Motorola 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

2003 Charges

During the year ended December 31, 2003, the Company recorded net reorganization of business charges of

$39 million, including $16 million of charges in Costs of sales and $23 million of charges under Other charges in

the Company's consolidated statement of operations. Included in the aggregate $39 million are charges of

$212 million, partially offset by $173 million of reversals for accruals no longer needed. The charges primarily

consisted of: (i) $85 million in the Mobile Devices segment, primarily related to the exit of certain manufacturing

activities in Flensburg, Germany and the closure of an engineering center in Boynton Beach, Florida,

(ii) $50 million in the Government and Enterprise Mobility Solutions segment for segment-wide employee

separation costs, and (iii) $39 million in General Corporate, primarily for the impairment of assets classified as

held-for-sale and employee separation costs. The $212 million of charges were partially offset by reversals of

previous accruals of $173 million, consisting of: (i) $125 million relating to unused accruals of previously-expected

employee separation costs across all segments, (ii) $28 million, primarily for assets that the Company intended to

use that were previously classified as held-for-sale, and (iii) $20 million for exit cost accruals no longer required

across all segments.

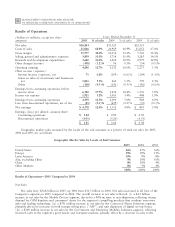

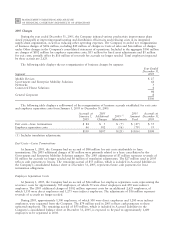

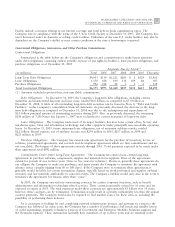

The following table displays the net reorganization of business charges by segment:

Year Ended

December 31,

Segment 2003

Mobile Devices $51

Government and Enterprise Mobility Solutions 32

Networks (40)

Connected Home Solutions (7)

Other Products 4

40

General Corporate (1)

$39

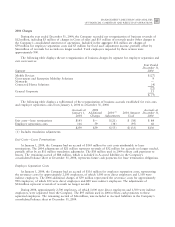

The following table displays a rollforward of the reorganization of business accruals established for exit costs

and employee separation costs from January 1, 2003 to December 31, 2003:

Accruals at 2003 Accruals at

January 1, Additional 2003(1) 2003 Amount December 31,

2003 Charges Adjustments Used 2003

Exit costs Ì lease terminations $209 $ 11 $ (20) $ (57) $143

Employee separation costs 336 163 (125) (258) 116

$545 $174 $(145) $(315) $259

(1) Includes translation adjustments.

Exit CostsÌLease Terminations

At January 1, 2003, the Company had an accrual of $209 million for exit costs attributable to lease

terminations. The 2003 additional charges of $11 million were primarily related to the exit of certain manufacturing

activities in Germany by the Mobile Devices segment. The 2003 adjustments of $20 million represent reversals for

accruals no longer needed. The $57 million used in 2003 reflects cash payments to lessors. The remaining accrual

of $143 million, which is included in Accrued liabilities in the Company's consolidated balance sheet at

December 31, 2003, represents future cash payments for lease termination obligations.

Employee Separation Costs

At January 1, 2003, the Company had an accrual of $336 million for employee separation costs, representing

the severance costs for approximately 5,700 employees, of which 2,000 were direct employees and 3,700 were

indirect employees. The 2003 additional charges of $163 million represented the severance costs for approximately

3,200 employees, of which 1,200 were direct employees and 2,000 were indirect employees. The adjustments of

$125 million represent the severance costs for approximately 1,600 employees previously identified for separation