Motorola 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

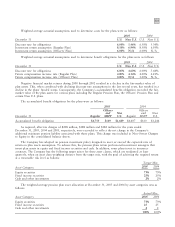

Weighted average actuarial assumptions used to determine costs for the plans were as follows:

2005

2004

December 31

U.S. Non U.S.

U.S. Non U.S.

Discount rate for obligations 6.00% 5.46% 6.50% 5.34%

Investment return assumption (Regular Plan) 8.50% 6.94% 8.50% 6.93%

Investment return assumption (Officers' Plan) 6.00% N/A 6.00% N/A

Weighted average actuarial assumptions used to determine benefit obligations for the plans were as follows:

2005

2004

December 31

U.S. Non U.S.

U.S. Non U.S.

Discount rate for obligations 6.00% 4.60% 6.00% 5.44%

Future compensation increase rate (Regular Plan) 4.00% 4.14% 4.00% 4.21%

Future compensation increase rate (Officers' Plan) 0.00% N/A 3.00% N/A

Negative financial market returns during 2000 through 2002 resulted in a decline in the fair-market value of

plan assets. This, when combined with declining discount rate assumptions in the last several years, has resulted in a

decline in the plans' funded status. Consequently, the Company's accumulated benefits obligation exceeded the fair-

market value of the plan assets for various plans including the Regular Pension Plan, the Officers' Pension Plan and

certain Non U.S. plans.

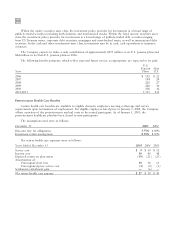

The accumulated benefit obligations for the plans were as follows:

2005

2004

Officers

Officers

and Non

and Non

December 31

Regular MSPP U.S.

Regular MSPP U.S.

Accumulated benefit obligation $4,759 $149 $1,429 $4,407 $160 $1,244

As required, after-tax charges of $208 million, $188 million and $182 million for the years ended

December 31, 2005, 2004 and 2003, respectively, were recorded to reflect the net change in the Company's

additional minimum pension liability associated with these plans. This change was included in Non-Owner Changes

to Equity in the consolidated balance sheets.

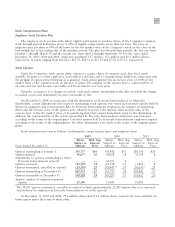

The Company has adopted an pension investment policy designed to meet or exceed the expected rate of

return on plan assets assumption. To achieve this, the pension plans retain professional investment managers that

invest plan assets in equity and fixed income securities and cash. In addition, some plans invest in insurance

contracts. The Company has the following target mixes for these asset classes, which are readjusted at least

quarterly, when an asset class weighting deviates from the target mix, with the goal of achieving the required return

at a reasonable risk level as follows:

Target Mix

2005

2004

Asset Category

Equity securities 73% 73%

Fixed income securities 25% 25%

Cash and other investments 2% 2%

The weighted-average pension plan asset allocation at December 31, 2005 and 2004 by asset categories was as

follows:

Actual Mix

Asset Category

2005

2004

Equity securities 73% 73%

Fixed income securities 25 25

Cash and other investments 22

100% 100%