Motorola 2005 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

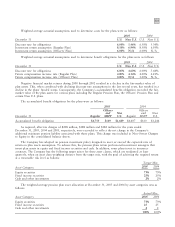

$217 million and $223 million, respectively. At December 31, 2005, future minimum lease obligations, net of

minimum sublease rentals, for the next five years and beyond are as follows: 2006Ì$438 million; 2007Ì

$190 million; 2008Ì$134 million; 2009Ì$109 million; 2010Ì$84 million; beyondÌ$195 million.

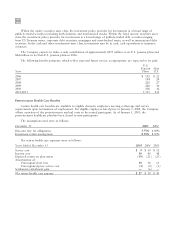

Legal

Iridium Program: The Company has been named as one of several defendants in putative class action

securities lawsuits arising out of alleged misrepresentations or omissions regarding the Iridium satellite

communications business, which on March 15, 2001, were consolidated in the District of Columbia under

Freeland v. Iridium World Communications, Inc., et al., originally filed on April 22, 1999. On August 31, 2004,

the court denied the motions to dismiss that had been filed on July 15, 2002 by the Company and the other

defendants.

The Company was sued by the Official Committee of the Unsecured Creditors of Iridium in the Bankruptcy

Court for the Southern District of New York on July 19, 2001. In re Iridium Operating LLC, et al. v. Motorola

asserts claims for breach of contract, warranty, fiduciary duty, and fraudulent transfer and preferences, and seeks in

excess of $4 billion in damages. Trial has been scheduled for August 7, 2006.

The Company has not reserved for any potential liability that may arise as a result of the litigation described

above related to the Iridium program. While the still pending cases are in various stages and the outcomes are not

predictable, an unfavorable outcome of one or more of these cases could have a material adverse effect on the

Company's consolidated financial position, liquidity or results of operations.

Other: The Company is a defendant in various other suits, claims and investigations that arise in the normal

course of business. In the opinion of management, and other than as discussed above with respect to the Iridium

cases, the ultimate disposition of these matters will not have a material adverse effect on the Company's

consolidated financial position, liquidity or results of operations.

Other

The Company is also a party to a variety of agreements pursuant to which it is obligated to indemnify the

other party with respect to certain matters. Some of these obligations arise as a result of divestitures of the

Company's assets or businesses and require the Company to hold the other party harmless against losses arising

from adverse tax outcomes. The total amount of indemnification under these types of provisions at December 31,

2005 and 2004 was $28 million and $37 million, respectively, with the Company accruing $1 million and $2 million

as of December 31, 2005 and 2004, respectively, for certain claims that have been asserted under these provisions.

In addition, the Company may provide indemnifications for losses that result from the breach of general

warranties contained in certain commercial, intellectual property and divestiture agreements. Historically, the

Company has not made significant payments under these agreements, nor have there been significant claims asserted

against the Company.

In all cases, payment by the Company is conditioned on the other party making a claim pursuant to the

procedures specified in the particular contract, which procedures typically allow the Company to challenge the

other party's claims. Further, the Company's obligations under these agreements are generally limited in terms of

duration, typically not more than 24 months, and for amounts not in excess of the contract value, and in some

instances, the Company may have recourse against third parties for certain payments made by the Company.

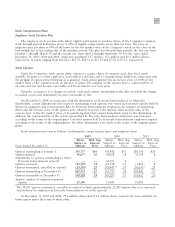

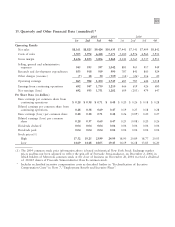

10. Information by Segment and Geographic Region

Effective January 1, 2005, the Company reports financial results for the following business segments, with all

historical amounts reclassified to conform to the current segment presentation.

‚ The Mobile Devices segment designs, manufactures, sells and services wireless handsets, with integrated

software and accessory products.

‚ The Government and Enterprise Mobility Solutions segment designs, manufactures, sells, installs and

services analog and digital two-way radio, voice and data communications products and systems to a wide

range of public safety, government, utility, transportation and other worldwide markets, and participates in

the market for integrated information management, mobile and biometric applications and services. The