Oracle 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To the extent we change the terms of our employee stock-based compensation programs, experience market

volatility in the pricing of our common stock that increases the implied volatility calculation of our publicly

traded options, refine different assumptions in future periods such as forfeiture rates that differ from our current

estimates, or assume stock awards from acquired companies that are different in nature than our stock award

arrangements, among other potential impacts, the stock-based compensation expense that we record in future

periods and the tax benefits that we realize may differ significantly from what we have recorded in previous

reporting periods.

Allowances for Doubtful Accounts

We make judgments as to our ability to collect outstanding receivables and provide allowances for the portion of

receivables when collection becomes doubtful. Provisions are made based upon a specific review of all

significant outstanding invoices. For those invoices not specifically reviewed, provisions are provided at

differing rates, based upon the age of the receivable, the collection history associated with the geographic region

that the receivable was recorded and current economic trends. If the historical data that we use to calculate the

allowances for doubtful accounts does not reflect the future ability to collect outstanding receivables, additional

provisions for doubtful accounts may be needed and our future results of operations could be materially affected.

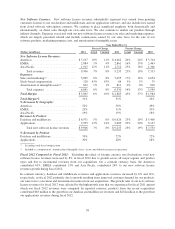

Results of Operations

Impact of Acquisitions

The comparability of our operating results in fiscal 2012 compared to fiscal 2011 is impacted by our acquisitions,

primarily the acquisition of Taleo in the fourth quarter of fiscal 2012, RightNow in the third quarter of fiscal

2012, ATG in the third quarter of fiscal 2011 and Phase Forward during the first quarter of fiscal 2011.

The comparability of our operating results in fiscal 2011 compared to fiscal 2010 is impacted by our acquisitions,

primarily the acquisition of Sun in the third quarter of fiscal 2010 and, to a lesser extent, our acquisitions of ATG

in the third quarter of fiscal 2011 and Phase Forward during the first quarter of fiscal 2011.

In our discussion of changes in our results of operations from fiscal 2012 compared to fiscal 2011 and fiscal 2011

compared to fiscal 2010, we quantify the contributions of our acquired products to the growth in new software

license revenues, software license updates and product support revenues, hardware systems products revenues (as

applicable) and hardware systems support revenues (as applicable) for the one year period subsequent to the

acquisition date. We also are able to quantify the total incremental expenses associated with our hardware systems

products and hardware systems support operating segments for fiscal 2011 in comparison to fiscal 2010. The

incremental contributions of our acquisitions to our other businesses and operating segments’ revenues and expenses

are not provided as they either were not separately identifiable due to the integration of these operating segments into

our existing operations and/or were insignificant to our results of operations during the periods presented.

We caution readers that, while pre- and post-acquisition comparisons, as well as the quantified amounts

themselves may provide indications of general trends, the acquisition information that we provide has inherent

limitations for the following reasons:

• the quantifications cannot address the substantial effects attributable to changes in business strategies, including

our sales force integration efforts. We believe that if our acquired companies had operated independently and

sales forces had not been integrated, the relative mix of products sold would have been different; and

• although substantially all of our customers, including customers from acquired companies, renew their

software license updates and product support contracts when the contracts are eligible for renewal and

we strive to renew cloud software subscription contracts and hardware systems support contracts, the

amounts shown as software license updates and product support deferred revenues, new software

licenses deferred revenues and hardware systems support deferred revenues in our supplemental

disclosure related to certain charges (presented below) are not necessarily indicative of revenue

improvements we will achieve upon contract renewal to the extent customers do not renew.

53