Motorola 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

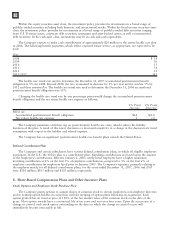

The Company has not reserved for any potential liability that may arise as a result of the litigation described

above related to the Iridium program. An unfavorable outcome in one or more of these cases could have a material

adverse effect on the Company’s consolidated financial position, liquidity or results of operations.

Telsim Class Action Securities: In April 2007, the Company entered into a settlement agreement in regards to

In re Motorola Securities Litigation, a class action lawsuit relating to the Company’s disclosure of its relationship

with Telsim Mobil Telekomunikasyon Hizmetleri A.S. Pursuant to the settlement, Motorola paid $190 million to

the class and all claims against Motorola by the class have been dismissed and released.

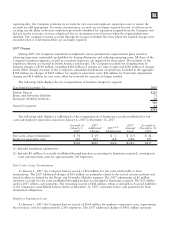

In the first quarter of 2007, the Company recorded a charge of $190 million for the legal settlement, partially

offset by $75 million of estimated insurance recoveries, of which $50 million had been tendered by certain

insurance carriers. During the second quarter of 2007, the Company commenced actions against the non-tendering

insurance carriers. In response to these actions, each insurance carrier who has responded denied coverage citing

various policy provisions. As a result of this denial of coverage and related actions, the Company recorded a

reserve of $25 million in the second quarter of 2007 against the receivable from insurance carriers.

Other: The Company is a defendant in various other suits, claims and investigations that arise in the normal

course of business. In the opinion of management, and other than as discussed above with respect to the Iridium

cases, the ultimate disposition of these matters will not have a material adverse effect on the Company’s

consolidated financial position, liquidity or results of operations.

Other

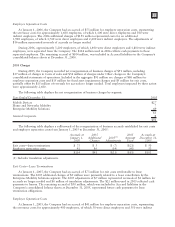

The Company is also a party to a variety of agreements pursuant to which it is obligated to indemnify the

other party with respect to certain matters. Some of these obligations arise as a result of divestitures of the

Company’s assets or businesses and require the Company to hold the other party harmless against losses arising

from the settlement of these pending obligations. The total amount of indemnification under these types of

provisions is $193 million, which the Company accrued $123 million as of December 31, 2007 for potential claims

under these provisions.

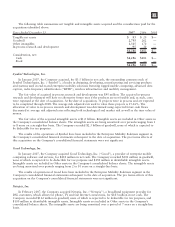

In addition, the Company may provide indemnifications for losses that result from the breach of general

warranties contained in certain commercial, intellectual property and divestiture agreements. Historically, the

Company has not made significant payments under these agreements, nor have there been significant claims

asserted against the Company. However, there is an increasing risk in relation to patent indemnities given the

current legal climate.

In all indemnification cases, payment by the Company is conditioned on the other party making a claim

pursuant to the procedures specified in the particular contract, which procedures typically allow the Company to

challenge the other party’s claims. Further, the Company’s obligations under these agreements for indemnification

based on breach of representations and warranties are generally limited in terms of duration, typically not more

than 24 months, and for amounts not in excess of the contract value, and in some instances, the Company may

have recourse against third parties for certain payments made by the Company.

The Company’s operating results are dependent upon our ability to obtain timely and adequate delivery of

quality materials, parts and components to meet the demands of our customers. Furthermore, certain of our

components are available only from a single source or limited sources. Even where alternative sources of supply

are available, qualification of the alternative suppliers and establishment of reliable supplies could result in delays

and a possible loss of sales, which may have an adverse effect on the Company’s operating results.

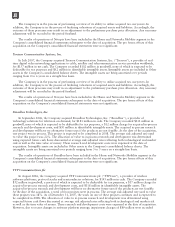

In the fourth quarter of 2007, the Company recorded a $277 million charge for a legal settlement with

Freescale Semiconductor.

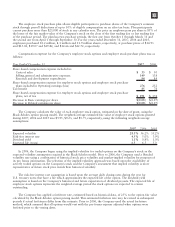

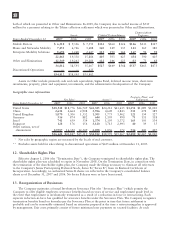

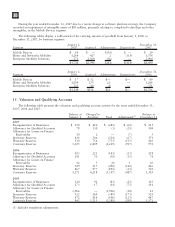

11. Information by Segment and Geographic Region

Beginning in the second quarter of 2007, the Company reports financial results for the following business

segments with all historical amounts reclassified to conform to the current segment presentation:

• The Mobile Devices segment designs, manufactures, sells and services wireless handsets with integrated

software and accessory products, and licenses intellectual property.

110