Motorola 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

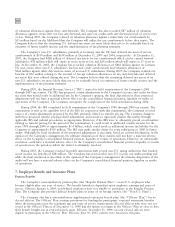

The status of the Company's plans is as follows:

2005

2004

Officers

Officers

and Non

and Non

Regular MSPP U.S.

Regular MSPP U.S.

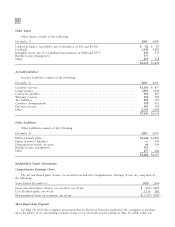

Change in benefit obligation:

Benefit obligation at January 1 $ 4,741 $185 $1,310 $ 4,174 $208 $1,225

Service cost 142 10 44 168 14 51

Interest cost 280 9 67 271 12 66

Plan amendments 4Ì Ì ÌÌ Ì

Discontinued operations ÌÌ Ì Ì Ì (80)

Settlement/curtailment Ì (20) (3) (115) (8) (27)

Actuarial (gain)loss 277 6 264 403 13 (36)

Foreign exchange valuation adjustment Ì Ì (148) Ì Ì 125

Employee contributions ÌÌ 11 ÌÌ 14

Tax payments Ì (16) Ì Ì (20) Ì

Benefit payments (269) (14) (25) (160) (34) (28)

Benefit obligation at December 31 5,175 160 1,520 4,741 185 1,310

Change in plan assets:

Fair value at January 1 3,483 87 772 2,798 96 668

Return on plan assets 247 2 155 265 3 60

Company contributions 275 33 62 580 25 47

Employee contributions ÌÌ 11 ÌÌ 14

Discontinued operations ÌÌ Ì Ì Ì (59)

Foreign exchange valuation adjustment Ì Ì (83) ÌÌ 61

Tax payments from plan assets Ì (15) Ì Ì (4) Ì

Benefit payments from plan assets (269) (15) (21) (160) (33) (19)

Fair value at December 31 3,736 92 896 3,483 87 772

Funded status of the plan (1,439) (68) (624) (1,258) (98) (538)

Unrecognized net loss 1,831 75 450 1,561 103 354

Unrecognized prior service cost (31) (3) 4 (40) 1 4

Prepaid (accrued) pension cost $ 361 $ 4 $ (170) $ 263 $ 6 $ (180)

Components of prepaid (accrued) pension cost:

Intangible asset $Ì$Ì$4$Ì$4$5

Prepaid benefit cost ÌÌ 18 ÌÌ 20

Accrued benefit liability (1,023) (58) (563) (924) (72) (485)

Deferred income taxes 526 24 2 452 28 1

Non-owner changes to equity 858 38 369 735 46 279

$ 361 $ 4 $ (170) $ 263 $ 6 $ (180)

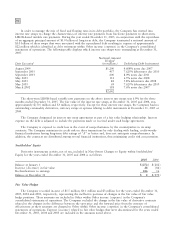

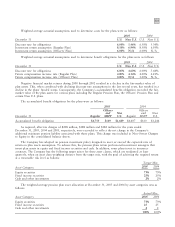

The Company uses a five-year, market-related asset value method of amortizing asset-related gains and losses.

Prior service costs are being amortized over periods ranging from 9 to 15 years. The benefit obligation and related

assets have been measured as of December 31, 2005 for all U.S. plans and as of October 1, 2005 for all Non-

U.S. plans. Benefits under all U.S. pension plans are valued based upon the projected unit credit cost method.

Certain actuarial assumptions such as the discount rate and the long-term rate of return on plan assets have a

significant effect on the amounts reported for net periodic cost as well as the related obligation amounts of the

Company's plans. The assumed discount rates reflects the prevailing market rates of a large population of high-

quality, non-callable, corporate bonds currently available that, if the obligation was settled at the measurement date,

would provide the necessary future cash flows to pay the benefit obligation when due. The long-term rate of return

on plan assets represents an estimate of long-term returns on an investment portfolio consisting of a mixture of

equities, fixed income, and cash and other investments. In determining the long-term return on plan assets, the

Company considers long-term rates of return on the asset classes (both historical and forecasted) in which the

Company expects the plan funds to be invested.