Oracle 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

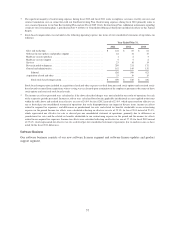

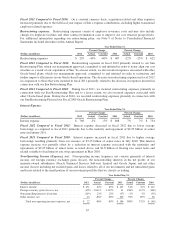

Amortization of Intangible Assets:

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2012 Actual Constant 2011 Actual Constant 2010

Software support agreements and related relationships ........... $ 585 3% 3% $ 570 -1% -1% $ 574

Hardware systems support agreements and related relationships . . . 119 1% 1% 118 300% 300% 29

Developed technology .................................... 923 -7% -7% 992 22% 22% 811

Core technology ......................................... 337 9% 9% 308 11% 11% 277

Customer relationships and contract backlog .................. 370 2% 2% 363 55% 55% 234

Cloud software subscriptions and related relationships ........... 33 267% 267% 9 * * —

Trademarks ............................................. 63 -7% -7% 68 41% 41% 48

Total amortization of intangible assets ................... $ 2,430 0% 0% $ 2,428 23% 23% $ 1,973

* Not meaningful

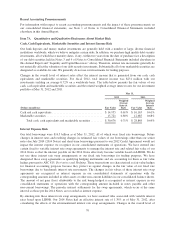

Fiscal 2012 Compared to Fiscal 2011: Amortization of intangible assets in fiscal 2012 in comparison to fiscal

2011 was flat as additional amortization from intangible assets that we acquired from our acquisitions of

RightNow and Taleo in fiscal 2012 and from our acquisitions of ATG and Phase Forward in fiscal 2011, amongst

others, were offset by a reduction in expenses associated with certain of our intangible assets that became fully

amortized. Note 7 of Notes to Consolidated Financial Statements included elsewhere in this Annual Report has

additional information regarding our intangible assets and related amortization.

Fiscal 2011 Compared to Fiscal 2010: Amortization of intangible assets increased in fiscal 2011 in

comparison to fiscal 2010 due to additional amortization from intangible assets that we acquired including our

acquisitions of ATG and Phase Forward in fiscal 2011 and our acquisition of Sun in fiscal 2010. These increases

were partially offset by a reduction in expenses associated with certain of our intangible assets that became fully

amortized.

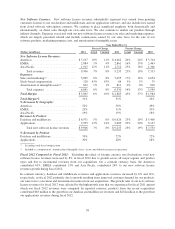

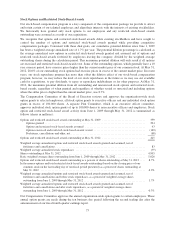

Acquisition Related and Other Expenses: Acquisition related and other expenses consist of personnel related

costs for transitional and certain other employees, stock-based compensation expenses, integration related

professional services, certain business combination adjustments including certain adjustments after the

measurement period has ended and changes in fair value of contingent consideration payable (see Note 2 of

Notes to Consolidated Financial Statements included elsewhere in this Annual Report) and certain other

operating expenses, net. Stock-based compensation expenses included in acquisition related and other expenses

resulted from unvested stock options and restricted stock-based awards assumed from acquisitions whereby

vesting was accelerated upon termination of the employees pursuant to the original terms of those stock options

and restricted stock-based awards.

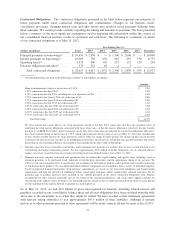

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2012 Actual Constant 2011 Actual Constant 2010

Transitional and other employee related costs ..... $ 25 -81% -81% $ 129 94% 86% $ 66

Stock-based compensation .................... 33 254% 254% 10 -37% -37% 15

Professional fees and other, net ................. 13 -81% -83% 66 -2% -4% 68

Business combination adjustments, net ........... (15) -499% -515% 3 -28% -78% 5

Total acquisition related and other expenses . . . $ 56 -73% -74% $ 208 35% 27% $ 154

Fiscal 2012 Compared to Fiscal 2011: On a constant currency basis, the decrease in acquisition related and

other expenses during fiscal 2012 was primarily due to lower transitional employee related costs and professional

services expenses in comparison to those that were incurred in fiscal 2011 (primarily related to our acquisition of

Sun), and was also due to a benefit from a business combination related legal settlement, which reduced our

fiscal 2012 expenses. These expense reductions were partially offset by an increase in stock-based compensation

expenses associated with our recent acquisitions and expenses associated with the change in fair value of

contingent consideration payable (see Note 2 of Notes to Consolidated Financial Statements included elsewhere

in this Annual Report).

66