Motorola 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

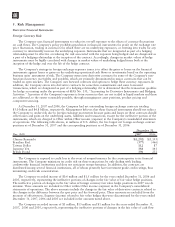

future, and (ii) reversals of valuation reserves recorded as an offset to Non-owner changes to equity and Goodwill

in the Company’s consolidated balance sheets.

The valuation allowances relate primarily to tax carryforwards, including tax carryforwards of acquired

businesses which have limitations upon their use, state tax carryforwards with short expiration periods and future

capital losses related to certain investments. Additionally, $37 million of valuation reserves relate to deferred tax

assets established in connection with acquisitions which, if reversed, would be a reduction in goodwill or other

identifiable intangible assets. The Company believes that the remaining deferred tax assets are more likely than not

to be realizable based on estimates of future taxable income and the implementation of tax planning strategies.

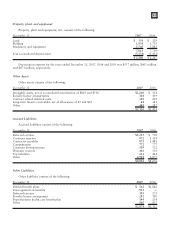

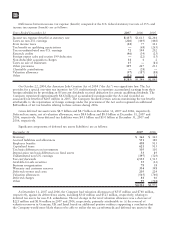

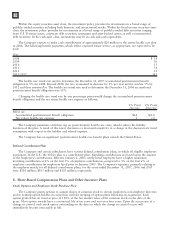

Tax carryforwards at December 31, 2007 are as follows:

Gross

Tax Loss Tax

Effected Expiration

Period

United States:

U.S. tax losses $1,422 $ 498 2019-2027

Foreign tax credits n/a 814 2013-2017

General business credits n/a 523 2018-2027

Minimum tax credits n/a 107 Unlimited

Capital losses 36 13 2011

State tax losses 3,367 102 2008-2027

State tax credits n/a 54 2009-2024

Non-U.S. Subsidiaries:

United Kingdom tax losses 572 160 Unlimited

Germany tax losses 374 108 Unlimited

Brazil hedge losses 66 22 Unlimited

Turkey tax losses 105 21 2012

Israel tax losses 75 20 Unlimited

Korea tax losses 45 12 2008

Other subsidiaries tax losses 51 14 Various

Spain tax credits n/a 32 2014-2021

Other subsidiaries tax credits n/a 53 Unlimited

$2,553

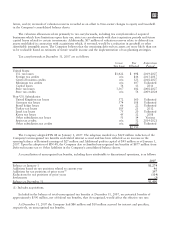

The Company adopted FIN 48 on January 1, 2007. The adoption resulted in a $120 million reduction of the

Company’s unrecognized tax benefits and related interest accrual and has been reflected as an increase in the

opening balance of Retained earnings of $27 million and Additional paid-in capital of $93 million as of January 1,

2007. Upon the adoption of FIN 48, the Company also reclassified unrecognized tax benefits of $877 million from

Deferred income tax to Other liabilities in the Company’s consolidated balance sheets.

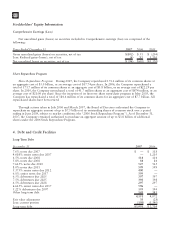

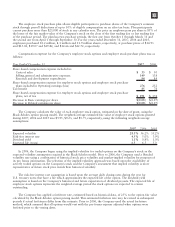

A reconciliation of unrecognized tax benefits, including those attributable to discontinued operations, is as follows:

2007

Balance at January 1 $1,274

Additions based on tax positions related to current year 46

Additions for tax positions of prior years

(1)

197

Reductions for tax positions of prior years (114)

Settlements (3)

Balance at December 31 $1,400

(1) Includes acquisitions.

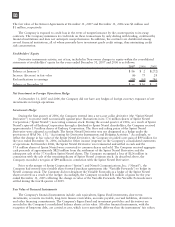

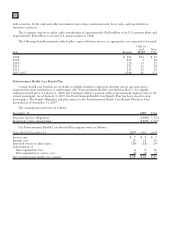

Included in the balance of total unrecognized tax benefits at December 31, 2007, are potential benefits of

approximately $590 million, net of federal tax benefits, that if recognized, would affect the effective tax rate.

At December 31, 2007 the Company had $86 million and $10 million accrued for interest and penalties,

respectively, on unrecognized tax benefits.

97