Motorola 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

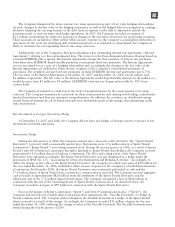

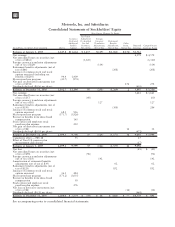

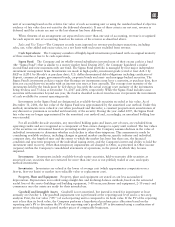

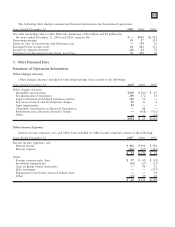

Motorola, Inc. and Subsidiaries

Consolidated Statements of Stockholders’ Equity

(In millions, except per share amounts) Shares

Common

Stock and

Additional

Paid-In

Capital

Fair Value

Adjustment

To Available

For Sale

Securities,

Net of Tax

Foreign

Currency

Translation

Adjustments,

Net of Tax

Retirement

Benefits

Adjustments,

Net of Tax

Other

Items,

Net of Tax

Retained

Earnings

Comprehensive

Earnings (Loss)

Non-Owner Changes To Equity

Balances at January 1, 2005 2,447.8 $11,664 $ 1,417 $(139) $(1,061) $(272) $1,722

Net earnings 4,578 $ 4,578

Net unrealized losses on securities (net

of tax of $812) (1,320) (1,320)

Foreign currency translation adjustments

(net of tax of $29) (114) (114)

Retirement benefits adjustments (net of

tax of $66) (208) (208)

Issuance of common stock and stock

options exercised (including tax

benefits of $210) 96.6 1,409

Share repurchase program (41.7) (874)

Net gain on derivative instruments (net

of tax of $154) 274 274

Dividends declared ($0.16 per share) (403)

Balances at December 31, 2005 2,502.7 12,199 97 (253) (1,269) 2 5,897 $ 3,210

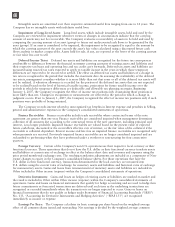

Net earnings 3,661 $ 3,661

Net unrealized losses on securities (net

of tax of $37) (60) (60)

Foreign currency translation adjustments

(net of tax of $1) 127 127

Retirement benefits adjustments (net of

tax of $150) (308) 206

Issuance of common stock and stock

options exercised 68.1 916

Share repurchase program (171.7) (3,826)

Excess tax benefits from share-based

compensation 165

Stock option and employee stock

purchase plan expense 252

Net gain on derivative instruments (net

of tax of $6) 14 14

Dividends declared ($0.19 per share) (472)

Balances at December 31, 2006 2,399.1 9,706 37 (126) (1,577) 16 9,086 $ 3,948

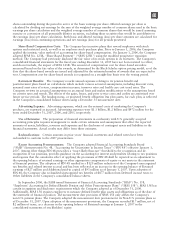

Cumulative effect — FIN 48 93 27

Effect of Non-U.S. pension plan

measurement date change (17)

Balances at January 1, 2007 2,399.1 9,799 37 (126) (1,577) 16 9,096

Net loss (49) $ (49)

Net unrealized losses on securities (net

of tax of $58) (96) (96)

Foreign currency translation adjustments

(net of tax of $3) 142 142

Amortization of retirement benefits

adjustments (net of tax of $39) 62 62

Retirement benefits adjustments (net of

tax of $328) 852 852

Issuance of common stock and stock

options exercised 36.1 484

Share repurchase program (171.2) (3,035)

Excess tax benefits from share-based

compensation 50

Stock option and employee stock

purchase plan expense 276

Net loss on derivative instruments (net

of tax of $6) (16) (16)

Dividends declared ($0.20 per share) (468)

Balances at December 31, 2007 2,264.0 $ 7,574 $ (59) $ 16 $ (663) $ — $8,579 $ 895

See accompanying notes to consolidated financial statements.

78