Motorola 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

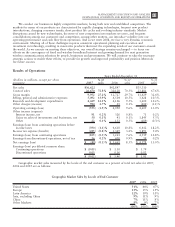

What were the financial results for our three operating business segments in 2007?

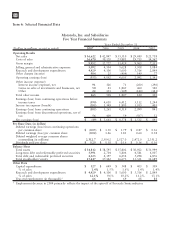

•In Our Mobile Devices Business: Net sales were $19.0 billion in 2007, a decrease of 33% compared to

net sales of $28.4 billion in 2006. The business incurred an operating loss of $1.2 billion in 2007, compared

to operating earnings of $2.7 billion in 2006. The business had lower net sales in all regions. The decrease

in net sales was primarily driven by: (i) a 27% decrease in unit shipments, (ii) a 9% decrease in average

selling price (“ASP”), and (iii) decreased revenue from intellectual property and technology licensing. The

operating loss was primarily due to a decrease in gross margin, driven by: (i) a 9% decrease in ASP,

(ii) decreased income from intellectual property and technology licensing, (iii) a 27% decrease in unit

shipments, and (iv) a $277 million charge for a legal settlement with Freescale Semiconductor, partially

offset by savings from supply chain cost-reduction initiatives. Our global handset market share for the full

year 2007 was approximately 14%, a decrease of approximately 8 percentage points versus full year 2006.

•In Our Home and Networks Mobility Business: Net sales were $10.0 billion in 2007, an increase of 9%

compared to net sales of $9.2 billion in 2006. Operating earnings were $709 million, a decrease of

10% compared to operating earnings of $787 million in 2006. The business had higher net sales in all

regions. The increase in net sales reflected higher net sales in the home business, partially offset by lower net

sales of wireless networks. The decrease in operating earnings was primarily due to a decrease in gross

margin driven by: (i) lower net sales of iDEN infrastructure equipment, and (ii) continued competitive

pricing pressure in the market for GSM infrastructure equipment, partially offset by increased net sales of

digital entertainment devices.

•In Our Enterprise Mobility Solutions Business: Net sales were $7.7 billion in 2007, an increase of

43% compared to net sales of $5.4 billion in 2006. Operating earnings were $1.2 billion, an increase of

27% compared to operating earnings of $958 million in 2006. The increase in net sales reflects higher net

sales in all regions and was primarily driven by sales from the Symbol business acquired in January 2007, as

well as higher net sales in the government and public safety market due to strong demand in North

America. The increase in operating earnings was primarily due to an increase in gross margin in both: (i) the

commercial enterprise market, driven by net sales from the Symbol business, and (ii) the government and

public safety market, driven by strong net sales in North America, partially offset by: (i) an inventory-

related charge in connection with the acquisition of Symbol, and (ii) increases in SG&A and R&D expenses,

primarily due to expenses of recently acquired businesses.

What were our major challenges and accomplishments in 2007?

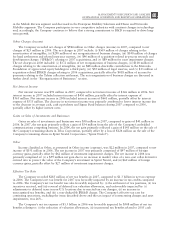

•In Our Mobile Devices Business: The Mobile Devices business faced significant challenges in 2007. While

overall market demand remained strong during the year, demand for Motorola’s wireless handsets slowed

substantially. As a result, Mobile Devices net sales were down 33% compared to 2006 and the business

incurred an operating loss of $1.2 billion.

Unit shipments in 2007 were 159.1 million, a 27% decrease compared to unit shipments of

217.4 million in 2006. The decrease in unit shipments resulted primarily from gaps in the segment’s product

portfolio, including limited offerings of 3G products and products for the Multimedia and Mass Market

product segments, as well as an aging product portfolio. As a result, Motorola believes it lost 8 percentage

points of market share and estimates its global market share to be approximately 14% for the full year

2007.

During 2007, the Mobile Devices business launched 41 new phones, including several devices based on

its newer open software platforms. New devices included: the RAZR2 Feature Phone for GSM, CDMA and

UMTS technologies; the ROKR Z6 family of music devices; the GSM Q8 and UMTS Q9h, for consumers

who multi-task and want flexibility in today’s business environment; and several handsets at affordable

price points for consumers with everyday communications needs.

Progress was made on key initiatives to implement a multi-vendor silicon strategy and utilize improved

software platforms. The business will use multiple silicon providers to aid in faster time to market and

reduce costs. As an example, in 2007 the Mobile Devices business named Texas Instruments as one of its

silicon suppliers for future UMTS devices. The business also continued its efforts to streamline and improve

its software platforms, including rationalizing its R&D expenditures on legacy platforms and acquiring a

50% stake in UIQ Technology AB (“UIQ”). This investment will strengthen UIQ as an open application

delivery platform for multimedia devices. MOTO DEV Studio, which includes multi-platform tools aimed at

developers, was launched to enhance the ecosystem around its Linux wireless platform, MOTOMAGX.

38 MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS