Motorola 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

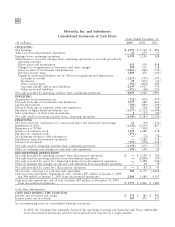

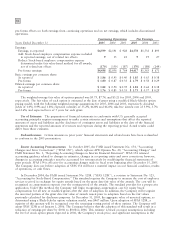

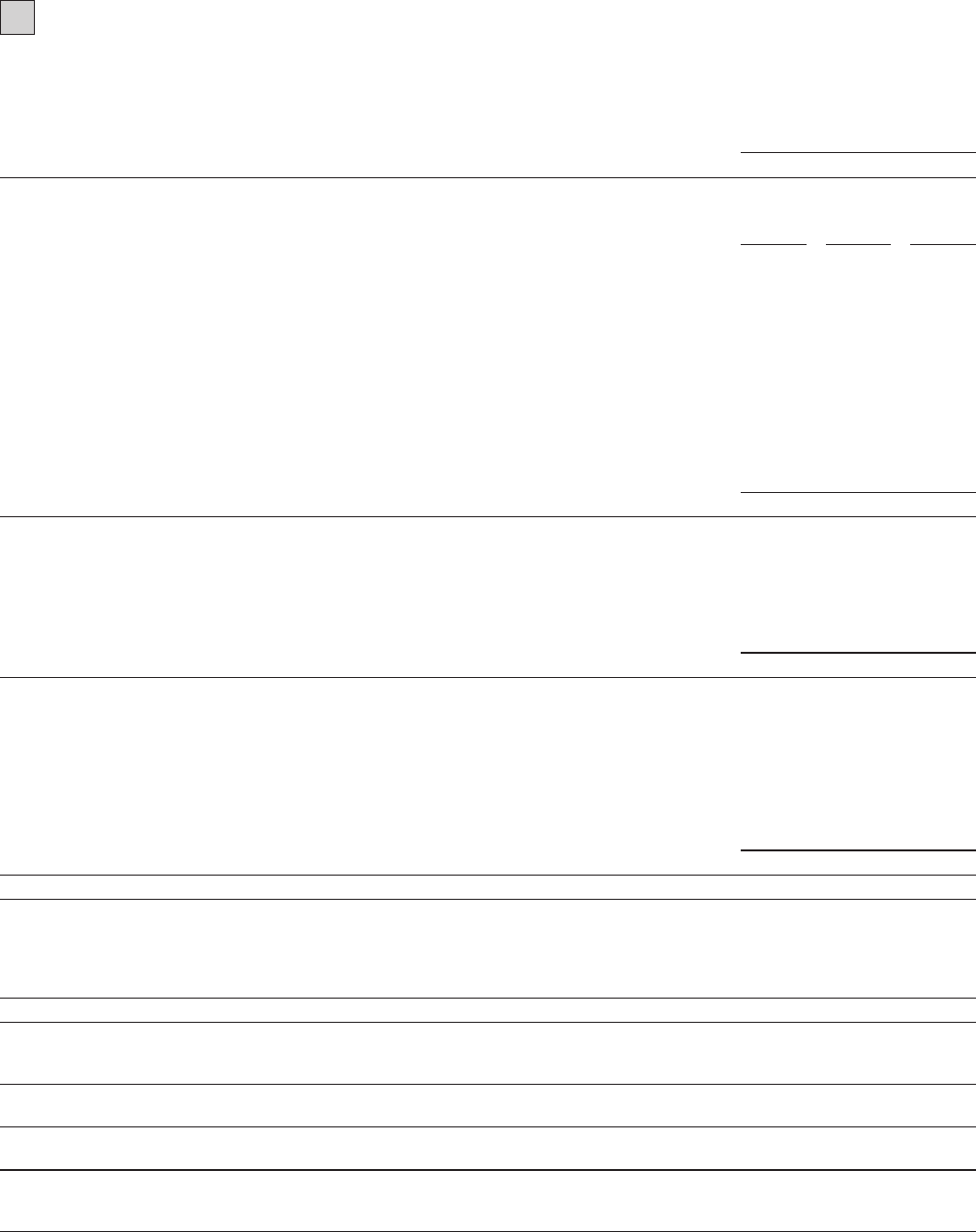

82

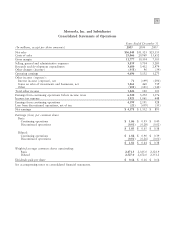

Motorola, Inc. and Subsidiaries

Consolidated Statements of Cash Flows Years Ended December 31

(In millions)

2005

2004 2003

OPERATING

Net Earnings $ 4,578 $ 1,532 $ 893

Add: Loss from discontinued operations 21 659 35

Earnings from continuing operations 4,599 2,191 928

Adjustments to reconcile earnings from continuing operations to net cash provided by

operating activities:

Depreciation and amortization 613 659 818

Charges for reorganization of businesses and other charges 209 151 158

Gains on sales of investments and businesses (1,861) (460) (539)

Deferred income taxes 1,000 456 (160)

Change in assets and liabilities, net of effects of acquisitions and dispositions:

Accounts receivable (1,251) (539) (141)

Inventories 23 (433) (34)

Other current assets (703) (808) 109

Accounts payable and accrued liabilities 2,347 1,917 576

Other assets and liabilities (371) (68) 276

Net cash provided by operating activities from continuing operations 4,605 3,066 1,991

INVESTING

Acquisitions and investments, net (312) (476) (279)

Proceeds from sale of investments and businesses 1,557 682 665

Capital expenditures (583) (494) (344)

Proceeds from sale of property, plant and equipment 103 138 104

Purchases of Sigma Funds investments, net (3,157) (1,522) (6,188)

Sales (purchases) of short-term investments 8(13) (82)

Net cash used for investing activities from continuing operations (2,384) (1,685) (6,124)

FINANCING

Net proceeds from (repayment of) commercial paper and short-term borrowings 11 (19) (234)

Repayment of debt (1,132) (2,250) (827)

Repayment of TOPrS Ì(500) Ì

Issuance of common stock 1,199 1,680 158

Purchase of common stock (874) ÌÌ

Net payments related to debt redemption Ì(52) (78)

Distribution from discontinued operations Ì1,282 556

Payment of dividends (394) (378) (332)

Net cash used for financing activities from continuing operations (1,190) (237) (757)

Effect of exchange rate changes on cash and cash equivalents (103) 100 29

DISCONTINUED OPERATIONS*

Net cash provided by operating activities from discontinued operations $Ì$ 1,199 $ 796

Net cash used for investing activities from discontinued operations Ì(2,848) (87)

Net cash provided by (used for) financing activities from discontinued operations Ì1,498 (724)

Effect of exchange rate changes on cash and cash equivalents from discontinued operations Ì64 58

Net cash provided by (used for) discontinued operations $Ì$ (87) $ 43

Net increase (decrease) in cash and cash equivalents 928 1,157 (4,818)

Cash and cash equivalents, beginning of year (includes $87 million at January 1, 2004

and $44 million at January 1, 2003 from discontinued operations) 2,846 1,689 6,507

Cash and cash equivalents, end of year (includes $87 million at December 31, 2003

from discontinued operations) $ 3,774 $ 2,846 $ 1,689

Cash Flow Information

CASH PAID DURING THE YEAR FOR:

Interest, net of interest rate swaps $ 318 $ 381 $ 442

Income taxes, net of refunds 693 471 435

See accompanying notes to consolidated financial statements.

* In 2005, the Company has separately disclosed the operating, investing and financing cash flows attributable

to its discontinued operations, which in prior periods were reported as a single amount.