Motorola 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

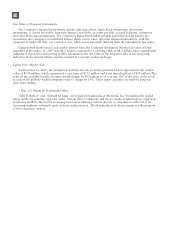

unit of accounting based on the relative fair value of each accounting unit or using the residual method if objective

evidence of fair value does not exist for the delivered element(s). If any of these criteria are not met, revenue is

deferred until the criteria are met or the last element has been delivered.

When elements of an arrangement are separated into more than one unit of accounting, revenue is recognized

for each separate unit of accounting based on the nature of the revenue as described above.

Sales and Use Taxes—The Company records taxes imposed on revenue-producing transactions, including

sales, use, value added and excise taxes, on a net basis with such taxes excluded from revenue.

Cash Equivalents: The Company considers all highly-liquid investments purchased with an original maturity

of three months or less to be cash equivalents.

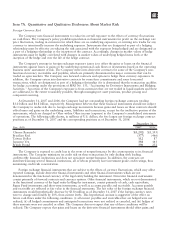

Sigma Fund: The Company and its wholly-owned subsidiaries invested most of their excess cash in a fund

(the “Sigma Fund”) that is similar to a money market fund. During 2007, the Company liquidated a similar

second fund and now maintains only one fund. The Sigma Fund portfolio is managed by four major independent

investment management firms. Investments are made in high-quality, investment grade (rated at least A/A-1 by

S&P or A2/P-1 by Moody’s at purchase date), U.S. dollar-denominated debt obligations including certificates of

deposit, commercial paper, government bonds, corporate bonds and asset- and mortgage-backed securities. The

Sigma Fund’s investment policies require that floating rate instruments must have a maturity, at purchase date, that

does not exceed thirty-six months with an interest rate reset at least annually. The average reset maturity of the

investments held by the funds must be 120 days or less with the actual average reset maturity of the investments

being 40 days and 53 days at December 31, 2007 and 2006, respectively. While the Sigma Fund includes some

securities with maturities beyond one year, the fund is classified as short-term because it represents the investments

of cash available for current operating needs.

Investments in the Sigma Fund are designated as available-for-sale securities recorded at fair value. As of

December 31, 2006, the fair value of the Sigma Fund was approximated by the amortized cost method. Under this

method, investments were valued at cost when purchased and thereafter, a constant proportionate amortization of

any discount or premium is recorded until maturity of the security. During the year ended 2007, the Sigma Fund

fair value was no longer approximated by the amortized cost method and, accordingly, an unrealized holding loss

was recorded.

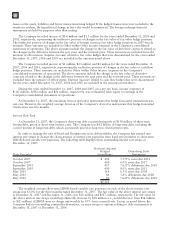

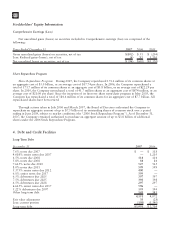

For all available-for-sale securities, any unrealized holding gains and losses, net of taxes, are excluded from

operating results and are recognized as a component of Non-owner changes to equity until realized. The fair values

of the securities are determined based on prevailing market prices. The Company assesses declines in the value of

individual investments to determine whether such decline is other-than-temporary. This assessment is made by

considering available evidence, including changes in general market conditions, specific industry and individual

company data, the length of time and the extent to which the market has been less than cost, the financial

condition and near-term prospects of the individual issuing entity, and the Company’s intent and ability to hold the

investment until recovery. Other-than-temporary impairments are charged to Other, as presented in Other income

(expense) within the Company’s consolidated statements of operations, in the period in which they become

impaired.

Investments: Investments include available-for-sale equity securities, held-to-maturity debt securities at

amortized cost, securities that are restricted for more than one year or not publicly traded at cost, and equity

method investments.

Inventories: Inventories are valued at the lower of average cost (which approximates computation on a

first-in, first-out basis) or market (net realizable value or replacement cost).

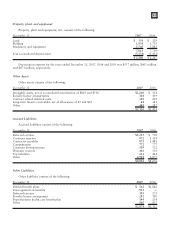

Property, Plant and Equipment: Property, plant and equipment are stated at cost less accumulated

depreciation. Depreciation is recorded using straight-line and declining-balance methods, based on the estimated

useful lives of the assets (buildings and building equipment, 5-40 years; machinery and equipment, 2-10 years) and

commences once the assets are ready for their intended use.

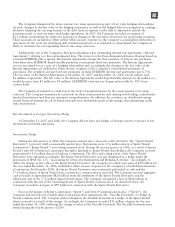

Goodwill and Intangible Assets: Goodwill is not amortized, but instead is tested for impairment at least

annually on October 1. The goodwill impairment test is performed at the reporting unit level and is a two-step

analysis. First, the fair value (“FV”) of each reporting unit is compared to its book value. If the FV of the reporting

unit is less than its book value, the Company performs a hypothetical purchase price allocation based on the

reporting unit’s FV to determine the FV of the reporting unit’s goodwill. FV is determined using a combination of

present value techniques and quoted market prices of comparable businesses.

81