Motorola 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

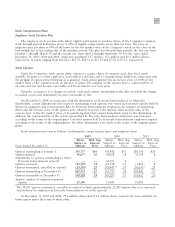

Stock Compensation Plans

Employee Stock Purchase Plan

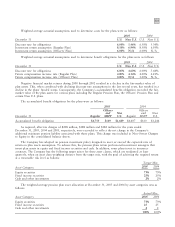

The employee stock purchase plan allows eligible participants to purchase shares of the Company's common

stock through payroll deductions of up to 10% of eligible compensation on an after-tax basis. The price an

employee pays per share is 85% of the lower of the fair market value of the Company's stock on the close of the

first trading day or last trading day of the purchase period. The plan has two purchase periods, the first one from

October 1 through March 31 and the second one from April 1 through September 30. For the years ended

December 31, 2005, 2004 and 2003, employees purchased 11.7 million, 13.1 million and 20.5 million shares,

respectively, at prices ranging from $12.66 to $12.72, $10.31 to $15.33 and $7.02 to $7.10, respectively.

Stock Options

Under the Company's stock option plans, options to acquire shares of common stock have been made

available for grant to certain employees, non-employee directors and to existing option holders in connection with

the merging of option plans following an acquisition. Each option granted has an exercise price of 100% of the

market value of the common stock on the date of grant. The majority of the options have a contractual life of

10 years and vest and become exercisable at 25% increments over four years.

Upon the occurrence of a change in control, each stock option outstanding on the date on which the change

in control occurs will immediately become exercisable in full.

On December 2, 2004, in connection with the distribution of Freescale Semiconductor to Motorola

shareholders, certain adjustments were made to outstanding stock options. For vested and unvested options held by

Motorola employees and vested options held by Freescale Semiconductor employees, the number of underlying

shares and the exercise price of the options were adjusted to preserve the intrinsic value and the ratio of the

exercise price to the fair market value of an underlying share that existed immediately prior to the distribution. In

addition, the contractual life of the vested options held by Freescale Semiconductor employees was truncated

according to the terms of the original grant. Unvested options held by Freescale Semiconductor employees expired

according to the terms of the original grants. No other adjustments were made to the terms of the original option

grants.

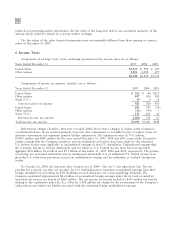

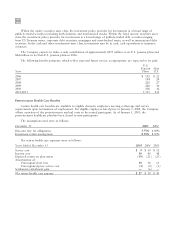

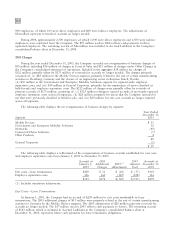

Stock options activity was as follows (in thousands, except exercise price and employee data):

2005

2004 2003

Shares Wtd. Avg.

Shares Wtd. Avg. Shares Wtd. Avg.

Subject to Exercise

Subject to Exercise Subject to Exercise

Years Ended December 31

Options Price

Options Price Options Price

Options outstanding at January 1 335,757 $16 305,842 $17 286,536 $20

Options granted 40,675 16 58,429 18 76,769 8

Adjustments to options outstanding to reflect

Freescale Semiconductor spin-off ÌÌ36,111 2 Ì Ì

Options exercised (85,527) 12 (25,178) 13 (1,412) 8

Options terminated, cancelled or expired (23,150) 25 (39,447)* 15 (56,051) 21

Options outstanding at December 31 267,755 17 335,757 16 305,842 17

Options exercisable at December 31 149,329 19 195,297 17 135,612 23

Approx. number of employees granted

options 25,300 33,900 41,900

*The 39,447 options terminated, cancelled or expired includes approximately 22,000 options that were unvested

and forfeited by employees of Freescale Semiconductor as of the spin-off.

At December 31, 2005 and 2004, 79.6 million shares and 111.2 million shares, respectively, were available for

future grants under the terms of these plans.