Motorola 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

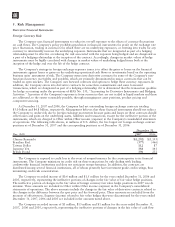

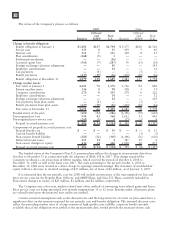

Using quoted market prices and market interest rates, the Company determined that the fair value of long-

term debt at December 31, 2007 was $4.2 billion, compared to a carrying value of $4.2 billion. Since considerable

judgment is required in interpreting market information, the fair value of the long-term debt is not necessarily

indicative of the amount which could be realized in a current market exchange.

6. Income Taxes

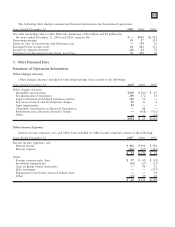

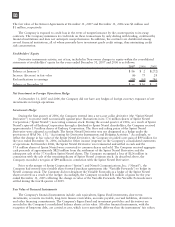

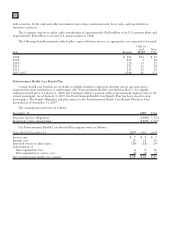

Components of earnings (loss) from continuing operations before income taxes are as follows:

Years Ended December 31 2007 2006 2005

United States $(2,540) $1,034 $3,232

Other nations 2,150 3,576 3,180

$ (390) $4,610 $6,412

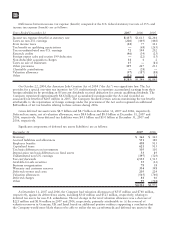

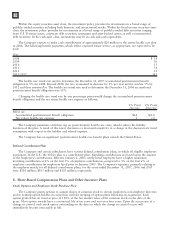

Components of income tax expense (benefit) are as follows:

Years Ended December 31 2007 2006 2005

United States $40 $ 10 $ 240

Other nations 402 488 638

States (U.S.) 20 13 15

Current income tax expense 462 511 893

United States (633) 892 891

Other nations (50) (147) (42)

States (U.S.) (64) 93 151

Deferred income tax expense (benefit) (747) 838 1,000

Total income tax expense (benefit) $(285) $1,349 $1,893

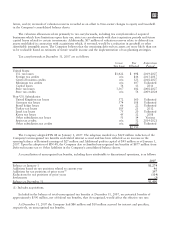

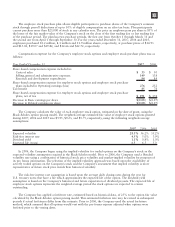

Deferred tax charges (benefits) that were recorded within Non-owner changes to equity in the Company’s

consolidated balance sheets resulted from fair value adjustments to available-for-sale securities, net unrealized

losses on securities, net gains (losses) on derivative instruments and retirement benefit adjustments. The

adjustments were $306 million, $(182) million and $(753) million for the years ended December 31, 2007, 2006

and 2005, respectively. Except for certain earnings that the Company intends to reinvest indefinitely, provisions

have been made for the estimated U.S. federal income taxes applicable to undistributed earnings of

non-U.S. subsidiaries. Undistributed earnings that the Company intends to reinvest indefinitely, and for which no

U.S. federal income taxes have been provided, aggregate $4.1 billion, $4.0 billion and $2.8 billion at December 31,

2007, 2006 and 2005, respectively. The portion of earnings not reinvested indefinitely may be distributed without

an additional U.S. federal income tax charge given the U.S. federal tax accrued on undistributed earnings and the

utilization of available foreign tax credits.

95