Motorola 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

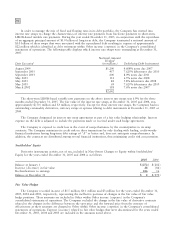

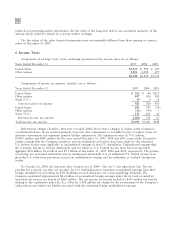

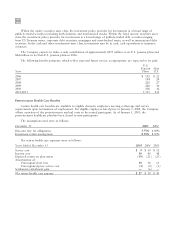

of valuation allowances against these carryforwards. The Company has also recorded $87 million of valuation

allowance against certain state tax loss carryforwards and state tax credits with carryforward period of seven years

or less. During 2005, the Company reduced its valuation allowance against certain State tax carryforwards by

$15 million based on the likelihood that the Company will utilize the tax carryforwards before they expire. The

Company believes that the remaining U.S. deferred tax assets are more likely than not to be realizable based on

estimates of future taxable income and the implementation of tax planning strategies.

The Company's non-U.S. subsidiaries, primarily in Germany and the UK, had deferred tax assets from tax

carryforwards of $530 million and $634 million at December 31, 2005 and 2004, respectively. At December 31,

2005, the Company had $428 million of deferred tax assets for tax carryforwards which can be carried forward

indefinitely, $78 million which will expire in seven years or less and $24 million which will expire in 15 years or

less. At December 31, 2005, the Company has recorded valuation allowances of $461 million against its German,

UK and certain other non-U.S. subsidiaries tax loss and credit carryforwards and valuation allowances of

$164 million against other deferred tax assets of its non-U.S. subsidiaries. During 2005, the Company realized tax

benefits of $76 million relating to the reversal of foreign valuation allowances on tax carryforwards and deferred

tax assets that were utilized during the year. The Company believes that the remaining deferred tax assets of its

non-U.S. subsidiaries are more likely than not to be realizable based on estimates of future taxable income and the

implementation of tax planning strategies.

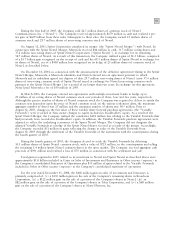

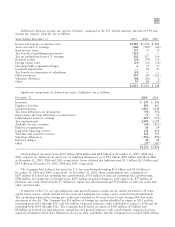

During 2005, the Internal Revenue Service (""IRS'') started its field examination of the Company's 2001

through 2003 tax returns. The IRS has proposed certain adjustments to the Company's income and credit for these

tax years that would result in additional tax. In the Company's opinion, the final disposition of these proposed

adjustments will not have a material adverse effect on the consolidated financial position, liquidity or results of

operations of the Company. The Company anticipates the completion of the field examination during 2006.

During 2004, the IRS completed its field examination of the Company's 1996 through 2000 tax returns. The

examination is now at the appellate level of the IRS. In connection with this examination, the Company received

notices of certain adjustments proposed by the IRS, primarily related to transfer pricing. The Company disagrees

with these proposed transfer pricing-related adjustments and intends to vigorously dispute this matter through

applicable IRS and judicial procedures, as appropriate. However, if the IRS were to ultimately prevail on all matters

relating to transfer pricing for the period of the examination, it could result in additional taxable income for the

years 1996 through 2000 of approximately $1.4 billion, which could result in additional income tax liability for the

Company of approximately $500 million. The IRS may make similar claims for years subsequent to 2000 in future

audits. Although the final resolution of the proposed adjustments is uncertain, based on current information, in the

opinion of the Company's management, the ultimate disposition of these matters will not have a material adverse

effect on the Company's consolidated financial position, liquidity or results of operations. However, an unfavorable

resolution could have a material adverse effect on the Company's consolidated financial position, liquidity or results

of operations in the period in which the matter is ultimately resolved.

During 2005, the Company reached favorable agreements with several non-U.S. taxing authorities that resulted

in net income tax benefits of $28 million. The Company has several other non-U.S. income tax audits pending and

while the final resolution is uncertain, in the opinion of the Company's management the ultimate disposition of the

audits will not have a material adverse effect on the Company's consolidated financial position, liquidity or results

of operations.

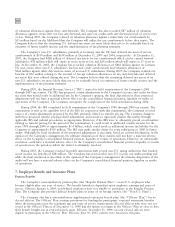

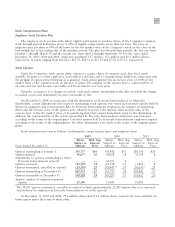

7. Employee Benefit and Incentive Plans

Pension Benefits

The Company's noncontributory pension plan (the ""Regular Pension Plan'') covers U.S. employees who

became eligible after one year of service. The benefit formula is dependent upon employee earnings and years of

service. Effective January 1, 2005, newly-hired employees were not eligible to participate in the Regular Pension

Plan. The Company also provides defined benefit plans to some of its foreign entities (the ""Non-U.S. Plans'').

The Company also has a noncontributory supplemental retirement benefit plan (the ""Officers' Plan'') for its

elected officers. The Officers' Plan contains provisions for funding the participants' expected retirement benefits

when the participants meet the minimum age and years of service requirements. Elected officers who were not yet

vested in the Officers' Plan as of December 31, 1999 had the option to remain in the Officers' Plan or elect to have

their benefit bought out in restricted stock units. Effective December 31, 1999, no new elected officers were

eligible to participate in the Officers' Plan. Effective June 30, 2005, salaries were frozen for this plan.