Motorola 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

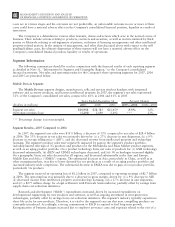

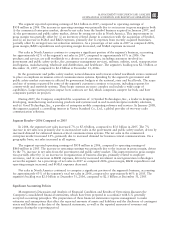

The segment reported operating earnings of $709 million in 2007, compared to operating earnings of

$787 million in 2006. The decrease in operating earnings was primarily due to a decrease in gross margin, driven

by: (i) lower net sales of iDEN infrastructure equipment, and (ii) continued competitive pricing pressure in the

market for GSM infrastructure equipment, partially offset by: (i) increased net sales of digital entertainment

devices, and (ii) the reversal of reorganization of business accruals recorded in 2006 relating to employee severance

which are no longer needed. SG&A expenses increased primarily due to the expenses from recently acquired

businesses, partially offset by savings from cost-reduction initiatives. R&D expenditures decreased primarily due to

savings from cost-reduction initiatives, partially offset by expenditures by recently acquired businesses and

continued investment in digital entertainment devices and WiMAX. As a percentage of net sales in 2007 as

compared to 2006, gross margin, SG&A expenses, R&D expenditures and operating margin all decreased. The

segment’s gross margin percentages differ among its services, software and equipment products. Accordingly, the

aggregate gross margin of the segment can fluctuate from period to period depending upon the relative mix of sales

in the given period.

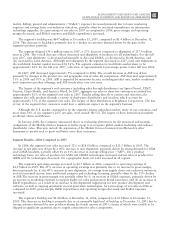

Due to the nature of the segment’s business, many of the agreements we enter into are long-term contracts

that require sizeable investments by our customers. The segment is dependent upon a small number of customers

for a significant portion of its sales. A small number of large cable television multiple system operators (“MSOs”)

own a large portion of the cable systems and account for a significant portion of the total capital spending in the

cable industry. In 2007, sales to our top five customers (Comcast; Verizon; KDDI, a service provider in Japan;

China Mobile; and Sprint Nextel) represented approximately 43% of the segments net sales. The loss of one of

these major customers could have a significant impact on the segment’s business and, because many of these

contracts are long-term in nature, could impact revenue and earnings over several quarters. The segment’s backlog

was $2.6 billion at December 31, 2007, compared to $3.2 billion at December 31, 2006.

In the home business, demand for the segment’s products depends primarily on the level of capital spending by

broadband operators for constructing, rebuilding or upgrading their communications systems, and for offering

advanced services. During the second quarter of 2007, the segment began shipping digital set-tops that support the

Federal Communications Commission (“FCC”)—mandated separable security requirement. FCC regulations

mandating the separation of security functionality from set-tops went into effect on July 1, 2007. As a result of

these regulations, many cable service providers accelerated their purchases of set-tops in the first half of 2007.

Additionally, in 2007, our digital video customers significantly increased their purchases of the segment’s products

and services, primarily due to increased demand for digital video set-tops, particularly HD/DVR set-tops.

In the wireless networks business, the segment has been a long-standing proponent of WiMAX and is now

participating in over 40 WiMAX trials globally and several commercial contracts globally. The segment also

maintained momentum in infrastructure development and services in 2007 by continuing to deliver outstanding

technologies and services for wireless and wireline carriers.

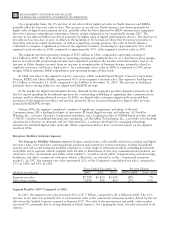

During 2007, the segment completed the acquisitions of: (i) Netopia, Inc., a broadband equipment provider

for DSL customers, which allows for phone, TV and fast Internet connections, (ii) Tut Systems, Inc., a leading

developer of edge routing and video encoders, (iii) Modulus Video, Inc., a provider of MPEG-4 Advanced Coding

compression systems designed for delivery of high-value video content in IP set-top devices for the digital video,

broadcast and satellite marketplaces, (iv) Terayon Communication Systems, Inc., a provider of real-time digital

video networking applications to cable, satellite and telecommunication service providers worldwide, and

(v) Leapstone Systems, Inc., a provider of intelligent multimedia service delivery and content management solutions

to networks operators. These acquisitions enhance our ability to provide a complete end-to-end solution for the

delivery of advanced video, voice and data services. In December 2007, Motorola completed the sale of its

embedded communication computing business to Emerson for $346 million in cash.

Segment Results—2006 Compared to 2005

In 2006, the segment’s net sales increased 1% to $9.2 billion, compared to $9.0 billion in 2005. The 1%

increase in net sales reflected a 16% increase in net sales in the home business, partially offset by a 5%

decrease in net sales of wireless networks. Net sales of digital entertainment devices increased approximately

24%, reflecting increased demand for HD/DVR set-tops, partially offset by a decline in ASP due to a product

mix shift. Unit shipments of digital entertainment devices increased 57% to 10.1 million units. Net sales of

broadband gateways increased approximately 18%, primarily due to: (i) increased unit shipments of cable

modems, and (ii) increased ASPs for cable modems, reflecting increased demand for advanced voice-enabled

modems. Net sales of wireless networks decreased 5%, primarily driven by lower demand for GSM, iDEN and

CDMA infrastructure equipment.

61

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS