Oracle 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

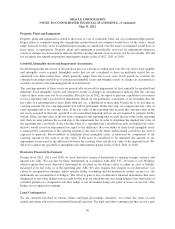

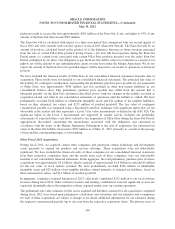

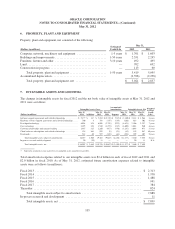

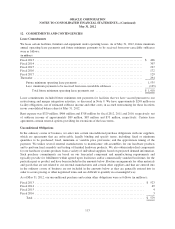

The changes in the carrying amounts of goodwill, which is generally not deductible for tax purposes, for our

operating segments for fiscal 2012 and 2011 were as follows:

Software

License

Updates

New and Hardware

Software Product Systems

(Dollars in millions) Licenses Support Support Other(2) Total

Balances as of May 31, 2010 ................... $ 5,995 $ 11,802 $ 923 $ 1,705 $ 20,425

Goodwill from acquisitions ................. 797 240 23 2 1,062

Goodwill adjustments(1) .................... (7) 10 63 — 66

Balances as of May 31, 2011 ................... 6,785 12,052 1,009 1,707 21,553

Goodwill from acquisitions ................. 658 461 184 2,378 3,681

Goodwill adjustments(1) .................... (76) (34) — (5) (115)

Balances as of May 31, 2012 ................... $ 7,367 $ 12,479 $ 1,193 $ 4,080 $ 25,119

(1) Pursuant to our business combinations accounting policy, we recorded goodwill adjustments for the effect on goodwill of changes to net

assets acquired during the measurement period (up to one year from the date of an acquisition). The other goodwill adjustments

presented in the table above were not significant to our previously reported operating results or financial position.

(2) Represents goodwill allocated to our other operating segments and approximately $2.3 billion of goodwill for certain of our acquisitions

that will be allocated based upon the finalization of valuations.

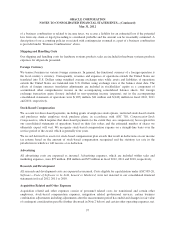

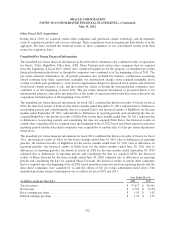

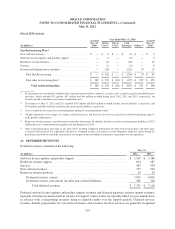

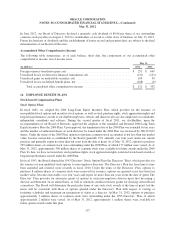

8. NOTES PAYABLE AND OTHER BORROWINGS

Notes payable and other borrowings consisted of the following:

May 31, May 31,

(Dollars in millions) 2012 2011

Short-term borrowings ............................................................................. $ 1,700 $ 1,150

4.95% senior notes due April 2013 .................................................................... 1,250 1,250

3.75% senior notes due July 2014, net of fair value adjustment of $69 each as of May 31, 2012 and 2011(1) .......... 1,569 1,569

5.25% senior notes due January 2016, net of discount of $4 and $5 as of May 31, 2012 and 2011, respectively ........ 1,996 1,995

5.75% senior notes due April 2018, net of discount of $1 each as of May 31, 2012 and 2011 ...................... 2,499 2,499

5.00% senior notes due July 2019, net of discount of $5 each as of May 31, 2012 and 2011 ....................... 1,745 1,745

3.875% senior notes due July 2020, net of discount of $2 each as of May 31, 2012 and 2011 ...................... 998 998

6.50% senior notes due April 2038, net of discount of $2 each as of May 31, 2012 and 2011 ...................... 1,248 1,248

6.125% senior notes due July 2039, net of discount of $8 each as of May 31, 2012 and 2011 ...................... 1,242 1,242

5.375% senior notes due July 2040, net of discount of $24 and $25 as of May 31, 2012 and 2011, respectively ........ 2,226 2,225

Capital leases .................................................................................... 1 1

Total borrowings .............................................................................. $ 16,474 $ 15,922

Notes payable, current and other current borrowings .............................................. $ 2,950 $ 1,150

Notes payable, non-current and other non-current borrowings ...................................... $ 13,524 $ 14,772

(1) Refer to Note 11 for a description of our accounting for fair value hedges.

106