Motorola 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

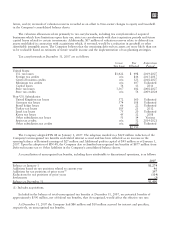

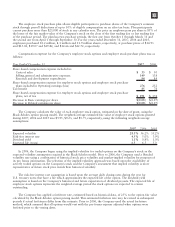

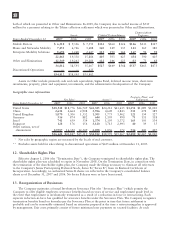

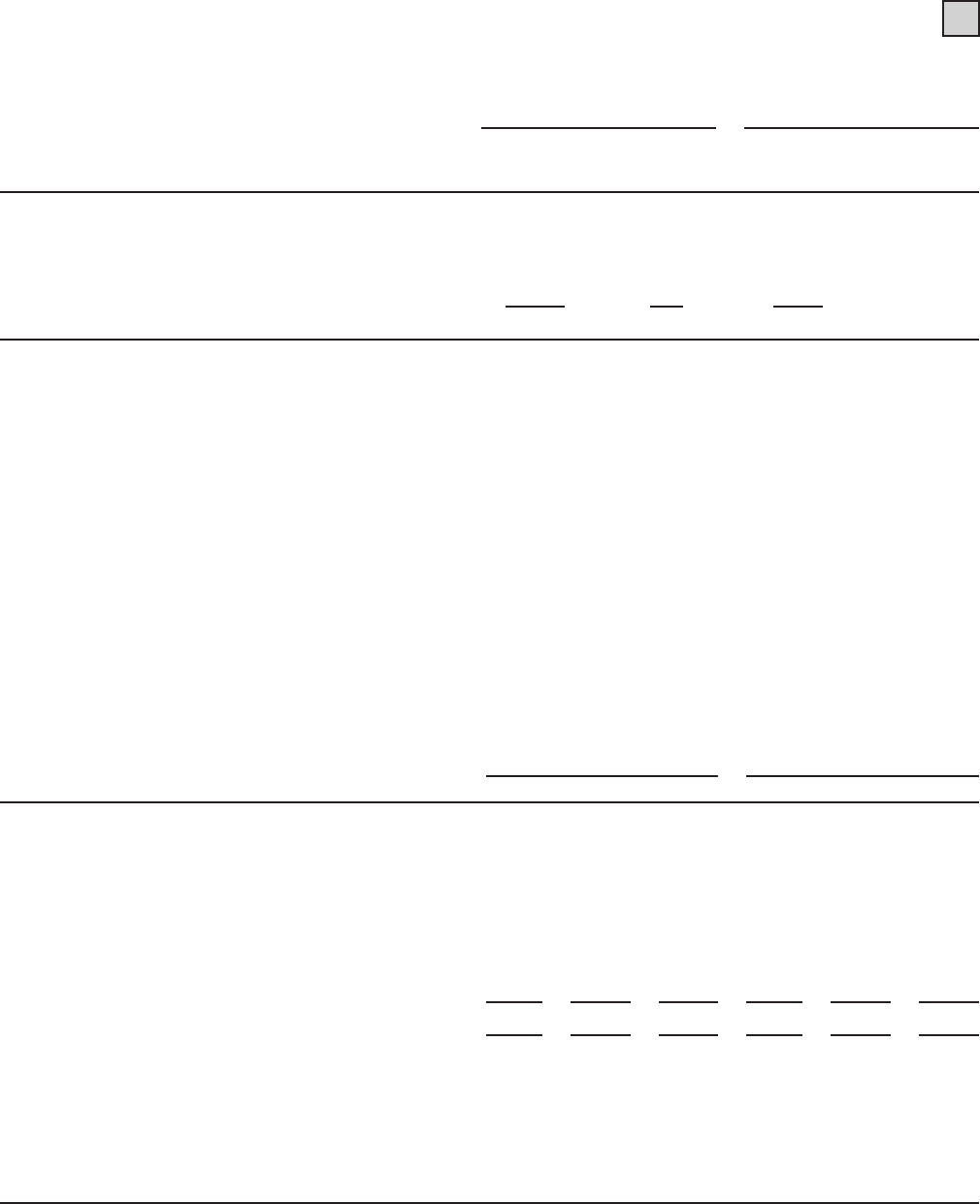

Restricted stock and restricted stock unit activity was as follows (in thousands, except fair value):

Years Ended December 31 RS and RSU

Wtd. Avg.

Grant Date

Fair Value RS and RSU

Wtd Avg.

Grant Date

Fair Value

2007 2006

RS and RSU outstanding at January 1 6,016 $19 4,383 $16

Granted 7,766 18 2,761 22

Vested (1,068) 19 (938) 15

Terminated, canceled or expired (1,959) 19 (190) 18

RS and RSU outstanding at December 31 10,755 17 6,016 19

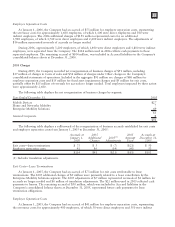

At December 31, 2007, the Company had unrecognized compensation expense related to restricted stock and

restricted stock units of $113 million, expected to be recognized over the weighted average period of

approximately three years. An aggregate of approximately 7.8 million, 2.8 million and 1.7 million shares of

restricted stock and restricted stock units were granted in 2007, 2006 and 2005, respectively. The amortization of

unrecognized compensation for the years ended December 31, 2007, 2006 and 2005 was $39 million, $24 million

and $14 million, respectively. The total fair value of restricted stock and restricted stock unit shares vested during

the years ended December 31, 2007, 2006 and 2005 was $13 million, $22 million and $32 million, respectively.

The aggregate intrinsic value of outstanding restricted stock and restricted stock units as of December 31, 2007

was $173 million.

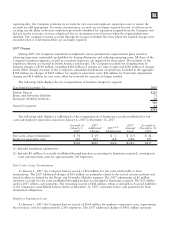

Total Share-Based Compensation Presentation

Under the modified prospective transition method, results for 2005 have not been restated to reflect the effects

of implementing SFAS 123R. The following pro forma information is presented for comparative purposes and

illustrate the pro forma effect on Earnings from continuing operations and Net earnings and the respective earnings

per share for each period presented as if the Company had applied the fair value recognition provisions to share-

based employee compensation prior to 2006 (in millions, except per share amounts):

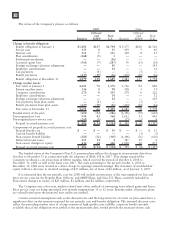

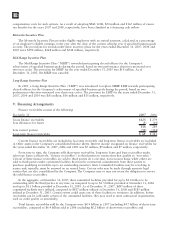

Years Ended December 31 2007 2006 2005 2007 2006 2005

Continuing Operations Net Earnings (Loss)

Earnings (loss):

Earnings (loss), as reported $ (105) $3,261 $4,519 $ (49) $3,661 $4,578

Add: Share-based employee compensation expense

included in reported earnings, net of related tax

effects n/a n/a 9 n/a n/a 9

Deduct: Share-based employee compensation

expense determined under fair value-based

method for all awards, net of related tax effects n/a n/a (170) n/a n/a (170)

Pro forma earnings (loss) $ (105) $3,261 $4,358 $ (49) $3,661 $4,417

Basic earnings (loss) per common share:

As reported $(0.05) $ 1.33 $ 1.83 $(0.02) $ 1.50 $ 1.85

Pro forma $ n/a $ n/a $ 1.76 $ n/a $ n/a $ 1.79

Diluted earnings (loss) per common share:

As reported $(0.05) $ 1.30 $ 1.79 $(0.02) $ 1.46 $ 1.81

Pro forma $ n/a $ n/a $ 1.72 $ n/a $ n/a $ 1.75

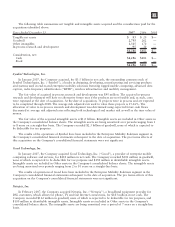

Prior to adopting SFAS 123R, the Company presented all tax benefits resulting from the exercise of stock

options as operating cash flows in the consolidated statements of cash flows. As a result, $210 million of excess

tax benefits for 2005 has been classified as an operating cash inflow. SFAS 123R requires cash flows resulting from

excess tax benefits to be classified as a part of cash flows from financing activities. Excess tax benefits are realized

tax benefits from tax deductions for exercised options in excess of the deferred tax asset attributable to stock

107