Motorola 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Facility include covenants relating to net interest coverage and total debt-to-book capitalization ratios. The

Company was in compliance with the terms of the 3-Year Credit Facility at December 31, 2005. The Company has

never borrowed under its domestic revolving credit facilities. Utilization of the non-U.S. credit facilities may also be

dependent on the Company's ability to meet certain conditions at the time a borrowing is requested.

Contractual Obligations, Guarantees, and Other Purchase Commitments

Contractual Obligations

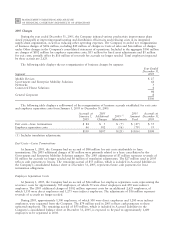

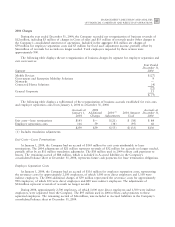

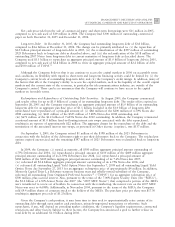

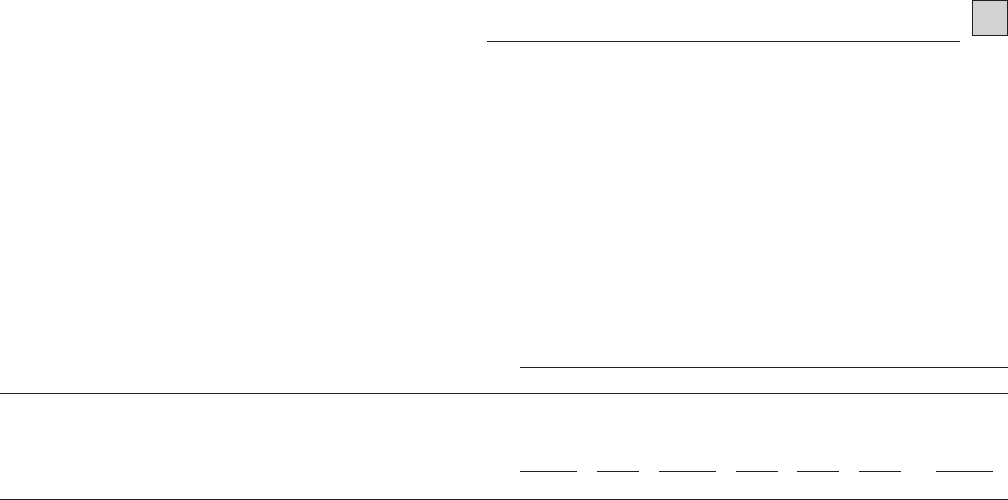

Summarized in the table below are the Company's obligations and commitments to make future payments

under debt obligations (assuming earliest possible exercise of put rights by holders), lease payment obligations, and

purchase obligations as of December 31, 2005.

Payments Due by Period(1)

(in millions) Total 2006 2007 2008 2009 2010 Thereafter

Long-Term Debt Obligations $4,033 $119 $1,222 $200 $ 2 $529 $1,961

Lease Obligations 1,150 438 190 134 109 84 195

Purchase Obligations 992 418 28322 539

Total Contractual Obligations $6,175 $975 $1,440 $337 $113 $615 $2,695

(1) Amounts included represent firm, non-cancelable commitments.

Debt Obligations: At December 31, 2005, the Company's long-term debt obligations, including current

maturities and unamortized discount and issue costs, totaled $4.0 billion, as compared to $5.0 billion at

December 31, 2004. A table of all outstanding long-term debt securities can be found in Note 4, ""Debt and Credit

Facilities,'' to the Company's consolidated financial statements. As previously discussed, the decrease in the long-

term debt obligations as compared to December 31, 2004, was due to the redemptions and repurchases of

$1.0 billion principal amount of outstanding securities during 2005. Also, as previously discussed, the remaining

$118 million of 7.6% Notes due January 1, 2007 were reclassified to current maturities of long-term debt.

Lease Obligations: The Company owns most of its major facilities, but does lease certain office, factory and

warehouse space, land, and information technology and other equipment under principally non-cancelable operating

leases. At December 31, 2005, future minimum lease obligations, net of minimum sublease rentals, totaled

$1.2 billion. Rental expense, net of sublease income, was $254 million in 2005, $217 million in 2004 and

$223 million in 2003.

Purchase Obligations: The Company has entered into agreements for the purchase of inventory, license of

software, promotional agreements, and research and development agreements which are firm commitments and are

not cancelable. The longest of these agreements extends through 2015. Total payments expected to be made under

these agreements total $992 million.

Commitments Under Other Long-Term Agreements: The Company has entered into certain long-term

agreements to purchase software, components, supplies and materials from suppliers. Most of the agreements

extend for periods of one to three years (three to five years for software). However, generally these agreements do

not obligate the Company to make any purchases, and many permit the Company to terminate the agreement with

advance notice (usually ranging from 60 to 180 days). If the Company were to terminate these agreements, it

generally would be liable for certain termination charges, typically based on work performed and supplier on-hand

inventory and raw materials attributable to canceled orders. The Company's liability would only arise in the event it

terminates the agreements for reasons other than ""cause.''

In 2003, the Company entered into outsourcing contracts for certain corporate functions, such as benefit

administration and information technology related services. These contracts generally extend for 10 years and are

expected to expire in 2013. The total payments under these contracts are approximately $3 billion over 10 years;

however, these contracts can be terminated. Termination would result in a penalty substantially less than the annual

contract payments. The Company would also be required to find another source for these services, including the

possibility of performing them in-house.

As is customary in bidding for and completing network infrastructure projects and pursuant to a practice the

Company has followed for many years, the Company has a number of performance/bid bonds and standby letters

of credit outstanding, primarily relating to projects of Government and Enterprise Mobility Solutions segment and

the Networks segment. These instruments normally have maturities of up to three years and are standard in the