Motorola 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

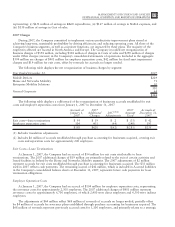

may be made through separate legal entities that are also consolidated by the Company. The Company may or

may not retain the obligation to service the sold finance receivables.

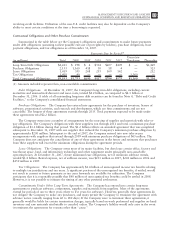

In the aggregate, at December 31, 2007, these committed facilities provided for up to $1.4 billion to be

outstanding with the third parties at any time, as compared to up to $1.3 billion provided at December 31, 2006

and up to $1.1 billion provided at December 31, 2005. As of December 31, 2007, $497 million of these

committed facilities were utilized, compared to $817 million utilized at December 31, 2006 and $585 million

utilized at December 31, 2005. Certain events could cause one of these facilities to terminate. In addition, before

receivables can be sold under certain of the committed facilities, they may need to meet contractual requirements,

such as credit quality or insurability.

Total finance receivables sold by the Company were $4.9 billion in 2007 (including $4.7 billion of short-term

receivables), compared to $6.4 billion sold in 2006 (including $6.2 billion of short-term receivables) and

$4.5 billion sold in 2005 (including $4.2 billion of short-term receivables). As of December 31, 2007, there were

$978 million of receivables outstanding under these programs for which the Company retained servicing

obligations (including $587 million of short-term receivables), compared to $1.1 billion outstanding at

December 31, 2006 (including $789 million of short-term receivables) and $1.0 billion outstanding at

December 31, 2005 (including $838 million of short-term receivables).

Under certain receivables programs, the value of the receivables sold is covered by credit insurance obtained

from independent insurance companies, less deductibles or self-insurance requirements under the policies (with the

Company retaining credit exposure for the remaining portion). The Company’s total credit exposure to outstanding

short-term receivables that have been sold was $23 million at December 31, 2007, as compared to $19 million at

December 31, 2006. Reserves of $1 million and $4 million were recorded for potential losses on sold receivables at

December 31, 2007 and December 31, 2006, respectively.

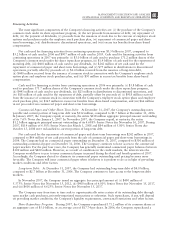

Adequate Internal and External Funding Resources

The Company believes that it has adequate internal and external resources available to fund expected working

capital and capital expenditure requirements for the next twelve months as supported by the level of cash, cash

equivalents, short-term investments and Sigma Fund balances in the U.S., the ability to repatriate cash, cash

equivalents, short-term investments and Sigma Fund balances from foreign jurisdictions, the ability to borrow

under the committed credit facility or future credit facilities, the ability to issue commercial paper, and access to

the short-term and long-term debt markets.

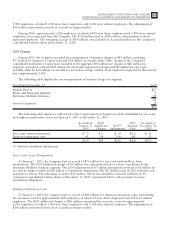

Other Contingencies

Potential Contractual Damage Claims in Excess of Underlying Contract Value: In certain circumstances, our

businesses may enter into contracts with customers pursuant to which the damages that could be claimed by the

other party for failed performance might exceed the revenue the Company receives from the contract. Contracts

with these sorts of uncapped damage provisions are fairly rare, but individual contracts could still represent

meaningful risk. There is a possibility that a damage claim by a counterparty to one of these contracts could result

in expenses to the Company that are far in excess of the revenue received from the counterparty in connection

with the contract.

Indemnification Provisions: In addition, the Company may provide indemnifications for losses that result

from the breach of general warranties contained in certain commercial, intellectual property and divestiture

agreements. Historically, the Company has not made significant payments under these agreements, nor have there

been significant claims asserted against the Company. However, there is an increasing risk in relation to intellectual

property indemnities given the current legal climate. In all indemnification cases, payment by the Company is

conditioned on the other party making a claim pursuant to the procedures specified in the particular contract,

which procedures typically allow the Company to challenge the other party’s claims. Further, the Company’s

obligations under these agreements for indemnification based on breach of representations and warranties are

generally limited in terms of duration, typically not more than 24 months, and for amounts not in excess of the

contract value, and in some instances, the Company may have recourse against third parties for certain payments

made by the Company.

Legal Matters: The Company has several lawsuits filed against it relating to the Iridium program, as further

described under Part I, Item 3: Legal Proceedings of this document. The Company has not reserved for any

potential liability that may arise as a result of U.S. litigation related to the Iridium program. While the still pending

57

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS