Motorola 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

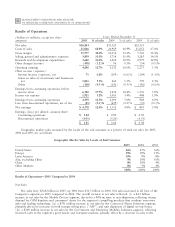

automotive electronics market, and (iv) a $306 million increase in net sales by the Networks segment, driven by

increased customer purchases of cellular infrastructure equipment, as well as increased sales of wireless broadband

systems and embedded computing communications systems.

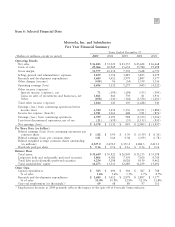

Gross Margin

Gross margin was $11.8 billion, or 32.0% of net sales, in 2005, compared to $10.4 billion, or 33.1% of net

sales, in 2004. Two of the Company's four operating segments had a decrease in gross margin as a percentage of

net sales: (i) Mobile Devices, primarily due to a higher percentage of lower-tier, lower-priced, lower margin

handsets in the overall sales mix and a charge for past use of Kodak intellectual property, and (ii) Connected

Home Solutions, primarily due to increased sales of high-definition digital video recording (""HD/DVR'') products,

which carry lower margins. These changes in gross margin percentage were partially offset by increased gross margin

as a percentage of net sales by Networks, primarily due to the increase in net sales and cost savings from

improvements in supply-chain management. Gross margin as a percentage of net sales was relatively flat in 2005

compared to 2004 for the Government and Enterprise Mobility Solutions segment.

The Company's overall gross margin as a percentage of net sales can be impacted by the proportion of overall

net sales generated by its various businesses. The decrease in overall gross margin as a percentage of net sales in

2005 compared to 2004 can be partially attributed to the fact that an increased percentage of the Company's net

sales were generated by the Mobile Devices and Connected Home Solutions segments, two segments that generate

lower gross margins than the overall Company average.

Selling, General and Administrative Expenses

Selling, general and administrative (""SG&A'') expenditures increased 4% to $3.9 billion, or 10.5% of net sales,

in 2005, compared to $3.7 billion, or 11.9% of net sales, in 2004. All four of the Company's segments had

increased SG&A expenditures in 2005 compared to 2004. These increases in SG&A for the segments were offset by

a decrease in SG&A expenditures related to corporate functions. The increase in SG&A expenditures in 2005

compared to 2004 was due to: (i) increased advertising and promotional expenditures in Mobile Devices to support

higher sales and promote brand awareness, (ii) increased selling and sales support expenditures in all four operating

segments, driven by the increase in sales commissions resulting from the increase in net sales, and (iii) increased

marketing expenditures in three of the four of the segments. SG&A expenditures as a percentage of net sales

decreased in two of the four segments.

Research and Development Expenditures

Research and development (""R&D'') expenditures increased 8% to $3.7 billion, or 10.0% of net sales, in 2005,

compared to $3.4 billion, or 10.9% of net sales, in 2004. All four of the Company's segments had increased R&D

expenditures in 2005 compared to 2004, although R&D expenditures as percentage of net sales decreased in three

of the four segments. The increase in R&D expenditures was primarily due to developmental engineering

expenditures for new product development and investment in next-generation technologies across all segments.

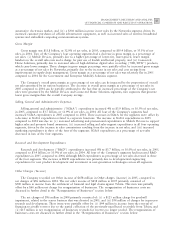

Other Charges (Income)

The Company recorded net Other income of $458 million in Other charges (income) in 2005, compared to

net charges of $96 million in 2004. The net other income of $458 million in 2005 primarily consisted of

$500 million in income from the settlement of financial and legal claims against Telsim. This item was partially

offset by a $66 million net charge for reorganization of businesses. The reorganization of businesses costs are

discussed in further detail in the ""Reorganization of Businesses'' section below.

The net charges of $96 million in 2004 primarily consisted of: (i) a $125 million charge for goodwill

impairment, related to the sensor business that was divested in 2005, and (ii) $34 million of charges for in-process

research and development. These items were partially offset by: (i) $44 million in income from the reversal of

financing receivable reserves due to the partial collection of the previously-uncollected receivable from Telsim, and

(ii) $15 million in net reorganization of businesses reversals for reserves no longer needed. The reorganization of

businesses costs are discussed in further detail in the ""Reorganization of Businesses'' section below.