Motorola 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

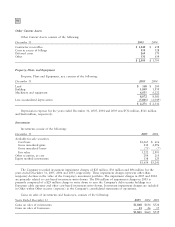

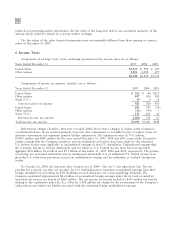

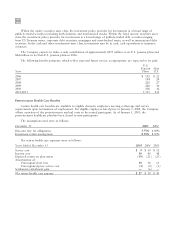

Differences between income tax expense (benefit) computed at the U.S. federal statutory tax rate of 35% and

income tax expense (benefit) are as follows:

Years Ended December 31 2005 2004 2003

Income tax expense at statutory rate $2,282 $1,138 $ 482

Taxes on non-U.S. earnings (468) (529) (62)

State income taxes 123 71 32

Tax benefit on qualifying repatriations (265) ÌÌ

Tax on undistributed non-U.S. earnings 202 327 114

Research credits (24) (74) (11)

Foreign export sales (14) (31) (16)

Non-deductible acquisition charges 211 11

Goodwill impairments Ì44 25

Tax benefit on disposition of subsidiaries (81) ÌÌ

Other provisions 233 42 (125)

Valuation allowance (88) (26) 2

Other 19 88 (4)

$1,921 $1,061 $ 448

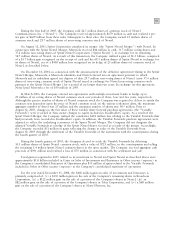

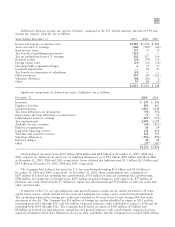

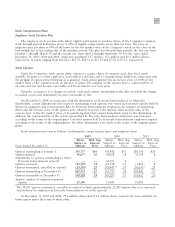

Significant components of deferred tax assets (liabilities) are as follows:

December 31

2005

2004

Inventory $ 233 $ 246

Employee benefits 881 865

Capitalized items 1,067 1,238

Tax basis differences on investments (98) 306

Depreciation tax basis differences on fixed assets 71 96

Undistributed non-U.S. earnings (229) (550)

Tax carryforwards 2,098 2,199

Available for sale securities (60) (871)

Business reorganization 20 24

Long-term financing reserves 152 868

Warranty and customer reserves 368 504

Valuation Allowances (896) (892)

Deferred charges 45 48

Other (37) (187)

$3,615 $3,894

Gross deferred tax assets were $10.0 billion, $9.8 billion and $8.8 billion at December 31, 2005, 2004 and

2003, respectively. Deferred tax assets, net of valuation allowances, were $9.1 billion, $8.9 billion and $8.0 billion

at December 31, 2005, 2004 and 2003, respectively. Gross deferred tax liabilities were $5.5 billion, $5.0 billion and

$3.9 billion at December 31, 2005, 2004 and 2003, respectively.

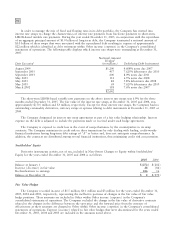

The Company had deferred tax assets for U.S. tax carryforwards totaling $1.6 billion and $1.6 billion at

December 31, 2005 and 2004, respectively. At December 31, 2005, these carryforwards were comprised of

$247 million of federal net operating loss carryforwards, $135 million of state net operating loss carryforwards,

$780 million of foreign tax credit carryovers, $270 million of general business credit carryovers, $75 million of

minimum tax credit carryforwards, $7 million of capital loss carryforwards and $54 million of state tax credit and

other carryforwards.

A majority of the U.S. net operating losses and general business credits can be carried forward for 20 years,

capital losses can be carried forward for five years and minimum tax credits can be carried forward indefinitely.

The carryforward period for foreign tax credits was extended to 10 years, from 5 years, during 2004 due to the

enactment of the Act. The Company has $35 million of foreign tax credits scheduled to expire in 2011 and the

remaining from 2013 through 2015 and $50 million of general business credits scheduled to expire in 2018 and the

remaining from 2019 through 2025. The Company has deferred tax assets of $168 million, $7 million and

$9 million of Federal net operating loss, capital loss and general business credit carryforwards, respectively, from

acquired subsidiaries which have limitations placed on their availability and the Company has recorded $184 million