Motorola 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financing Activities

The most significant components of the Company’s financing activities are: (i) the purchase of the Company’s

common stock under its share repurchase program, (ii) the net proceeds from issuance of debt, (iii) repayment of

debt, (iv) the payment of dividends, (v) proceeds from the issuances of stock due to the exercise of employee stock

options and purchases under the employee stock purchase plan, (vi) repayment of commercial paper and short-

term borrowings, (vii) distributions to discontinued operations, and (viii) excess tax benefits from share-based

compensation.

Net cash used for financing activities from continuing operations was $3.3 billion in 2007, compared to

$3.2 billion of cash used in 2006 and $907 million of cash used in 2005. Cash used for financing activities from

continuing operations in 2007 was primarily: (i) $3.0 billion of cash used to purchase 171.2 million shares of the

Company’s common stock under the share repurchase program, (ii) $1.4 billion of cash used for the repayment of

maturing debt, (iii) $468 million of cash used to pay dividends, (iv) $242 million of net cash used for the

repayment of commercial paper and short-term borrowings, and (v) $75 million in distributions to discontinued

operations, partially offset by proceeds of: (i) $1.4 billion received from the issuance of long-term debt,

(ii) $440 million received from the issuance of common stock in connection with the Company’s employee stock

option plans and employee stock purchase plan, and (iii) $50 million in excess tax benefits from share-based

compensation.

Cash used for financing activities from continuing operations in 2006 was primarily: (i) $3.8 billion of cash

used to purchase 171.7 million shares of the Company’s common stock under the share repurchase program,

(ii) $443 million of cash used to pay dividends, (iii) $23 million in distributions to discontinued operations, and

(iv) $18 million of cash used for the repayment of debt, partially offset by proceeds of: (i) $918 million received

from the issuance of common stock in connection with the Company’s employee stock option plans and employee

stock purchase plan, (ii) $165 million in excess tax benefits from share-based compensation, and (iii) $66 million

in net proceeds from commercial paper and short-term borrowings.

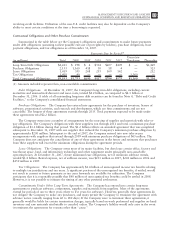

Commercial Paper and Other Short-Term Debt: At December 31, 2007, the Company’s outstanding notes

payable and current portion of long-term debt was $332 million, compared to $1.7 billion at December 31, 2006.

In January 2007, the Company repaid, at maturity, the entire $118 million aggregate principal amount outstanding

of its 7.6% Notes due January 1, 2007. In November 2007, the Company repaid, at maturity, the entire

$1.2 billion aggregate principal amount outstanding of its 4.608% Senior Notes due November 16, 2007. During

2007, $114 million of 6.50% Senior Notes due March 1, 2008 and $84 million of 5.80% Senior Notes due

October 15, 2008 were reclassified to current portion of long-term debt.

Net cash used for the repayment of commercial paper and short-term borrowings was $242 million in 2007,

compared to $66 million of net cash proceeds from the sale of commercial paper and short-term borrowings in

2006. The Company had no commercial paper outstanding on December 31, 2007, compared to $300 million of

outstanding commercial paper on December 31, 2006. The Company continues to have access to the commercial

paper markets. For the past four years, the Company has generally maintained commercial paper balances between

$300 million and $400 million. However, as a result of conditions in the credit markets, the interest rates the

Company would have to pay to issue commercial paper increased during the third and fourth quarters of 2007.

Accordingly, the Company elected to eliminate its commercial paper outstanding until pricing becomes more

favorable. The Company will issue commercial paper when it believes it is prudent to do so in light of prevailing

market conditions and other factors.

Long-term Debt: At December 31, 2007, the Company had outstanding long-term debt of $4.0 billion,

compared to $2.7 billion at December 31, 2006. The Company continues to have access to the long-term debt

markets.

In November 2007, the Company issued an aggregate face principal amount of: (i) $400 million of

5.375% Senior Notes due November 15, 2012, (ii) $400 million of 6.00% Senior Notes due November 15, 2017,

and (iii) $600 million of 6.625% Senior Notes due November 15, 2037.

The Company may from time to time seek to opportunistically retire certain of its outstanding debt through

open market cash purchases, privately-negotiated transactions or otherwise. Such repurchases, if any, will depend

on prevailing market conditions, the Company’s liquidity requirements, contractual restrictions and other factors.

Share Repurchase Program: During 2007, the Company repurchased 171.2 million of its common shares at

an aggregate cost of $3.0 billion, or an average cost of $17.74 per share. In 2006, the Company repurchased a

53

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS