Motorola 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

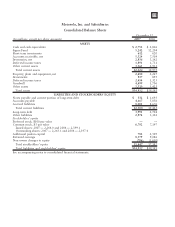

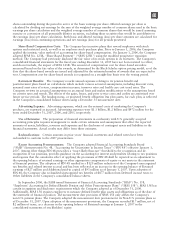

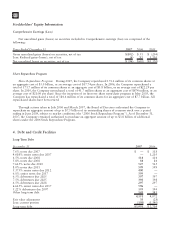

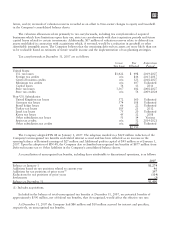

Years Ended December 31 Sigma

Fund Short-term

Investments Investments Unrealized

Gains Unrealized

Losses Cost

Basis

Fair Value Less

2006

Available-for-sale securities:

Commercial paper $ 4,461 $ — $ — $— $— $ 4,461

Certificates of deposit — 574 — — — 574

Bank obligation notes 392 — — — — 392

Government and agencies 330 20 — — — 350

Short-term corporate obligation 40 — — — — 40

Corporate bonds 5,791 2 — — — 5,793

Asset-backed securities 860 — — — — 860

Mortgage-backed securities 285 — — — — 285

Common stock and equivalents — — 130 68 (8) 70

Other 45 24 — — — 69

12,204 620 130 68 (8) 12,894

Other securities, at cost — — 676 — — 676

Equity method investments — — 89 — — 89

$12,204 $620 $895 $68 $(8) $13,659

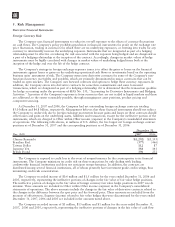

During the year ended December 31, 2007, the Company recorded a $75 million reduction in the available-

for-sale securities held in the Sigma Fund, reflecting a decline in the fair value of the securities. As of December 31,

2007, $57 million of this reduction represents a broad-based temporary decline in market value of various

securities primarily due to credit spreads widening in several debt market segments, with the offsetting reduction

reflected in Non-owners changes to equity. The Company believes credit market spreads will return to normal

levels in the future. Additionally, due to the high credit ratings of the underlying securities, it is probable that the

Company will be able to collect all amounts according to the contractual terms of the corporate bonds where fair

values are less than their cost as of December 31, 2007. It is for these reasons that the unrealized losses on these

corporate bonds are considered temporary. If it becomes probable that the Company will not collect all amounts in

accordance with the contractual terms of a corporate bond, the Company considers the decline other-than-

temporary. The remaining $18 million reduction in available-for-sale securities held by the Sigma Fund represents

an other-than-temporary decline and has been reflected as an investment impairment.

As of December 31, 2007, there is an unrealized loss of $79 million associated with common stock and equivalents,

of which $75 million is attributable to one equity security with a fair value of $228 million as of December 31, 2007.

Based on positive analyst coverage surrounding this equity security and the ability for strong growth, the Company

believes the security will recover to its cost basis. Additionally, the Company has both the ability and intent to hold the

common stock and equivalents until recovery. Accordingly, the unrealized loss is considered temporary.

The Company recorded investment impairment charges of $62 million, $27 million and $25 million for the years

ended December 31, 2007, 2006 and 2005, respectively. These impairment charges represent other-than-temporary

declines in the value of the Company’s Sigma Fund and investment portfolios. Investment impairment charges are

included in Other within Other income (expense) in the Company’s consolidated statements of operations.

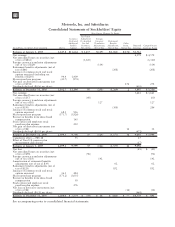

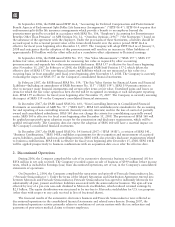

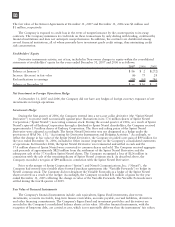

Gains (loss) on sales of investments and businesses, consists of the following:

Years Ended December 31 2007 2006 2005

Gains on sales of investments $17 $41 $1,848

Gains (loss) on sales of businesses 33 — (3)

$50 $41 $1,845

In 2007, the $50 million of net gains was primarily related to a $34 million gain on the sale of the Company’s

embedded communication computing business.

In 2006, the $41 million of net gains was primarily related to a $141 million gain on the sale of the

Company’s remaining shares in Telus Corporation, partially offset by a $126 million loss on the sale of the

Company’s remaining shares in Sprint Nextel Corporation (“Sprint Nextel”).

87