Motorola 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On a geographic basis, the 1% increase in net sales reflects higher net sales in North America and EMEA,

partially offset by lower net sales in Asia. The increase in net sales in North America was driven primarily by

higher sales of digital entertainment devices, partially offset by lower demand for iDEN infrastructure equipment

driven by customer expenditures returning to historic trends compared to an exceptionally strong 2005. The

increase in net sales in EMEA was driven primarily by higher sales of digital entertainment devices. The decrease in

net sales in Asia was due, in part, to delays in the granting of 3G licenses in China that led service providers to

slow their near-term capital investment, as well as competitive pricing pressure. Net sales in North America

continued to comprise a significant portion of the segment’s business, accounting for approximately 56% of the

segment’s total net sales in 2006, compared to approximately 55% of the segment’s total net sales in 2005.

The segment reported operating earnings of $787 million in 2006, compared to operating earnings of

$1.2 billion in 2005. The 36% decrease in operating earnings was primarily due to: (i) a decrease in gross margin,

due to an unfavorable product/regional mix and competitive pricing in the wireless networks market, and (ii) an

increase in Other charges (income) from an increase in reorganization of business charges, primarily related to

employee severance, and from a legal reserve. As a percentage of net sales in 2006 as compared to 2005, gross

margin, SG&A expenses, R&D expenditures and operating margin all decreased.

In 2006, net sales to the segment’s top five customers, which included Sprint Nextel, Comcast Corporation,

Verizon, KDDI and China Mobile, represented 45% of the segment’s total net sales. The segment’s backlog was

$3.2 billion at December 31, 2006, compared to $2.4 billion at December 31, 2005. The increase in backlog is

primarily due to strong orders for our digital and HD/DVR set-tops.

In the market for digital entertainment devices, demand for the segment’s products depends primarily on the

level of capital spending by broadband operators for constructing, rebuilding or upgrading their communications

systems, and for offering advanced services. In 2006, our digital video customers significantly increased their

purchases of the segment’s products and services, primarily due to increased demand for digital video set-tops,

particularly HD/DVR set-tops.

During 2006, the segment completed a number of significant acquisitions, including: (i) Kreatel

Communications AB, a leading developer of innovative IP-based digital set-tops and software, (ii) NextNet

Wireless, Inc., a former Clearwire Corporation subsidiary and a leading provider of OFDM-based non-line-of-sight

(“NLOS”) wireless broadband infrastructure equipment, (iii) Broadbus Technologies, Inc., a provider of technology

solutions for television on demand, and (iv) Vertasent LLC, a software developer for managing technology

elements for switched digital video networks. These acquisitions did not have a material impact on the segment

results in 2006.

Enterprise Mobility Solutions Segment

The Enterprise Mobility Solutions segment designs, manufactures, sells, installs and services analog and digital

two-way radio, voice and data communications products and systems for private networks, wireless broadband

systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets, including government

and public safety agencies (which, together with all sales to distributors of two-way communications products, are

referred to as the “government and public safety market”), as well as retail, utility, transportation, manufacturing,

healthcare and other commercial customers (which, collectively, are referred to as the “commercial enterprise

market”). In 2007, the segment’s net sales represented 21% of the Company’s consolidated net sales, compared to

13% in 2006 and 14% in 2005.

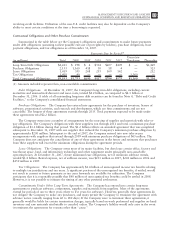

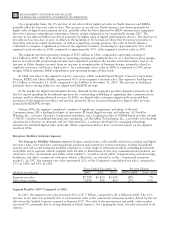

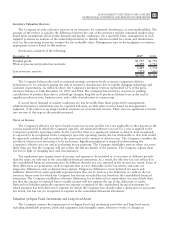

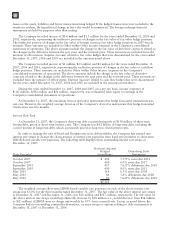

(Dollars in millions) 2007 2006 2005 2007—2006 2006—2005

Years Ended December 31 Percent Change

Segment net sales $7,729 $5,400 $5,038 43%7%

Operating earnings 1,213 958 860 27% 11%

Segment Results—2007 Compared to 2006

In 2007, the segment’s net sales increased 43% to $7.7 billion, compared to $5.4 billion in 2006. The 43%

increase in net sales was primarily due to increased net sales in the commercial enterprise market, driven by the net

sales from the Symbol business acquired in January 2007. Net sales in the government and public safety market

increased 6%, primarily due to strong demand in North America. On a geographic basis, net sales increased in all

regions.

62 MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS