Motorola 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

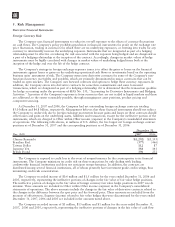

In September 2006, the FASB issued EITF 06-4, “Accounting for Deferred Compensation and Postretirement

Benefit Aspects of Endorsement Split-Dollar Life Insurance Arrangements” (“EITF 06-4”). EITF 06-4 requires that

endorsement split-dollar life insurance arrangements which provide a benefit to an employee beyond the

postretirement period be recorded in accordance with SFAS No. 106, “Employer’s Accounting for Postretirement

Benefits Other Than Pensions” or APB Opinion No. 12, “Omnibus Opinion—1967” (“the Statements”) based on

the substance of the agreement with the employee. Under the provisions of these Statements, a liability should be

accrued equal to the actuarial present value of the future death benefit over the service period. EITF 06-4 is

effective for fiscal years beginning after December 15, 2007. The Company will adopt EITF 06-4 as of January 1,

2008 and anticipates that the adoption of this pronouncement will result in an increase in Other liabilities of

approximately $50 million with the offset reflected as a cumulative-effect adjustment to Retained earnings.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS 157”). SFAS 157

defines fair value, establishes a framework for measuring fair value as required by other accounting

pronouncements and expands fair value measurement disclosures. SFAS 157 is effective for fiscal years beginning

after November 15, 2007. In February of 2008, the FASB issued FASB Staff Position 157-2 which delays the

effective date of SFAS 157 for non-financial assets and liabilities which are not measured at fair value on a

recurring basis (at least annually) until fiscal years beginning after November 15, 2008. The Company is currently

evaluating the impact of SFAS 157 on the Company’s consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities—Including an amendment of FASB Statement No. 115” (“SFAS 159”). SFAS 159 permits entities to

elect to measure many financial instruments and certain other items at fair value. Unrealized gains and losses on

items for which the fair value option has been elected will be recognized in earnings at each subsequent reporting

date. SFAS 159 is effective for fiscal years beginning after November 15, 2007. The Company is currently assessing

the impact of SFAS 159 on the Company’s consolidated financial statements.

In December 2007, the FASB issued SFAS No. 160, “Non-Controlling Interests in Consolidated Financial

Statements an amendment of ARB No. 51” (“SFAS 160”). SFAS 160 establishes new standards for the accounting

for and reporting of non-controlling interests (formerly minority interests) and for the loss of control of partially

owned and consolidated subsidiaries. SFAS 160 does not change the criteria for consolidating a partially owned

entity. SFAS 160 is effective for fiscal years beginning after December 15, 2008. The provisions of SFAS 160 will

be applied prospectively upon adoption except for the presentation and disclosure requirements, which will be

applied retrospectively. The Company does not expect the adoption of SFAS 160 will have a material impact on

the Company’s consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141(revised 2007) (“SFAS 141R”), a revision of SFAS 141,

“Business Combinations.” SFAS 141R establishes requirements for the recognition and measurement of acquired

assets, liabilities, goodwill, and non-controlling interests. SFAS 141R also provides disclosure requirements related

to business combinations. SFAS 141R is effective for fiscal years beginning after December 15, 2008. SFAS 141R

will be applied prospectively to business combinations with an acquisition date on or after the effective date.

2. Discontinued Operations

During 2006, the Company completed the sale of its automotive electronics business to Continental AG for

$856 million in net cash received. The Company recorded a gain on sale of business of $399 million before income

taxes, which is included in Earnings (loss) from discontinued operations, net of tax, in the Company’s consolidated

statements of operations.

On December 2, 2004, the Company completed the separation and spin-off of Freescale Semiconductor, Inc.

(“Freescale Semiconductor”). Under the terms of the Master Separation and Distribution Agreement entered into

between Motorola and Freescale Semiconductor, Freescale Semiconductor has agreed to indemnify Motorola for

substantially all past, present and future liabilities associated with the semiconductor business. The spin-off was

effected by way of a pro rata non-cash dividend to Motorola stockholders, which reduced retained earnings by

$2.5 billion. The equity distribution was structured to be tax-free to Motorola stockholders for U.S. tax purposes

(other than with respect to any cash received in lieu of fractional shares).

The financial results of the automotive electronics business and Freescale Semiconductor were reflected as

discontinued operations in the consolidated financial statements and related notes thereto. During 2007, the

discontinued operations activity primarily relates to resolutions of certain matters with the tax authorities and

payments of post-retiree medical claims to former employees.

84