Motorola 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Foreign Currency Risk

As a multinational company, the Company's transactions are denominated in a variety of currencies. The

Company uses financial instruments to hedge, or to reduce its overall exposure to, the effects of currency

fluctuations on cash flows. The Company's policy is not to speculate in financial instruments for profit on the

exchange rate price fluctuation, trade in currencies for which there are no underlying exposures, or enter into trades

for any currency to intentionally increase the underlying exposure. Instruments that are designated as part of a

hedging relationship must be effective at reducing the risk associated with the exposure being hedged and are

designated as a part of a hedging relationship at the inception of the contract. Accordingly, changes in market

values of hedge instruments must be highly correlated with changes in market values of underlying hedged items

both at inception of the hedge and over the life of the hedge contract.

The Company's strategy in foreign exchange exposure issues is to offset the gains or losses of the financial

instruments against losses or gains on the underlying operational cash flows or investments based on the operating

business units' assessment of risk. The Company enters into derivative contracts for some of the Company's non-

functional currency receivables and payables, which are denominated in major currencies that can be traded on

open markets. The Company uses forward contracts and options to hedge these currency exposures. In addition,

the Company enters into derivative contracts for some firm commitments and some forecasted transactions, which

are designated as part of a hedging relationship if it is determined that the transaction qualifies for hedge

accounting. A portion of the Company's exposure is from currencies that are not traded in liquid markets and these

are addressed, to the extent reasonably possible, through managing net asset positions, product pricing and

component sourcing.

At December 31, 2005 and 2004, the Company had net outstanding foreign exchange contracts totaling

$2.8 billion and $3.9 billion, respectively. Management believes that these financial instruments should not subject

the Company to undue risk due to foreign exchange movements because gains and losses on these contracts should

offset losses and gains on the underlying assets, liabilities and transactions, except for the ineffective portion of the

instruments which are charged to Other within Other income (expense) in the Company's consolidated statements

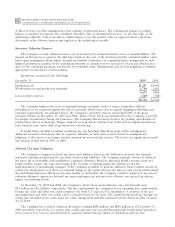

of operations. The following table shows, in millions of U.S. dollars, the five largest net foreign exchange derivative

positions as of December 31, 2005 compared to their respective positions at December 31, 2004:

December 31

Buy (Sell)

2005

2004

Euro $(1,076) $(1,588)

Chinese Renminbi (728) (821)

Brazilian Real (348) (318)

British Pound (226) (173)

Japanese Yen (73) (179)

The Company is exposed to credit-related losses if counterparties to financial instruments fail to perform their

obligations. However, the Company does not expect any counterparties, all of whom which presently have high

credit ratings, to fail to meet their obligations.

Foreign exchange financial instruments that are subject to the effects of currency fluctuations, which may

affect reported earnings, include derivative financial instruments and other financial instruments which are not

denominated in the currency of the legal entity holding the instrument. Derivative financial instruments consist

primarily of forward contracts. Other financial instruments, which are not denominated in the currency of the legal

entity holding the instrument, consist primarily of cash, cash equivalents, Sigma Funds, short-term investments, long-

term finance receivables, equity investments and notes, as well as accounts payable and receivable. Accounts payable

and receivable are reflected at fair value in the financial statements. The fair value of the foreign exchange financial

instruments would hypothetically decrease by $192 million as of December 31, 2005 if the foreign currency rates

were to change unfavorably by 10% of current levels. This hypothetical amount is suggestive of the effect on future

cash flows under the following conditions: (i) all current payables and receivables that are hedged were not

realized, (ii) all hedged commitments and anticipated transactions were not realized or canceled, and (iii) hedges

of these amounts were not canceled or offset. The Company does not expect that any of these conditions will be

realized. The Company expects that gains and losses on the derivative financial instruments should offset gains and

losses on the assets, liabilities and future transactions being hedged. If the hedged transactions were included in the