Motorola 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

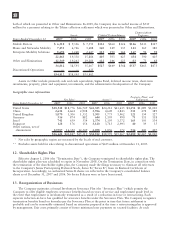

both of which are presented in Other and Eliminations. In 2005, the Company also recorded income of $515

million for a payment relating to the Telsim collection settlement which was presented in Other and Eliminations.

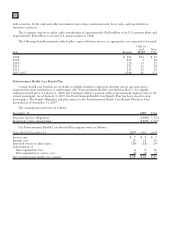

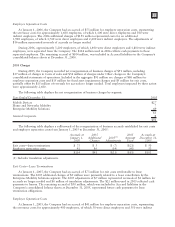

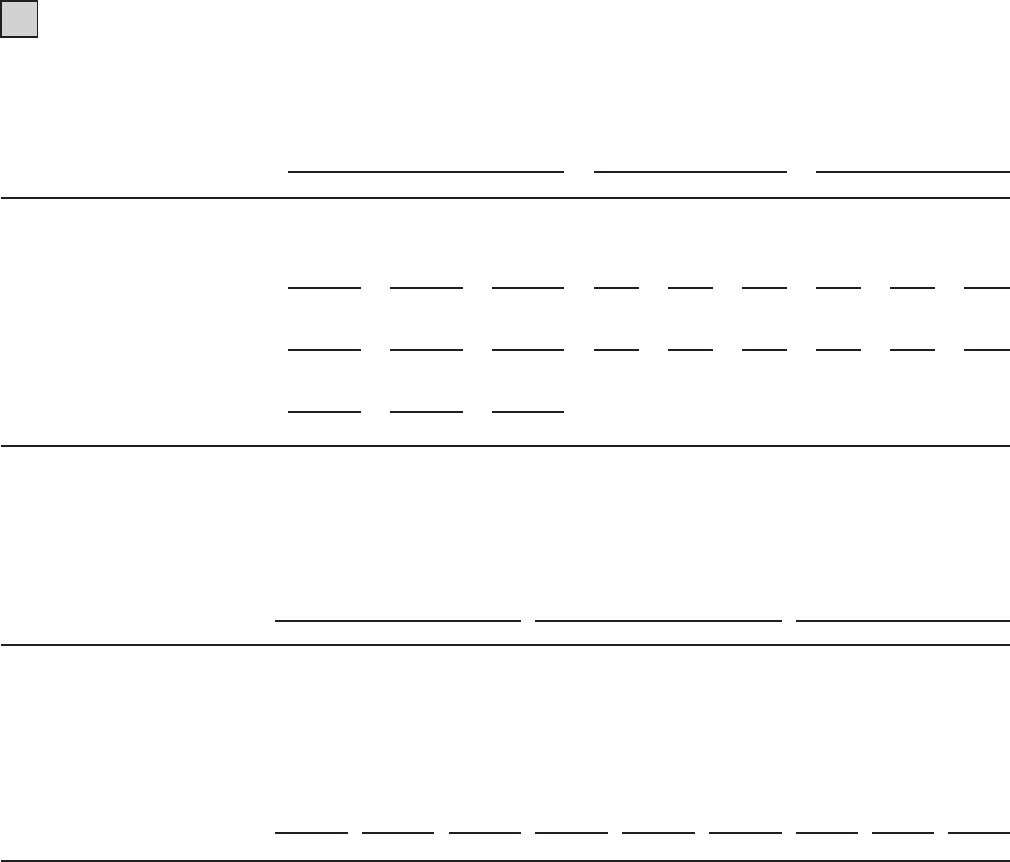

Years Ended December 31 2007 2006 2005 2007 2006 2005 2007 2006 2005

Assets Capital Expenditures Depreciation

Expense

Mobile Devices $ 6,318 $ 9,316 $ 7,551 $132 $164 $126 $146 $133 $127

Home and Networks Mobility 7,451 6,746 5,688 160 149 135 141 165 180

Enterprise Mobility Solutions 8,694 3,268 2,647 113 190 164 167 92 98

22,463 19,330 15,886 405 503 425 454 390 405

Other and Eliminations 12,349 19,263 19,281 122 146 123 83 73 68

34,812 38,593 35,167 $527 $649 $548 $537 $463 $473

Discontinued Operations —— 635

$34,812 $38,593 $35,802

Assets in Other include primarily cash and cash equivalents, Sigma Fund, deferred income taxes, short-term

investments, property, plant and equipment, investments, and the administrative headquarters of the Company.

Geographic area information

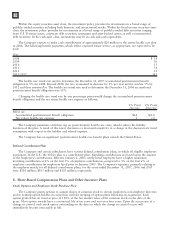

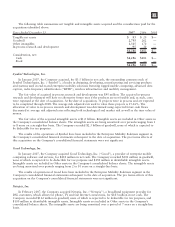

Years Ended December 31 2007 2006 2005 2007 2006 2005 2007 2006 2005

Net Sales* Assets** Property, Plant, and

Equipment

United States $18,548 $18,776 $16,749 $22,385 $24,212 $23,635 $1,252 $1,089 $1,010

China 2,632 4,664 2,908 3,926 4,649 3,843 311 278 189

United Kingdom 1,070 1,306 1,532 1,305 1,773 1,962 121 134 127

Germany 516 874 882 644 1,195 990 75 131 118

Israel 741 659 534 1,374 1,195 1,372 165 156 134

Singapore 128 176 156 3,120 3,713 2,993 40 39 35

Other nations, net of

eliminations 12,987 16,392 12,549 2,058 1,856 372 516 440 407

$36,622 $42,847 $35,310 $34,812 $38,593 $35,167 $2,480 $2,267 $2,020

* Net sales by geographic region are measured by the locale of end customer.

** Excludes assets held for sale relating to discontinued operations of $635 million at December 31, 2005.

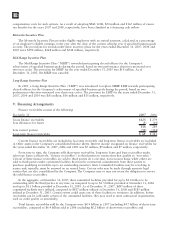

12. Shareholder Rights Plan

Effective August 1, 2006 (the “Termination Date”), the Company terminated its shareholder rights plan. The

shareholder rights plan was scheduled to expire in November 2008. On the Termination Date, in connection with

the termination of the shareholder rights plan, the Company made the filings necessary to eliminate all references

to the Company’s Junior Participating Preferred Stock, Series B (“Series B”) from its Restated Certificate of

Incorporation. Accordingly, no authorized Series B shares are reflected in the Company’s consolidated balance

sheets as of December 31, 2007 and 2006. No Series B shares were or have been issued.

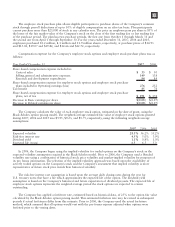

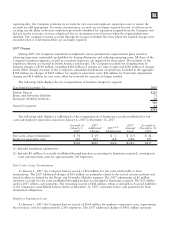

13. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the “Severance Plan”) which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in

the event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. Each

separate reduction-in-force has qualified for severance benefits under the Severance Plan. The Company recognizes

termination benefits based on formulas per the Severance Plan at the point in time that future settlement is

probable and can be reasonably estimated based on estimates prepared at the time a restructuring plan is approved

by management. Exit costs primarily consist of future minimum lease payments on vacated facilities. At each

112