Motorola 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

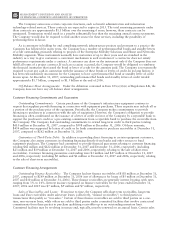

cases are in various stages and the outcomes are not predictable, an unfavorable outcome in one or more of these

cases could have a material adverse effect on the Company’s consolidated financial position, liquidity or results of

operations.

The Company is a defendant in various other lawsuits, claims and actions which arise in the normal course of

business. These include actions relating to products, contracts and securities, as well as matters initiated by third

parties or Motorola relating to infringements of patents, violations of licensing arrangements and other intellectual

property-related matters. In the opinion of management, and other than discussed above with respect to the still

pending Iridium cases, the ultimate disposition of these matters will not have a material adverse effect on the

Company’s consolidated financial position, liquidity or results of operations.

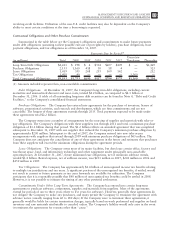

Segment Information

The following commentary should be read in conjunction with the financial results of each reporting segment

as detailed in Note 11, “Information by Segment and Geographic Region,” to the Company’s consolidated

financial statements. Net sales and operating results for the Company’s three operating segments for 2007, 2006

and 2005 are presented below.

Mobile Devices Segment

The Mobile Devices segment designs, manufactures, sells and services wireless handsets with integrated

software and accessory products, and licenses intellectual property. In 2007, the segment’s net sales represented

52% of the Company’s consolidated net sales, compared to 66% in 2006 and 61% in 2005.

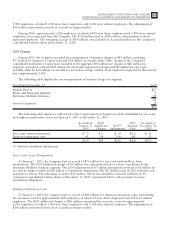

(Dollars in millions) 2007 2006 2005 2007—2006 2006—2005

Years Ended December 31 Percent Change

Segment net sales $18,988 $28,383 $21,459 (33)% 32%

Operating earnings (loss) (1,201) 2,690 2,192 *** 23%

*** Percentage change is not meaningful.

Segment Results—2007 Compared to 2006

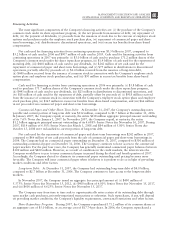

In 2007, the segment’s net sales were $19.0 billion, a decrease of 33% compared to net sales of $28.4 billion

in 2006. The 33% decrease in net sales was primarily driven by: (i) a 27% decrease in unit shipments, (ii) a 9%

decrease in average selling price (“ASP”), and (iii) decreased revenue from intellectual property and technology

licensing. The segment’s product sales were negatively impacted by gaps in the segment’s product portfolio,

including limited offerings of 3G products and products for the Multimedia and Mass Market product segments,

as well as an aging product portfolio. On a product technology basis, net sales of products for: (i) GSM technology

decreased substantially, (ii) iDEN and CDMA technologies decreased, and (iii) 3G technologies increased slightly.

On a geographic basis, net sales decreased in all regions, and decreased substantially in the Asia and Europe,

Middle East and Africa (“EMEA”) regions. The substantial decrease in Asia, particularly in China, as well as in

other emerging markets, was due to lower demand for our products as a result of an aging product portfolio and

increased industry-wide competition. The substantial decrease in EMEA was due to gaps in our product portfolio,

particularly 3G products.

The segment incurred an operating loss of $1.2 billion in 2007, compared to operating earnings of $2.7 billion

in 2006. The operating loss was primarily due to a decrease in gross margin, driven by: (i) a 9% decrease in ASP,

(ii) decreased income from intellectual property and technology licensing, (iii) a 27% decrease in unit shipments,

and (iv) a $277 million charge for a legal settlement with Freescale Semiconductor, partially offset by savings from

supply chain cost-reduction initiatives.

Research and development (“R&D”) expenditures increased, driven by increased expenditures on

developmental engineering for new products and software, as well as ongoing investment in next-generation

technologies, partially offset by savings from cost-reduction initiatives. The segment’s industry typically experiences

short life cycles for new products. Therefore, it is vital to the segment’s success that new, compelling products are

constantly introduced. Accordingly, a strong commitment to R&D is required to fuel long-term growth.

Reorganization of business charges increased due to employee severance costs and expenses related to the exit of a

58 MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS