Oracle 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(5) The significant majority of restructuring expenses during fiscal 2012 and fiscal 2011 relate to employee severance, facility exit costs and

contract termination costs in connection with our Sun Restructuring Plan. Restructuring expenses during fiscal 2010 primarily relate to

costs incurred pursuant to our Sun Restructuring Plan and our Fiscal 2009 Oracle Restructuring Plan. Additional information regarding

certain of our restructuring plans is provided in Note 9 of Notes to Consolidated Financial Statements included elsewhere in this Annual

Report.

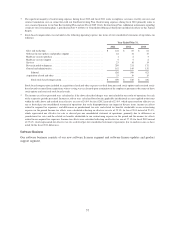

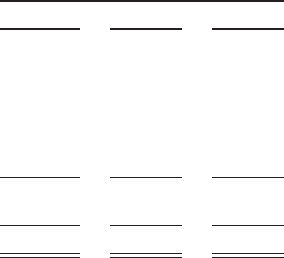

(6) Stock-based compensation was included in the following operating expense line items of our consolidated statements of operations (in

millions):

Year Ended May 31,

2012 2011 2010

Sales and marketing ................................................ $ 122 $ 87 $ 81

Software license updates and product support ............................ 18 14 17

Hardware systems products .......................................... 1 2 3

Hardware systems support ........................................... 5 5 2

Services ......................................................... 23 16 14

Research and development ........................................... 295 231 172

General and administrative ........................................... 162 145 132

Subtotal ...................................................... 626 500 421

Acquisition related and other ......................................... 33 10 15

Total stock-based compensation ................................... $ 659 $ 510 $ 436

Stock-based compensation included in acquisition related and other expenses resulted from unvested stock options and restricted stock-

based awards assumed from acquisitions whose vesting was accelerated upon termination of the employees pursuant to the terms of those

stock options and restricted stock-based awards.

(7) The income tax effects presented were calculated as if the above described charges were not included in our results of operations for each

of the respective periods presented. Income tax effects were calculated based on the applicable jurisdictional tax rates applied to the items

within the table above and resulted in an effective tax rate of 24.0% for fiscal 2012 instead of 23.0%, which represented our effective tax

rate as derived per our consolidated statement of operations, due to the disproportionate rate impact of discrete items, income tax effects

related to acquired tax exposures, and differences in jurisdictional tax rates and related tax benefits attributable to our restructuring

expenses in the period. Income tax effects were calculated reflecting an effective tax rate of 25.3% for fiscal 2011 instead of 25.1%,

which represented our effective tax rate as derived per our consolidated statement of operations, primarily due to differences in

jurisdictional tax rates and the related tax benefits attributable to our restructuring expenses in the period and the income tax effects

related to our acquired tax exposures. Income tax effects were calculated reflecting an effective tax rate of 27.1% for fiscal 2010 instead

of 25.6%, which represented our effective tax rate as derived per our consolidated statement of operations, due to similar reasons as those

noted for the fiscal 2011 differences.

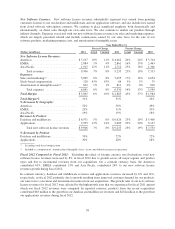

Software Business

Our software business consists of our new software licenses segment and software license updates and product

support segment.

57