Motorola 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

total of 171.7 million of its common shares at an aggregate cost of $3.8 billion, or an average cost of $22.29 per

share. In 2005, the Company repurchased a total of 41.7 million shares at an aggregate cost of $874 million, or an

average cost of $20.96 per share. Since the inception of its first-ever share repurchase program in May 2005, the

Company has repurchased a total of 384.6 million of its common shares for an aggregate cost of $7.7 billion. All

repurchased shares have been retired.

Through actions taken in July 2006 and March 2007, the Board of Directors authorized the Company to

repurchase an aggregate amount of up to $7.5 billion of its outstanding shares of common stock over a period

ending in June 2009, subject to market conditions (the “2006 Stock Repurchase Program”). As of December 31,

2007, the Company remained authorized to purchase an aggregate amount of up to $3.8 billion of additional

shares under the 2006 Stock Repurchase Program.

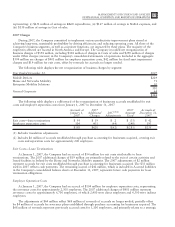

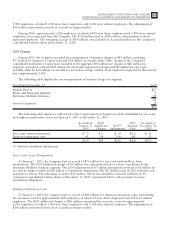

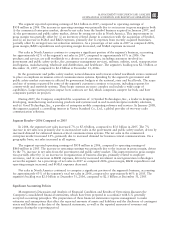

Credit Ratings: Three independent credit rating agencies, Fitch Investors Service (“Fitch”), Moody’s Investor

Services (“Moody’s”), and Standard & Poor’s (“S&P”), assign ratings to the Company’s short-term and long-term

debt. The following chart reflects the current ratings assigned to the Company’s senior unsecured non-credit

enhanced long-term debt and the Company’s commercial paper by each of these agencies.

Name of

Rating

Agency Rating Rating Date and Last Actions Taken

Long-Term Debt Commercial Paper

Fitch BBB F-2 February 1, 2008 (placed all debt on rating watch negative)

January 24, 2008 (downgraded long-term debt to BBB (negative

outlook) from BBB+ (negative outlook))

Moody’s Baa1 P-2 January 24, 2008 (placed long-term debt on review for possible

downgrade)

S&P BBB A-2 January 25, 2008 (downgraded long-term debt to BBB (credit watch

negative) from A- (negative outlook); placed A-2 commercial paper on credit

watch negative)

The Company’s debt ratings are considered “investment grade.” If the Company’s senior long-term debt were

rated lower than “BBB-” by S&P or Fitch or “Baa3” by Moody’s (which would be a decline of two levels from

current Fitch and S&P ratings), the Company’s long-term debt would no longer be considered “investment grade.”

If this were to occur, the terms on which the Company could borrow money would become more onerous. The

Company would also have to pay higher fees related to its domestic revolving credit facility. The Company has

never borrowed under its domestic revolving credit facilities.

As further described under “Customer Financing Arrangements” below, for many years the Company has

utilized a number of receivables programs to sell a broadly-diversified group of short-term receivables to third

parties. Certain of the short-term receivables are sold to a multi-seller commercial paper conduit. This program

provides for up to $400 million of short-term receivables to be outstanding with the conduit at any time. The

obligations of the conduit to continue to purchase receivables under this short-term receivables program could be

terminated if the Company’s long-term debt was rated lower than “BB+” by S&P or “Ba1” by Moody’s (which

would be a decline of three levels from the current S&P rating). If this short-term receivables program were

terminated, the Company would no longer be able to sell its short-term receivables to the conduit in this manner,

but it would not have to repurchase previously-sold receivables.

Credit Facilities

At December 31, 2007, the Company’s total domestic and non-U.S. credit facilities totaled $4.3 billion, of

which $314 million was considered utilized. These facilities are principally comprised of: (i) a $2.0 billion five-year

revolving domestic credit facility maturing in December 2011 (the “5-Year Credit Facility”) which is not utilized,

and (ii) $2.3 billion of uncommitted non-U.S. credit facilities (of which $314 million was considered utilized at

December 31, 2007). Unused availability under the existing credit facilities, together with available cash, cash

equivalents, Sigma Fund balances and other sources of liquidity, are generally available to support outstanding

commercial paper, of which none was outstanding at December 31, 2007.

In order to borrow funds under the 5-Year Credit Facility, the Company must be in compliance with various

conditions, covenants and representations contained in the agreements. The Company was in compliance with the

terms of the 5-Year Credit Facility at December 31, 2007. The Company has never borrowed under its domestic

54 MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS