Oracle 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

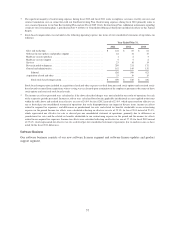

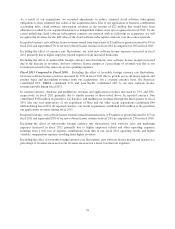

Our operating results include the following business combination accounting adjustments and expenses related to

acquisitions, as well as certain other significant expense items:

Year Ended May 31,

(in millions) 2012 2011 2010

New software licenses deferred revenues(1) ..................... $ 22 $ — $ —

Software license updates and product support deferred revenues(1) . . . 48 80 86

Hardware systems support deferred revenues(1) .................. 30 148 128

Hardware systems products expenses(2) ........................ — — 29

Amortization of intangible assets(3) ............................ 2,430 2,428 1,973

Acquisition related and other(4)(6) ............................. 56 208 154

Restructuring(5) ........................................... 295 487 622

Stock-based compensation(6) ................................. 626 500 421

Income tax effects(7) ....................................... (967) (1,003) (1,054)

$ 2,540 $ 2,848 $ 2,359

(1) In connection with our acquisitions, we have estimated the fair values of the cloud software subscription, software support and hardware

systems support obligations assumed. Due to our application of business combination accounting rules, we did not recognize new

software licenses revenues related to cloud software subscription contracts that would have otherwise been recorded by the acquired

businesses as independent entities, in the amount of $22 million in fiscal 2012. We also did not recognize software license updates and

product support revenues related to support contracts that would have otherwise been recorded by the acquired businesses as independent

entities, in the amounts of $48 million, $80 million and $86 million in fiscal 2012, fiscal 2011 and fiscal 2010, respectively. In addition,

we did not recognize hardware systems support revenues related to hardware systems support contracts that would have otherwise been

recorded by the acquired businesses as independent entities in the amounts of $30 million, $148 million and $128 million in fiscal 2012,

fiscal 2011 and fiscal 2010, respectively.

Approximately $34 million of estimated cloud software subscription contract revenues assumed will not be recognized during fiscal 2013

that would have otherwise been recognized as revenues by the acquired businesses as independent entities due to the application of the

aforementioned business combination accounting rules. Approximately $13 million and $2 million of estimated software license updates

and product support revenues related to software support contracts assumed will not be recognized during fiscal 2013 and 2014,

respectively, that would have otherwise been recognized by the acquired businesses as independent entities due to the application of the

aforementioned business combination accounting rules. Approximately $11 million of estimated hardware systems support revenues

related to hardware systems support contracts assumed will not be recognized during fiscal 2013 that would have otherwise been

recognized by certain acquired companies as independent entities due to the application of the aforementioned business combination

accounting rules. To the extent customers renew these contracts with us, we expect to recognize revenues for the full contracts’ values

over the contract renewal periods.

(2) Represents the effects of fair value adjustments to our inventories acquired from Sun that were sold to customers in fiscal 2010. Business

combination accounting rules require us to account for inventories assumed from our acquisitions at their fair values. The $29 million

included in the hardware systems products expenses line in the table above for fiscal 2010, is intended to adjust these expenses to the

hardware systems products expenses that would have been otherwise recorded by Sun as an independent entity upon the sale of these

inventories. If we acquire inventories in future acquisitions, we will be required to assess their fair values, which may result in fair value

adjustments to those inventories.

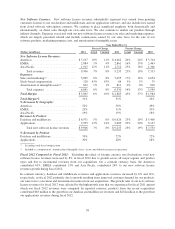

(3) Represents the amortization of intangible assets substantially all of which were acquired in connection with our acquisitions. As of

May 31, 2012, estimated future amortization expenses related to intangible assets were as follows (in millions):

Fiscal 2013 ................................................................................. $ 2,313

Fiscal 2014 ................................................................................. 1,938

Fiscal 2015 ................................................................................. 1,488

Fiscal 2016 ................................................................................. 941

Fiscal 2017 ................................................................................. 384

Thereafter .................................................................................. 824

Total intangible assets subject to amortization .................................................. 7,888

In-process research and development ............................................................. 11

Total intangible assets, net ................................................................. $ 7,899

(4) Acquisition related and other expenses primarily consist of personnel related costs for transitional and certain other employees, stock-

based compensation expenses, integration related professional services, certain business combination adjustments including certain

adjustments after the measurement period has ended and changes in fair value of contingent consideration payable (see Note 2 of Notes

to Consolidated Financial Statements included elsewhere in this Annual Report) and certain other operating expenses, net.

56