Motorola 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

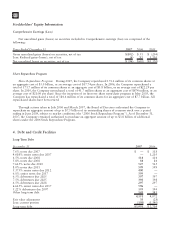

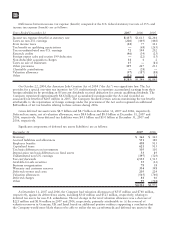

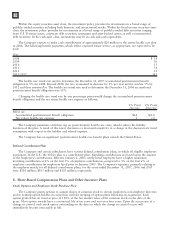

Differences between income tax expense (benefit) computed at the U.S. federal statutory tax rate of 35% and

income tax expense (benefit) are as follows:

Years Ended December 31 2007 2006 2005

Income tax expense (benefit) at statutory rate $(137) $1,613 $2,244

Taxes on non-U.S. earnings (206) (449) (460)

State income taxes (28) 77 121

Tax benefit on qualifying repatriations —(68) (265)

Tax on undistributed non-U.S. earnings 72 194 202

Research credits (46) (34) (23)

Foreign export sales and section 199 deduction —(22) (13)

Non-deductible acquisition charges 34 42

Taxes on sale of businesses 15 — (81)

Other provisions 119 247 233

Charitable contributions —(28) —

Valuation allowance (97) (187) (88)

Other (11) 221

$(285) $1,349 $1,893

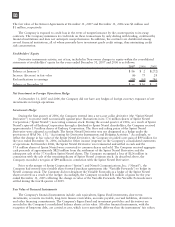

On October 22, 2004, the American Jobs Creation Act of 2004 (“the Act”) was signed into law. The Act

provides for a special one-time tax incentive for U.S. multinationals to repatriate accumulated earnings from their

foreign subsidiaries by providing an 85 percent dividends received deduction for certain qualifying dividends. The

Company repatriated approximately $4.6 billion of accumulated earnings under the Act and recorded an

associated tax benefit of $265 million in 2005. The Company finalized certain actions maximizing the tax benefit

attributable to the repatriation of foreign earnings under the provisions of the Act and recognized an additional

$68 million of net tax benefits relating to these actions during 2006.

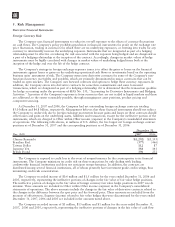

Gross deferred tax assets were $8.9 billion and $8.7 billion at December 31, 2007 and 2006, respectively.

Deferred tax assets, net of valuation allowances, were $8.4 billion and $8.0 billion at December 31, 2007 and

2006, respectively. Gross deferred tax liabilities were $4.1 billion and $5.0 billion at December 31, 2007 and

2006, respectively.

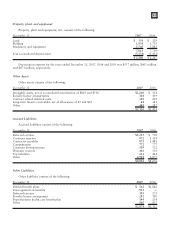

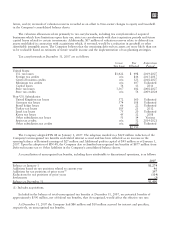

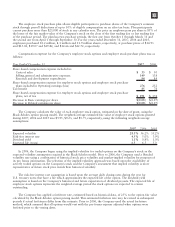

Significant components of deferred tax assets (liabilities) are as follows:

December 31 2007 2006

Inventory $ 162 $ 163

Accrued liabilities and allowances 551 380

Employee benefits 408 915

Capitalized items 621 915

Tax basis differences on investments 105 110

Depreciation tax basis differences on fixed assets 33 89

Undistributed non-U.S. earnings (397) (329)

Tax carryforwards 2,553 1,515

Available-for-sale securities 35 (23)

Business reorganization 78 38

Warranty and customer reserves 334 398

Deferred revenue and costs 205 224

Valuation allowances (515) (740)

Deferred charges 44 46

Other 95 (728)

$4,312 $2,973

At December 31, 2007 and 2006, the Company had valuation allowances of $515 million and $740 million,

respectively, against its deferred tax assets, including $310 million and $523 million, respectively, relating to

deferred tax assets for non-U.S. subsidiaries. The net change in the total valuation allowance was a decrease of

$225 million and $156 million in 2007 and 2006, respectively, primarily attributable to: (i) the reversal of

valuation reserves in Germany, UK and Israel based on additional positive evidence supporting a conclusion that

the Company would more likely than not be able to utilize the tax carryforwards and deferred tax assets in the

96