Motorola 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the first half of 2005, the Company sold 22.5 million shares of common stock of Nextel

Communications, Inc. (“Nextel”). The Company received approximately $679 million in cash and realized a pre-

tax gain of $609 million from these sales.

On August 12, 2005, Sprint Corporation completed its merger (the “Sprint Nextel Merger”) with Nextel. In

connection with the Sprint Nextel Merger, Motorola received $46 million in cash, 31.7 million voting shares and

37.6 million non-voting shares of Sprint Nextel, in exchange for its remaining 54.7 million shares of Nextel. As a

result of this transaction, the Company realized a gain of $1.3 billion, comprised of a $1.7 billion gain recognized

on the receipt of cash and the 69.3 million shares of Sprint Nextel in exchange for its shares of Nextel, net of a

$418 million loss recognized on its hedge of 25 million shares of common stock of Nextel.

During the fourth quarter of 2005, the Company elected to settle variable share purchase agreements by

delivering 30.3 million shares of Sprint Nextel common stock, with a value of $725 million, to the counterparties

and selling the remaining 1.4 million Sprint Nextel common shares in the open market. The Company received

aggregate cash proceeds of $391 million and realized a loss of $70 million in connection with the settlement and

sale.

On December 14, 2004, in connection with the announcement of the definitive agreement relating to the

Sprint Nextel Merger, Motorola, a Motorola subsidiary and Nextel entered into an agreement pursuant to which

Motorola and its subsidiary agreed to not dispose of their 29.7 million non-voting shares of Nextel (which became

37.6 million shares of non-voting common stock of Sprint Nextel issued in exchange for Nextel non-voting

common stock pursuant to the Sprint Nextel Merger) for a period of no longer than two years. In exchange for

this agreement, Nextel paid Motorola a fee of $50 million in 2005.

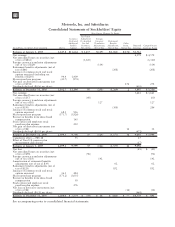

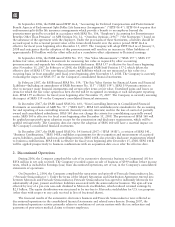

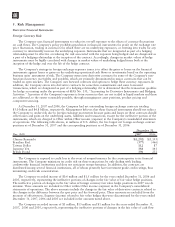

Accounts Receivable

Accounts receivable, net, consists of the following:

December 31 2007 2006

Accounts receivable $5,508 $7,587

Less allowance for doubtful accounts (184) (78)

$5,324 $7,509

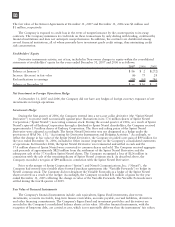

Inventories

Inventories, net, consist of the following:

December 31 2007 2006

Finished goods $1,737 $1,796

Work-in-process and production materials 1,470 1,782

3,207 3,578

Less inventory reserves (371) (416)

$2,836 $3,162

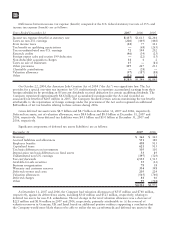

Other Current Assets

Other current assets consists of the following:

December 31 2007 2006

Costs and earnings in excess of billings $ 995 $ 505

Contractor receivables 960 1,349

Contract related deferred costs 763 369

Other 847 710

$3,565 $2,933

88