Motorola 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146

|

|

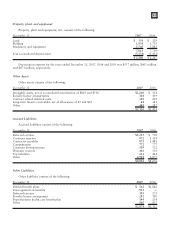

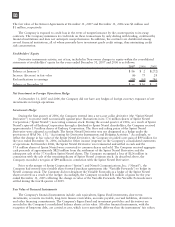

Property, plant, and equipment

Property, plant and equipment, net, consists of the following:

December 31 2007 2006

Land $ 134 $ 129

Building 1,934 1,705

Machinery and equipment 5,745 5,885

7,813 7,719

Less accumulated depreciation (5,333) (5,452)

$ 2,480 $ 2,267

Depreciation expense for the years ended December 31, 2007, 2006 and 2005 was $537 million, $463 million

and $473 million, respectively.

Other Assets

Other assets consists of the following:

December 31 2007 2006

Intangible assets, net of accumulated amortization of $819 and $536 $1,260 $ 354

Royalty license arrangements 364 439

Contract related deferred costs 180 200

Long-term finance receivables, net of allowances of $5 and $10 68 145

Other 448 287

$2,320 $1,425

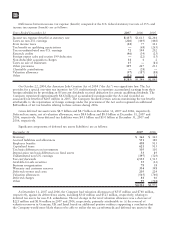

Accrued Liabilities

Accrued liabilities consists of the following:

December 31 2007 2006

Deferred revenue $1,235 $ 730

Customer reserves 972 1,305

Contractor payables 875 1,481

Compensation 772 777

Customer downpayments 509 532

Warranty reserves 416 530

Tax liabilities 234 444

Other 2,988 2,877

$8,001 $8,676

Other Liabilities

Other liabilities consists of the following:

December 31 2007 2006

Defined benefit plans $ 562 $1,882

Unrecognized tax benefits 933 —

Deferred revenue 393 273

Royalty license arrangement 282 300

Postretirement health care benefit plan 144 214

Other 560 653

$2,874 $3,322

89