale of these inventories. If we assume inventories in

future acquisitions, we will be required to assess their fair values, which may result in fair value adjustments to those inventories.

125