Motorola 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

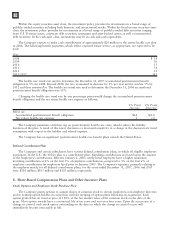

debt securities. In the cash and other investments asset class, investments may be in cash, cash equivalents or

insurance contracts.

The Company expects to make cash contributions of approximately $240 million to its U.S. pension plans and

approximately $50 million to its non-U.S. pension plans in 2008.

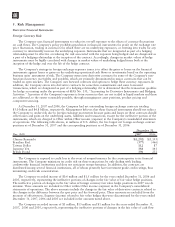

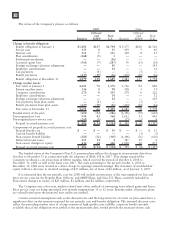

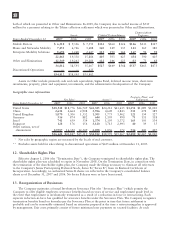

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Year Regular

Officers

and

MSPP Non

U.S.

2008 $ 196 $14 $ 25

2009 211 5 26

2010 220 13 27

2011 235 21 28

2012 251 22 30

2013-2017 1,544 26 173

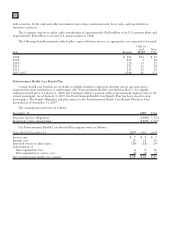

Postretirement Health Care Benefit Plan

Certain health care benefits are available to eligible domestic employees meeting certain age and service

requirements upon termination of employment (the “Postretirement Health Care Benefits Plan”). For eligible

employees hired prior to January 1, 2002, the Company offsets a portion of the postretirement medical costs to the

retired participant. As of January 1, 2005, the Postretirement Health Care Benefit Plan has been closed to new

participants. The benefit obligation and plan assets for the Postretirement Health Care Benefit Plan have been

measured as of December 31, 2007.

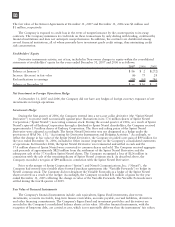

The assumptions used were as follows:

December 31 2007 2006

Discount rate for obligations 6.50% 5.75%

Investment return assumptions 8.50% 8.50%

Net Postretirement Health Care Benefit Plan expenses were as follows:

Years Ended December 31 2007 2006 2005

Service cost $7 $8 $9

Interest cost 23 25 30

Expected return on plan assets (19) (18) (19)

Amortization of:

Unrecognized net loss 6910

Unrecognized prior service cost (2) (2) (3)

Net postretirement health care expense $15 $22 $27

102