Motorola 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

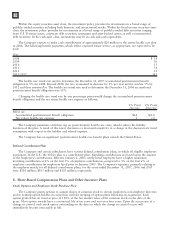

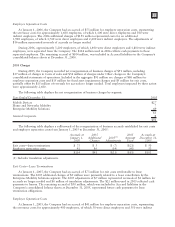

compensation costs for such options. As a result of adopting SFAS 123R, $50 million and $165 million of excess

tax benefits for the years 2007 and 2006, respectively, have been classified as a financing cash inflow.

Motorola Incentive Plan

The Motorola Incentive Plan provides eligible employees with an annual payment, calculated as a percentage

of an employee’s eligible earnings, in the year after the close of the current calendar year if specified business goals

are met. The provisions for awards under these incentive plans for the years ended December 31, 2007, 2006 and

2005 were $190 million, $268 million and $548 million, respectively.

Mid-Range Incentive Plan

The Mid-Range Incentive Plan (“MRIP”) rewarded participating elected officers for the Company’s

achievement of specified business goals during the period, based on two performance objectives measured over

two-year cycles. The provision for MRIP for the year ended December 31, 2005 was $19 million. As of

December 31, 2005, the MRIP was canceled.

Long-Range Incentive Plan

In 2005, a Long-Range Incentive Plan (“LRIP”) was introduced to replace MRIP. LRIP rewards participating

elected officers for the Company’s achievement of specified business goals during the period, based on two

performance objectives measured over three-year cycles. The provision for LRIP for the years ended December 31,

2007, 2006 and 2005 was $(8) million, $16 million and $15 million, respectively.

9. Financing Arrangements

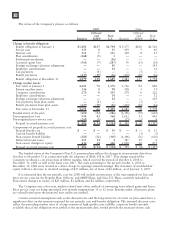

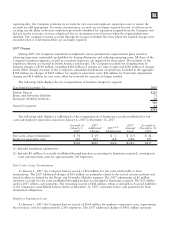

Finance receivables consist of the following:

December 31 2007 2006

Gross finance receivables $123 $ 279

Less allowance for losses (5) (10)

118 269

Less current portion (50) (124)

Long-term finance receivables $68 $ 145

Current finance receivables are included in Accounts receivable and long-term finance receivables are included

in Other assets in the Company’s consolidated balance sheets. Interest income recognized on finance receivables for

the years ended December 31, 2007, 2006 and 2005 was $7 million, $9 million and $7 million, respectively.

From time to time, the Company sells short-term receivables, long-term loans and lease receivables under

sales-type leases (collectively, “finance receivables”) to third parties in transactions that qualify as “true-sales.”

Certain of these finance receivables are sold to third parties on a one-time, non-recourse basis, while others are

sold to third parties under committed facilities that involve contractual commitments from these parties to

purchase qualifying receivables up to an outstanding monetary limit. Committed facilities may be revolving in

nature and, typically, must be renewed on an annual basis. Certain sales may be made through separate legal

entities that are also consolidated by the Company. The Company may or may not retain the obligation to service

the sold finance receivables.

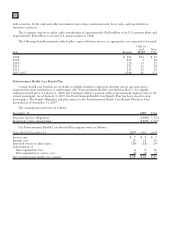

In the aggregate, at December 31, 2007, these committed facilities provided for up to $1.4 billion to be

outstanding with the third parties at any time, as compared to up to $1.3 billion provided at December 31, 2006

and up to $1.1 billion provided at December 31, 2005. As of December 31, 2007, $497 million of these

committed facilities were utilized, compared to $817 million utilized at December 31, 2006 and $585 million

utilized at December 31, 2005. Certain events could cause one of these facilities to terminate. In addition, before

receivables can be sold under certain of the committed facilities, they may need to meet contractual requirements,

such as credit quality or insurability.

Total finance receivables sold by the Company were $4.9 billion in 2007 (including $4.7 billion of short-term

receivables), compared to $6.4 billion sold in 2006 (including $6.2 billion of short-term receivables) and

108