Motorola 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

pro forma effects on both earnings from continuing operations and on net earnings, which includes discontinued

operations.

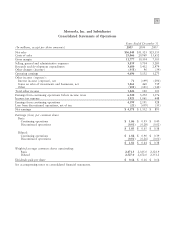

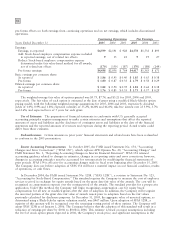

Continuing Operations Net Earnings

Years Ended December 31

2005

2004 2003

2005

2004 2003

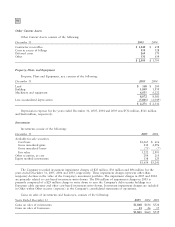

Earnings:

Earnings, as reported $4,599 $2,191 $ 928 $4,578 $1,532 $ 893

Add: Stock-based employee compensation expense included

in reported earnings, net of related tax effects 915 23 919 27

Deduct: Stock-based employee compensation expense

determined under fair value-based method for all awards,

net of related tax effects (170) (150) (187) (170) (188) (249)

Pro forma earnings $4,438 $2,056 $ 764 $4,417 $1,363 $ 671

Basic earnings per common share:

As reported $ 1.86 $ 0.93 $ 0.40 $ 1.85 $ 0.65 $ 0.38

Pro forma $ 1.80 $ 0.87 $ 0.33 $ 1.79 $ 0.58 $ 0.29

Diluted earnings per common share:

As reported $ 1.82 $ 0.90 $ 0.39 $ 1.81 $ 0.64 $ 0.38

Pro forma $ 1.76 $ 0.85 $ 0.33 $ 1.75 $ 0.57 $ 0.29

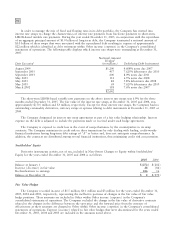

The weighted-average fair value of options granted was $5.75, $7.74, and $3.21 for 2005, 2004 and 2003,

respectively. The fair value of each option is estimated at the date of grant using a modified Black-Scholes option

pricing model, with the following weighted-average assumptions for 2005, 2004 and 2003, respectively: dividend

yields of 1.0%, 0.9% and 1.8%; expected volatility of 35.2%, 46.8% and 46.6%; risk-free interest rate of 3.9%, 3.7%

and 2.6%; and expected lives of 5 years for each grant.

Use of Estimates: The preparation of financial statements in conformity with U.S. generally accepted

accounting principles requires management to make certain estimates and assumptions that affect the reported

amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could

differ from those estimates.

Reclassifications: Certain amounts in prior years' financial statements and related notes have been reclassified

to conform to the 2005 presentation.

Recent Accounting Pronouncements: In October 2005, the FASB issued Statement No. 154, ""Accounting

Changes and Error Corrections'' (""SFAS 154''), which replaces APB Opinion No. 20, ""Accounting Changes'' and

FASB Statement No. 3, ""Reporting Accounting Changes in Interim Financial Statement''. SFAS 154 retained

accounting guidance related to changes in estimates, changes in a reporting entity and error corrections; however,

changes in accounting principles must be accounted for retrospectively by modifying the financial statements of

prior periods. SFAS 154 is effective for accounting changes made in fiscal years beginning after December 15, 2005.

The Company does not believe adoption of SFAS 154 will have a material impact on our financial condition, results

of operations, or cash flows.

In December 2004, the FASB issued Statement No. 123R (""SFAS 123R''), a revision to Statement No. 123,

""Accounting for Stock-Based Compensation.'' This standard requires the Company to measure the cost of employee

services received in exchange for equity awards based on the grant date fair value of the awards. The cost will be

recognized as compensation expense over the vesting period of the awards. The standard provides for a prospective

application. Under this method, the Company will begin recognizing compensation cost for equity based

compensation for all new or modified grants after the date of adoption. In addition, the Company will recognize

the unvested portion of the grant date fair value of awards issued prior to adoption based on the fair values

previously calculated for disclosure purposes. At December 31, 2005, the aggregate value of unvested options, as

determined using a Black-Scholes option valuation model, was $467 million. Upon adoption of SFAS 123R, a

majority of this amount will be recognized over the remaining vesting period of these options. The Company will

adopt SFAS 123R as of January 1, 2006. The Company believes that the adoption of this standard will result in a

reduction of earnings per share by $0.06 to $0.08 in 2006. This estimate is based on many assumptions including

the level of stock option grants expected in 2006, the Company's stock price, and significant assumptions in the