Motorola 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

circumstances indicate that the carrying value may not be recoverable. The Company performs a goodwill

impairment test at the reporting unit level at least annually on October 1, or more often should triggering events

occur. Factors considered important that could trigger an impairment review include: (i) underperformance relative

to expected historical or projected future operating results, (ii) changes in the manner of use of the assets or the

strategy for our overall business, (iii) negative industry or economic trends, (iv) declines in price of an investment

for a sustained period, and (v) our market capitalization relative to net book value.

If it becomes probable that the Company will not collect all amounts in accordance with the contractual terms

of a debt security within the Sigma Fund, the Company considers the decline other-than-temporary and an

investment impairment is recorded.

When the Company determines that the carrying value of intangible assets and long-lived assets may not be

recoverable, an impairment charge is recorded. Impairment is generally measured based on a projected discounted

cash flow method using a discount rate determined by management to be commensurate with the risk inherent in

our current business model or prevailing market rates of investment securities, if available.

When performing a goodwill impairment test, the fair value of the reporting unit is determined using a

combination of present value techniques and quoted market prices of comparable businesses.

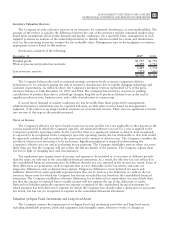

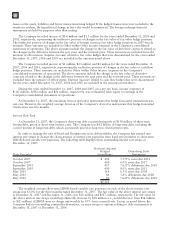

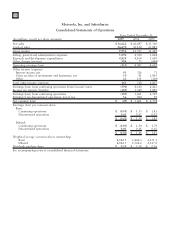

At December 31, 2007 and 2006, the net book values of these assets were as follows (in millions):

December 31 2007 2006

Sigma Fund $ 5,242 $12,204

Investments 837 895

Property, plant and equipment 2,480 2,267

Intangible assets 1,260 354

Goodwill 4,499 1,706

$14,318 $17,426

The Company recorded investment impairment charges of $62 million, $27 million and $25 million in 2007,

2006 and 2005, respectively, representing other-than-temporary declines in the value of the Company’s Sigma Fund

and investment portfolios. Additionally, the available-for-sale securities portfolio reflected an unrealized loss

position of $96 million and an unrealized gain position of $60 million at December 31, 2007 and 2006,

respectively.

The Company recorded fixed asset impairment charges of $50 million in 2007, and $15 million in both 2006

and 2005. The Company recorded intangible asset impairment charges of $81 million in 2007, compared to no

impairment charges in 2006 and 2005. No goodwill impairment charges were required in the periods presented.

The Company cannot predict the occurrence of future impairment-triggering events nor the impact such events

might have on these reported asset values. Such events may include strategic decisions made in response to the

economic conditions relative to product lines or operations and the impact of the economic environment on our

customer base.

Restructuring Activities

The Company maintains a formal Involuntary Severance Plan (the “Severance Plan”) which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in

the event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. Each

separate reduction-in-force has qualified for severance benefits under the Severance Plan. The Company recognizes

termination benefits based on formulas per the Severance Plan at the point in time that future settlement is

probable and can be reasonably estimated based on estimates prepared at the time a restructuring plan is approved

by management. Exit costs primarily consist of future minimum lease payments on vacated facilities. At each

reporting date, the Company evaluates its accruals for exit costs and employee separation costs to ensure the

accruals are still appropriate. In certain circumstances, accruals are no longer required because of efficiencies in

carrying out the plans or because employees previously identified for separation resigned from the Company and

did not receive severance or were redeployed due to circumstances not foreseen when the original plans were

initiated. The Company reverses accruals through the income statement line item where the original charges were

recorded when it is determined they are no longer required.

66 MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS