Motorola 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

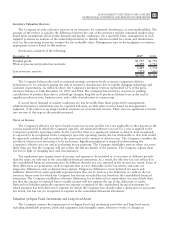

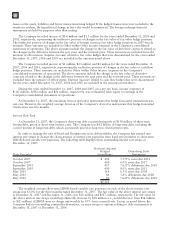

Inventory Valuation Reserves

The Company records valuation reserves on its inventory for estimated obsolescence or non-marketability. The

amount of the reserve is equal to the difference between the cost of the inventory and the estimated market value

based upon assumptions about future demand and market conditions. On a quarterly basis, management in each

segment performs an analysis of the underlying inventory to identify reserves needed for excess and obsolescence

and, for the remaining inventory, assesses the net realizable value. Management uses its best judgment to estimate

appropriate reserves based on this analysis.

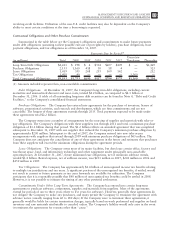

Inventories consisted of the following:

December 31 2007 2006

Finished goods $1,737 $1,796

Work-in-process and production materials 1,470 1,782

3,207 3,578

Less inventory reserves (371) (416)

$2,836 $3,162

The Company balances the need to maintain strategic inventory levels to ensure competitive delivery

performance to its customers against the risk of inventory obsolescence due to rapidly changing technology and

customer requirements. As reflected above, the Company’s inventory reserves represented 12% of the gross

inventory balance at both December 31, 2007 and 2006. The Company has inventory reserves for pending

cancellations of product lines due to technology changes, long-life cycle products, lifetime buys at the end of

supplier production runs, business exits, and a shift of production to outsourcing.

If actual future demand or market conditions are less favorable than those projected by management,

additional inventory writedowns may be required. Likewise, as with other reserves based on management’s

judgment, if the reserve is no longer needed, amounts are reversed into income. There were no significant reversals

into income of this type in the periods presented.

Taxes on Income

The Company’s effective tax rate is based on pre-tax income and the tax rates applicable to that income in the

various jurisdictions in which the Company operates. An estimated effective tax rate for a year is applied to the

Company’s quarterly operating results. In the event that there is a significant unusual or discrete item recognized,

or expected to be recognized, in the Company’s quarterly operating results, the tax attributable to that item would

be separately calculated and recorded at the same time as the unusual or discrete item. The Company considers the

resolution of prior-year tax matters to be such items. Significant judgment is required in determining the

Company’s effective tax rate and in evaluating its tax positions. The Company establishes reserves when it is more

likely than not that the Company will not realize the full tax benefit of the position. The Company adjusts these

reserves in light of changing facts and circumstances.

Tax regulations may require items of income and expense to be included in a tax return in different periods

than the items are reflected in the consolidated financial statements. As a result, the effective tax rate reflected in

the consolidated financial statements may be different than the tax rate reported in the income tax return. Some of

these differences are permanent, such as expenses that are not deductible on the tax return, and some are

temporary differences, such as depreciation expense. Temporary differences create deferred tax assets and

liabilities. Deferred tax assets generally represent items that can be used as a tax deduction or credit in the tax

return in future years for which the Company has already recorded the tax benefit in the consolidated financial

statements. The Company establishes valuation allowances for its deferred tax assets when it is more likely than

not that the amount of expected future taxable income will not support the use of the deduction or credit.

Deferred tax liabilities generally represent tax expense recognized in the consolidated financial statements for

which payment has been deferred or expense for which the Company has already taken a deduction on an income

tax return, but has not yet recognized as expense in the consolidated financial statements.

Valuation of Sigma Fund, Investments and Long-Lived Assets

The Company assesses the impairment of its Sigma Fund and investment portfolios and long-lived assets,

including identifiable property, plant and equipment and intangible assets, whenever events or changes in

65

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS