Motorola 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

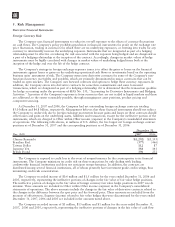

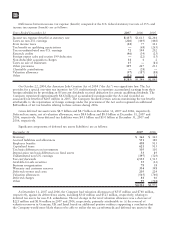

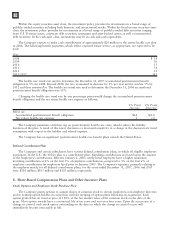

A summary of open tax years by major jurisdiction is presented below:

Jurisdiction:

United States

(1)

1996—2007

Brazil 2003—2007

China 1998—2007

France 2004—2007

Germany

(1)

2002—2007

India 1995—2007

Israel 2004—2007

Japan 2002—2007

Malaysia 1997—2007

Singapore 1998—2007

United Kingdom 1998—2007

(1) Includes federal as well as state, provincial or similar local jurisdictions, as applicable.

The Company is currently contesting significant tax adjustments related to transfer pricing for the 1996

through 2003 tax years at the appellate level of the Internal Revenue Service (“IRS”). The Company disagrees with

all of these proposed transfer pricing-related adjustments and intends to vigorously dispute them through

applicable IRS and judicial procedures, as appropriate. However, if the IRS were to ultimately prevail on these

matters, it could result in: (i) additional taxable income for the years 1996 through 2000 of approximately

$1.4 billion, which could result in additional income tax liability for the Company of approximately $500 million,

and (ii) additional taxable income for the years 2001 and 2002 of approximately $800 million, which could result

in additional income tax liability for the Company of approximately $300 million. The IRS is currently reviewing

a claim for additional research tax credits for the years 1996-2003. The IRS is conducting its field examination of

the Company’s 2004 and 2005 tax returns. Although the final resolution of these matters is uncertain, based on

current information, in the opinion of the Company’s management, the ultimate disposition of these matters will

not have a material adverse effect on the Company’s consolidated financial position, liquidity or results of

operations. However, an unfavorable resolution could have a material adverse effect on the Company’s

consolidated financial position, liquidity or results of operations in the periods in which the matter is ultimately

resolved. It is reasonably possible that within the next 12 months, these disputes will be resolved and such

resolution may have a significant impact upon the amount of unrecognized tax benefits related to these issues.

The Company has several other non-U.S. income tax audits pending and while the final resolution is

uncertain, in the opinion of the Company’s management, the ultimate disposition of the audits will not have a

material adverse effect on the Company’s consolidated financial position, liquidity or results of operations.

Based on the outcome of these examinations, or as a result of the expiration of statute of limitations for

specific jurisdictions, it is reasonably possible that the related unrecognized tax benefits for tax positions taken

regarding previously filed tax returns will differ from those recorded as liabilities in the Company’s consolidated

balance sheets at December 31, 2007. The Company anticipates that it is reasonably possible that within the next

12 months, several of the audits may be finalized resulting in a reduction in unrecognized tax benefits of

approximately $40 million. However, based on the number of tax years currently under audit by the relevant

federal, state and foreign tax authorities, the status of these examinations, and the protocol of finalizing audits by

the relevant tax authorities, which could include formal legal proceedings, it is not possible to estimate the impact

of any other amounts of such changes, if any, to previously recorded uncertain tax positions.

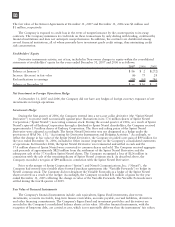

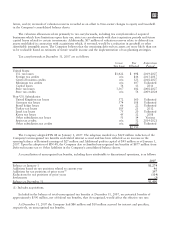

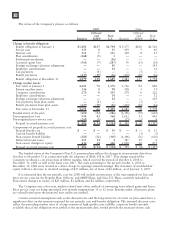

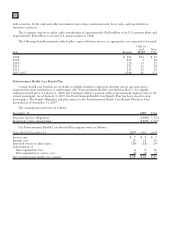

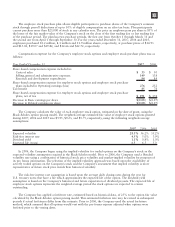

7. Retirement Benefits

Pension Benefit Plans

The Company’s noncontributory pension plan (the “Regular Pension Plan”) covers U.S. employees who

became eligible after one year of service. The benefit formula is dependent upon employee earnings and years of

service. Effective January 1, 2005, newly-hired employees were not eligible to participate in the Regular Pension

Plan. The Company also provides defined benefit plans which cover non-U.S. employees in certain jurisdictions

principally the United Kingdom, Germany, Ireland, Japan and Korea (the “Non-U.S. Plans”). Any other pension

plans are not material to the Company either individually or in the aggregate.

The Company has a noncontributory supplemental retirement benefit plan (the “Officers’ Plan”) for its

officers elected prior to December 31, 1999. The Officers’ Plan contains provisions for vesting and funding the

98