Motorola 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

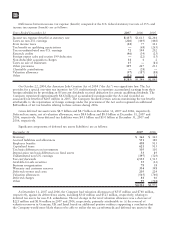

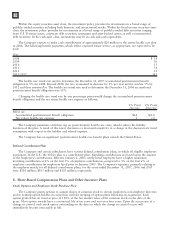

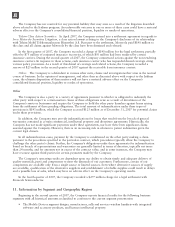

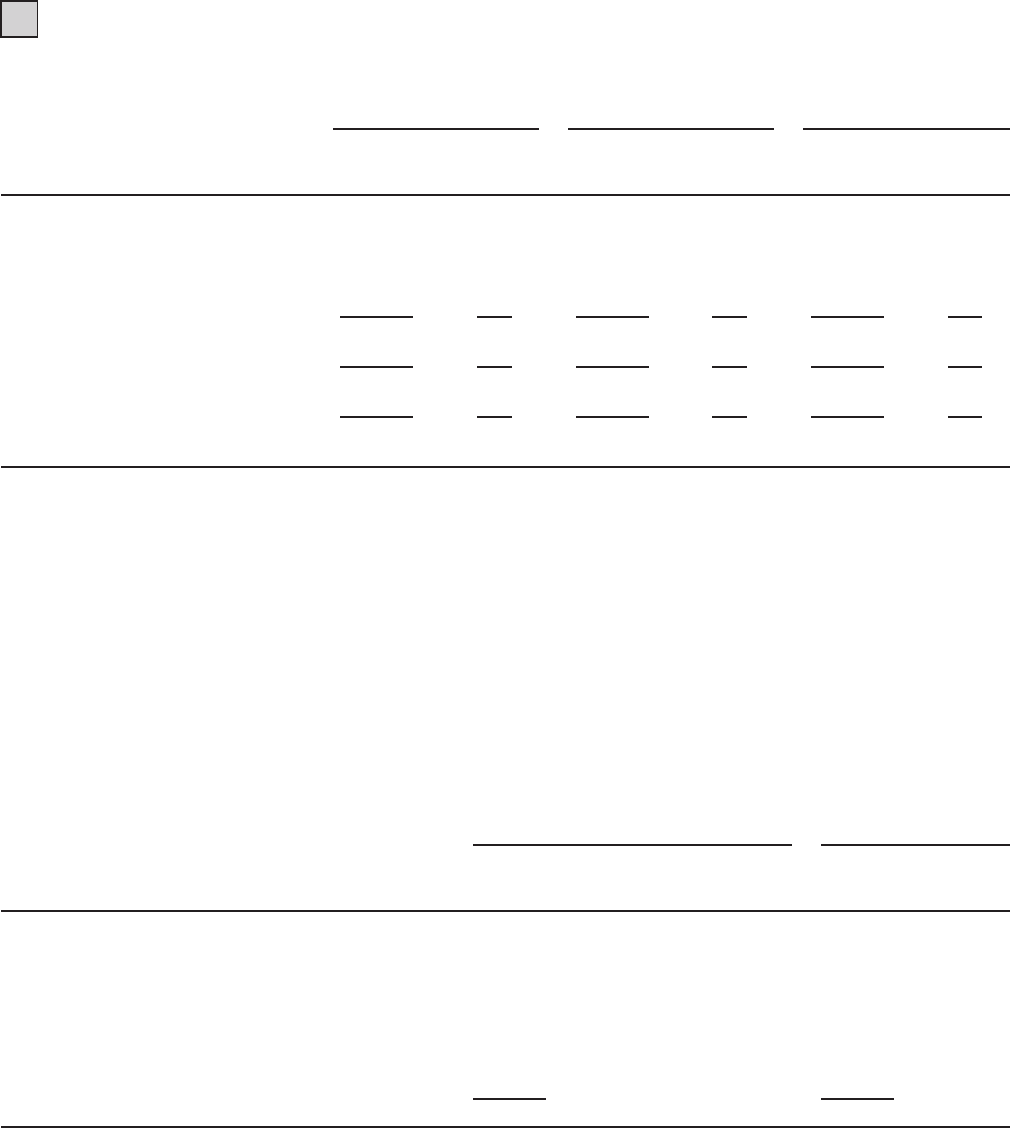

Stock option activity was as follows (in thousands, except exercise price and employee data):

Years Ended December 31

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

2007 2006 2005

Options outstanding at January 1 233,445 $18 267,755 $17 335,757 $16

Options granted 40,257 18 37,202 21 40,675 16

Options exercised (26,211) 11 (59,878) 13 (85,527) 12

Options terminated, canceled or

expired (23,236) 19 (11,634) 19 (23,150) 25

Options outstanding at December

31 224,255 19 233,445 18 267,755 17

Options exercisable at December

31 138,741 19 135,052 19 149,329 19

Approx. number of employees

granted options 32,000 28,900 25,300

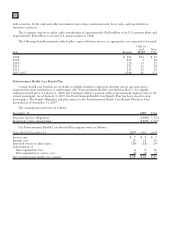

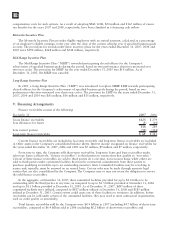

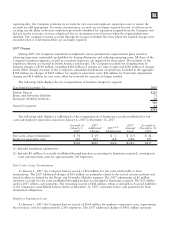

At December 31, 2007, the Company had $361 million of total unrecognized compensation expense, net of

estimated forfeitures, related to stock option plans and the employee stock purchase plan that will be recognized

over the weighted average period of approximately two years. Cash received from stock option exercises and the

employee stock purchase plan was $440 million, $918 million and $1.2 billion for the years ended December 31,

2007, 2006 and 2005, respectively. The total intrinsic value of options exercised during the years ended

December 31, 2007, 2006 and 2005 was $177 million, $568 million and $571 million, respectively. The aggregate

intrinsic value for options outstanding and exercisable as of December 31, 2007 was $307 million and

$292 million, respectively, based on a December 31, 2007 stock price of $16.04 per share.

At December 31, 2007 and 2006, 88.0 million shares and 110.9 million shares, respectively, were available for

future share-based award grants under the 2006 Motorola Omnibus Plan, covering all equity awards to employees

and non-employee directors.

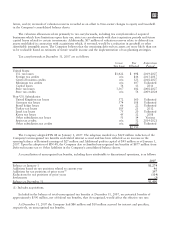

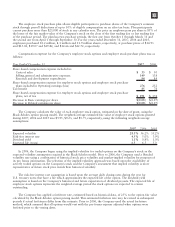

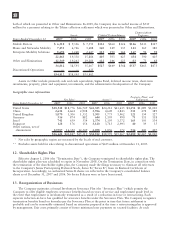

The following table summarizes information about stock options outstanding and exercisable at December 31,

2007 (in thousands, except exercise price and years):

Exercise price range No. of

options

Wtd. avg.

Exercise

Price

Wtd. avg.

contractual

life (in yrs.) No. of

options

Wtd. avg.

Exercise

Price

Options Outstanding Options Exercisable

Under $7 907 $ 4 7 264 $ 6

$7-$13 51,569 10 4 51,085 10

$14-$20 110,907 17 7 49,363 16

$21-$27 31,923 22 8 9,080 22

$28-$34 1,716 32 2 1,716 32

$35-$41 26,865 39 7 26,865 39

$42-$48 332 44 3 332 44

$49-$55 36 51 2 36 51

224,255 138,741

The weighted average contractual life for options outstanding and exercisable as of December 31, 2007 was

seven and six years, respectively.

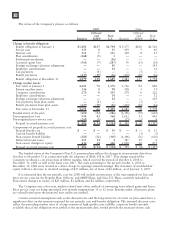

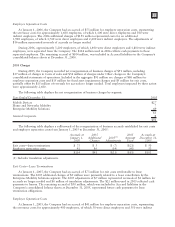

Restricted Stock and Restricted Stock Units

Restricted stock (“RS”) and restricted stock unit (“RSU”) grants consist of shares or the rights to shares of the

Company’s common stock which are awarded to employees and non-employee directors. The grants are restricted

such that they are subject to substantial risk of forfeiture and to restrictions on their sale or other transfer by the

employee. Upon the occurrence of a change in control, the restrictions on all shares of RS and RSUs outstanding

on the date on which the change in control occurs will lapse.

106