Motorola 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

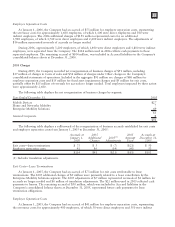

reporting date, the Company evaluates its accruals for exit costs and employee separation costs to ensure the

accruals are still appropriate. In certain circumstances, accruals are no longer required because of efficiencies in

carrying out the plans or because employees previously identified for separation resigned from the Company and

did not receive severance or were redeployed due to circumstances not foreseen when the original plans were

initiated. The Company reverses accruals through the income statement line item where the original charges were

recorded when it is determined they are no longer required.

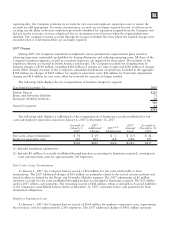

2007 Charges

During 2007, the Company committed to implement various productivity improvement plans aimed at

achieving long-term, sustainable profitability by driving efficiencies and reducing operating costs. All three of the

Company’s business segments, as well as corporate functions, are impacted by these plans. The majority of the

employees affected are located in North America and Europe. The Company recorded net reorganization of

business charges of $394 million, including $104 million of charges in Costs of sales and $290 million of charges

under Other charges (income) in the Company’s consolidated statements of operations. Included in the aggregate

$394 million are charges of $401 million for employee separation costs, $42 million for fixed asset impairment

charges and $19 million for exit costs, offset by reversals for accruals no longer needed.

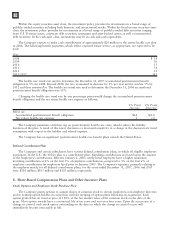

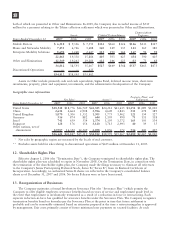

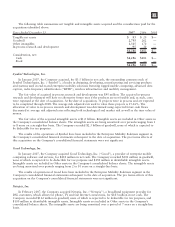

The following table displays the net reorganization of business charges by segment:

Year Ended December 31, 2007

Mobile Devices $229

Home and Networks Mobility 71

Enterprise Mobility Solutions 30

330

General Corporate 64

$394

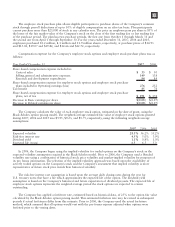

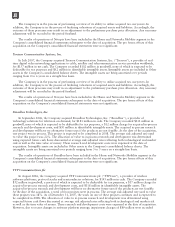

The following table displays a rollforward of the reorganization of businesses accruals established for exit

costs and employee separation costs from January 1, 2007 to December 31, 2007:

Accruals at

January 1,

2007

2007

Additional

Charges 2007

(1)(2)

Adjustments

2007

Amount

Used

Accruals at

December 31,

2007

Exit costs—lease terminations $ 54 $ 19 $ 2 $ (33) $ 42

Employee separation costs 104 401 (64) (248) 193

$158 $420 $(62) $(281) $235

(1) Includes translation adjustments.

(2) Includes $6 million of accruals established through purchase accounting for businesses acquired, covering exit

costs and separation costs for approximately 200 employees.

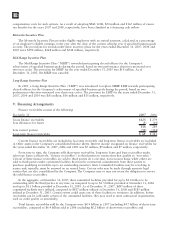

Exit Costs—Lease Terminations

At January 1, 2007, the Company had an accrual of $54 million for exit costs attributable to lease

terminations. The 2007 additional charges of $19 million are primarily related to the exit of certain activities and

leased facilities in Ireland by the Home and Networks Mobility segment. The 2007 adjustments of $2 million

represent accruals for exit costs established through purchase accounting for businesses acquired. The $33 million

used in 2007 reflects cash payments. The remaining accrual of $42 million, which is included in Accrued liabilities

in the Company’s consolidated balance sheets at December 31, 2007, represents future cash payments for lease

termination obligations.

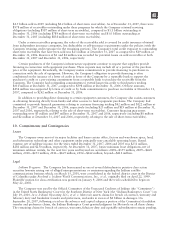

Employee Separation Costs

At January 1, 2007, the Company had an accrual of $104 million for employee separation costs, representing

the severance costs for approximately 2,300 employees. The 2007 additional charges of $401 million represent

113