Oracle 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ORACLE CORPORATION

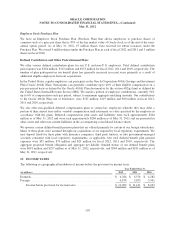

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

Intervention in the qui tam action, alleging that Oracle made false and fraudulent statements to the General

Services Administration (GSA) in 1997-98 regarding Oracle’s commercial pricing practices, discounts provided

to Oracle’s commercial customers and discounts provided to government purchasers. On October 6, 2011, the

parties signed a settlement agreement, which resolved the qui tam action without any admission of liability on the

part of Oracle. Under the terms of the settlement, Oracle paid the United States $199.5 million and paid relator’s

counsel $2 million for attorneys’ fees in exchange for a release of claims as set forth in the agreement. The court

dismissed the qui tam action with prejudice on October 11, 2011.

Although the qui tam action has been dismissed, plaintiffs in the derivative suits allege that the officer and

director defendants have exposed Oracle to reputational damage, potential monetary damages and costs relating

to the investigation, defense and remediation of the underlying claims. Plaintiffs bring claims for breach of

fiduciary duty, abuse of control and unjust enrichment. Following consolidation of the actions and plaintiffs’

filing of a consolidated complaint on February 10, 2011, Oracle moved to dismiss the complaint. On

November 9, 2011, the court granted Oracle’s motion to dismiss and granted plaintiffs leave to file an amended

complaint. The parties have agreed to mediate all disputes relating to this matter. Accordingly, the parties entered

into a stipulated stay of this action, which the court signed on February 8, 2012.

On September 8, 2011, another stockholder derivative lawsuit based on the qui tam action was filed in the United

States District Court for the Northern District of California, alleging similar theories and seeking similar relief as

the consolidated cases mentioned above. This derivative suit was brought by an alleged stockholder of Oracle,

purportedly on our behalf, against some of our current officers and directors. On October 4, 2011, and again on

April 9, 2012, the court approved a stipulated stay of this action. The parties have agreed to mediate all disputes

relating to this matter. Oracle believes that the claims in the qui tam action were meritless, that there are

additional defenses to plaintiff’s bringing this action on Oracle’s behalf and that there are additional defenses to

plaintiffs’ in the consolidated cases bringing that action on Oracle’s behalf.

On September 12, 2011, two alleged stockholders of Oracle filed a Verified Petition for Writ of Mandate for

Inspection of Corporate Books and Records in the Superior Court of the State of California, County of San

Mateo. The petition names as respondents Oracle and two of our officers. Citing the claims in a qui tam action

(discussed above), the alleged stockholders claim that they are investigating alleged corporate mismanagement

and alleged improper and fraudulent practices relating to the pricing of Oracle’s products supplied to the United

States government. The alleged stockholders request that the court issue a writ of mandate compelling the

inspection of certain of the company’s accounting books and records and minutes of meetings of the

stockholders, the Board of Directors and the committees of the Board of Directors, related to those allegations,

plus expenses of the audit and attorneys’ fees. On October 5, 2011, the alleged stockholders dismissed their

claims against the two company officers and filed an Application for a Writ of Mandate in support of their

previously filed Verified Petition. At a hearing on November 10, 2011, the court granted the alleged

stockholders’ Application, which was confirmed in a judgment on December 12, 2011. Oracle filed a notice of

appeal on February 2, 2012. The parties have agreed to mediate all disputes relating to this matter. Accordingly,

the parties entered into a stipulated stay of further proceedings in the San Mateo Superior Court, which the court

signed on February 6, 2012. Oracle believes that the claims in the qui tam action were meritless.

On June 5, 2012, the parties in the derivative actions discussed above and the Writ of Mandate action met with a

mediator and, at the end of the mediation session, the parties agreed to continue discussing a potential resolution

of these matters.

On September 30, 2011, a stockholder derivative lawsuit was filed in the Court of Chancery of the State of

Delaware and a second stockholder was permitted to intervene as a plaintiff on November 15, 2011. The

derivative suit is brought by two alleged stockholders of Oracle, purportedly on Oracle’s behalf, against our

current directors, including against our Chief Executive Officer as an alleged controlling stockholder. Plaintiffs

allege that Oracle’s directors breached their fiduciary duties in agreeing to purchase Pillar Data Systems, Inc. at

128